Binance is the most popular exchange to short cryptocurrencies.

The platform has an easy-to-use futures trading interface, a large number of coin support and high liquidity.

Following our tutorial, you can easily short Bitcoin, Ethereum and various altcoins on Binance and open short positions.

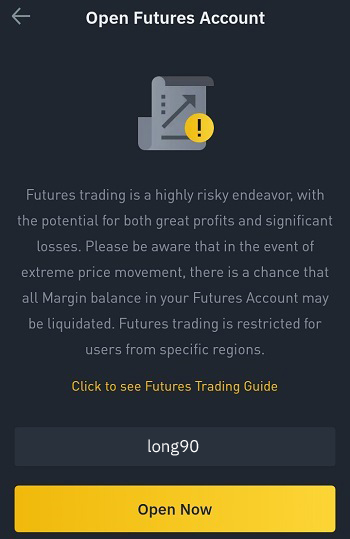

First thing you need to do to open short positions on Binance is open / activate your Futures account on Binance.

How to activate your Binance Futures account

Log in to your Binance account and click ”USDS-M Futures” under the derivatives menu or the ”Futures” tab on mobile.

Use the code ”long90” when opening your Futures account on Binance and start trading on the platform.

You can click various buttons on the futures trading page such as buy and sell buttons to view ”open futures account” form if it is not visible.

If you can’t view the Futures tab on mobile, you can click the user icon and then switch to Binance Pro.

If you want to short crypto on Binance but don’t have a Binance account yet, click the button below or use the referral ID ”WRYOO8BZ” to open your Binance account with a 20% fee discount:

You can also refer to our tutorial on how to create a Binance account on mobile which features step-by-step instructions on creating and setting up a Binance account.

How to open a short position on Binance Futures

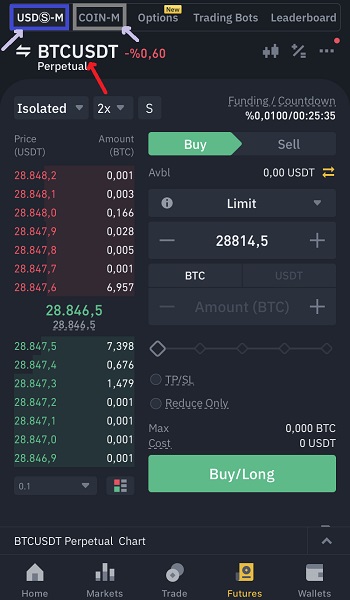

To short crypto on Binance, first click ”USDS-M Futures” under the derivatives menu on Binance’s website or the ”Futures” tab on mobile.

If you can’t see the Futures tab on mobile, click the user icon and then switch to Binance Pro.

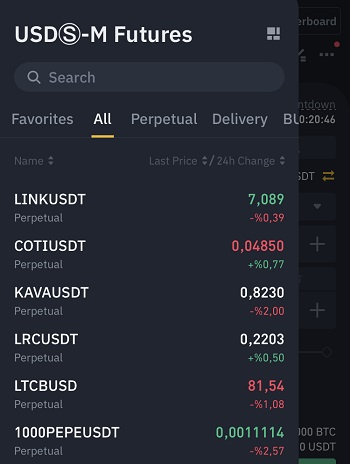

How to select the futures contract / pair to trade on Binance

If you want to open a short position using stablecoins such as USDT and BUSD, click ”USDS-M” and select the trading pair (futures contract) by clicking ”BTCUSDT” (red arrow).

When shorting cryptocurrencies such as Bitcoin and Ethereum, if you want to use the coin itself as your margin instead of USDT or BUSD, you can select and trade COIN-M pairs.

After clicking the pair ”BTCUSDT (perpetual)”, you can select the crypto that you want to short.

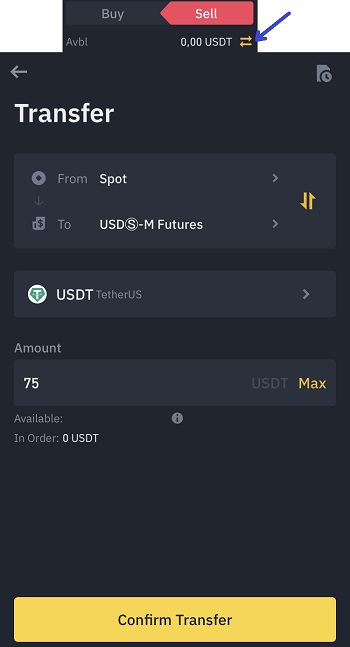

How to transfer USDT to your Futures wallet on Binance

Click the transfer icon beside your balance to transfer USDT from your spot wallet to USDS-M Futures wallet.

You can then use your USDT balance to open a short position.

Which margin mode to use on Binance & Leverage

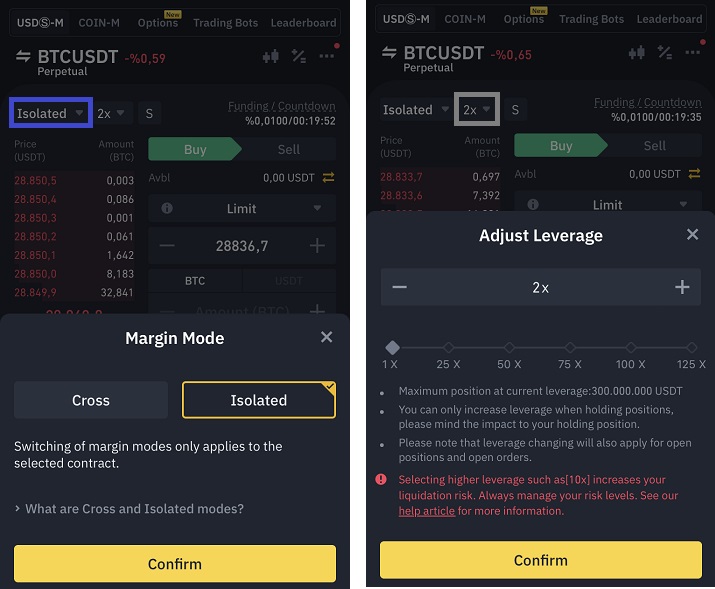

After transferring USDT to your USDS-M Futures wallet, select the margin mode and adjust the leverage.

If you use the cross margin mode, your futures wallet balance will also be used as your margin in addition to the margin allocated to the position.

And if the position gets liquidated, you may lose your futures wallet balance and also risk your other open positions that share the same margin balance if any.

When you use the isolated margin mode to open short positions, you can only lose your margin (cost) that is allocated to the position.

If you are a beginner, you can start opening short positions using the isolated margin mode which is easier to manage risk-wise.

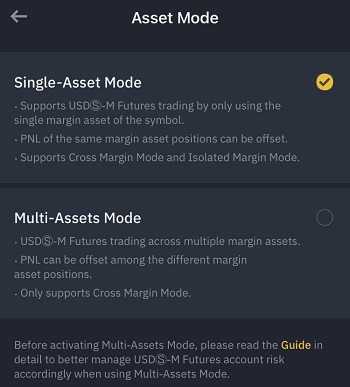

What is asset mode on Binance

When you click the letter ”S” next to leverage, you can change the asset mode. If you use the isolated margin mode, you don’t need to and can’t change the asset mode.

If you use the cross margin mode and want to use multiple assets such as USDT, BUSD, BTC and ETH as your margin to trade USDS-M Futures contracts, you can select the multi-assets mode.

To learn about the benefits of multi-assets mode, you can refer to Binance’s article.

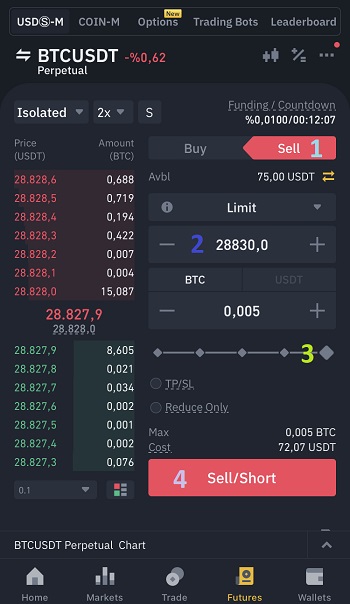

How to place a sell / short order on Binance

After selecting the margin mode and leverage, click the sell button to place your sell / short order.

Select ”limit” if you want to open your short position at a certain price (2) or ”market” to open your position at the market price.

After adjusting the position size (3) and checking your cost (margin), you can click the sell/short button (4) to place your order in the market.

If you are a beginner, you may not understand the relationship between cost (margin), leverage and position size.

For example, if you use 2x leverage, your position size (the quantity of BTC * entry price) will be around double of your cost (margin).

So if you have 100 USDT as margin, you can open approximately a 500 USDT worth of position using 5x leverage.

When you place your sell/short order, you can see it under ”open orders” if it does not get filled yet.

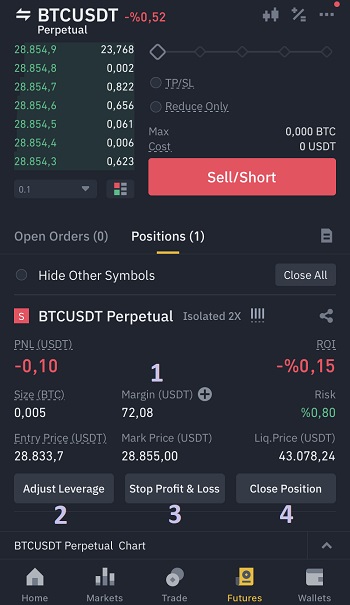

After your sell/short order gets filled, your short position will be open and you can see it under ”positions”.

How to add margin to a position on Binance

Margin (1) is the amount of crypto that is allocated to a position.

You can click the plus sign next to the margin and add margin to your position which will reduce your risk of liquidation.

As you can see in the image above, adding margin to your position will improve your liquidation price.

Depending on your position’s profitability, it’s also possible sometimes to remove margin from the position which will increase your risk of liquidation.

How to use the adjust leverage button on Binance

Alternatively, if you want to use a lower amount of margin for your position, you can increase the leverage (2) and then remove margin from your position by clicking the plus sign next to the margin.

When you increase your leverage using the ”adjust leverage” button, nothing will change as the amount of margin and the position size are still same.

But you will be able to remove a lot more margin from your position depending on the increase in leverage.

And if you remove margin from your position, it will make your position riskier as the liquidation price will change, getting closer to your entry price.

Size is the position size which will be around (margin * leverage) = (size * entry price).

Mark price is an index price based on prices on various major exchanges. It is used for PNL and margin calculations to prevent manipulation.

Liq. price is the liquidation price at which your position gets liquidated and you lose your margin.

”Risk” shows the risk of liquidation. When it reaches 100%, your position gets liquidated. So you need to watch it closely.

PNL and ROI are profit/loss indicators. You can see how much your unrealized profit or los is before closing your position.

How to place stop loss and take profit orders on Binance

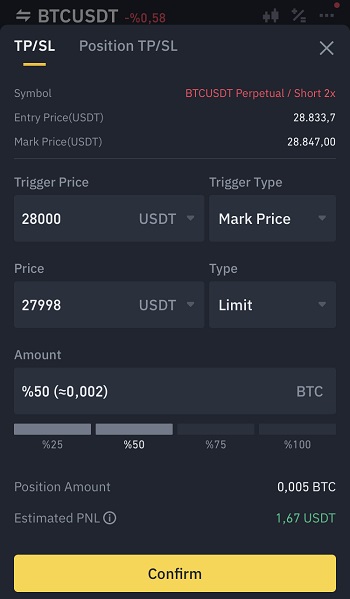

By clicking the ”stop profit & loss” button, you can place take profit and stop loss orders for your short position.

To place a take profit order for your short position, ”price” must be equal to or lower than the ”trigger” price.

You can also change the order type from limit to market if you want your take profit order to be executed at the market price after the trigger price is hit.

The trigger price is the price at which your take profit or stop loss order will be activated and placed in the market.

When taking profit or stopping your loss, you don’t need to close your entire position. You can enter a certain amount of position size or adjust the percentage when placing a TP/SL order.

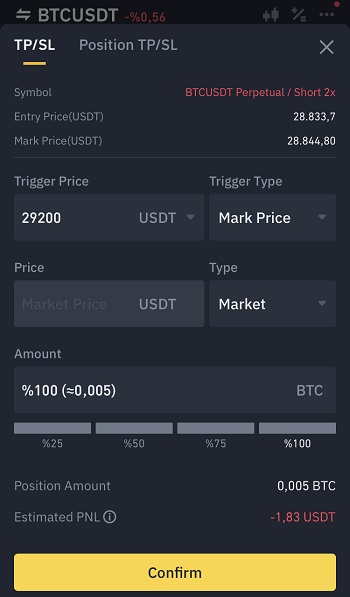

To place a stop loss order for your short position using the stop profit & loss button, enter a price higher than or equal to the trigger price or use the market order type.

Again, when placing a stop loss order, you don’t need to sell your entire position. You can enter a certain amount and close part of your position.

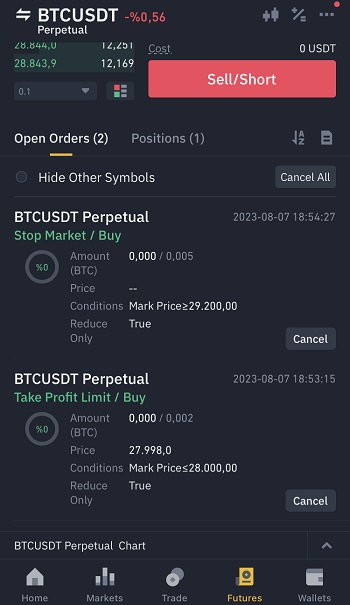

After placing stop loss and take profit orders, you can see your orders under the ”open orders” tab.

How to close your futures position on Binance

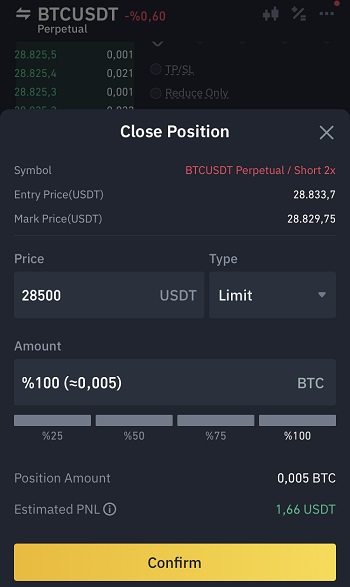

To close your short position, you can use the ”close position” button.

Enter a certain price at which you want your short position to be closed or select the market order type.

After entering a certain amount of position size or selecting 100%, you can place your order in the market by clicking the confirm button.

When you place a stop loss / take profit order or a close order for your short position, it will be shown as ”buy” order.

As you place sell/short order to open a short position, you need to place a buy/long order to close your short position.

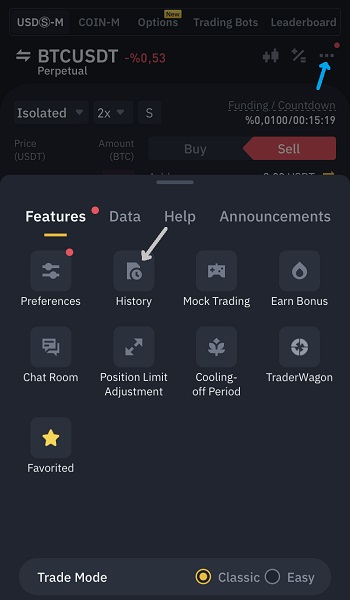

How to view trade history on Binance Futures

To see your trade history, realized PNLs and fees paid, click the ellipsis sign and then select ”history” under the features tab.

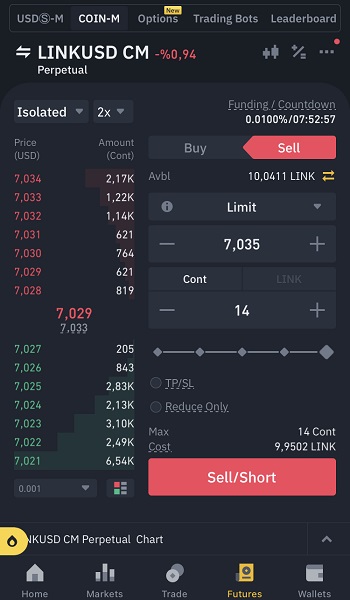

Trading COIN-M Futures contracts on Binance

To trade coin-margined futures contracts on Binance, you need to select ”COIN-M” and the pair (contract) that you want to trade on the futures page.

After transferring the coin itself that you want to short to your COIN-M Futures wallet, you can place a sell/short order.

The position size will be expressed in contracts and each contract is worth 10 USD. So the position size for the short position below is 140 USD.

For Bitcoin, each coin-margined futures contract represents 100 USD. So the contract value may differ depending on the contract.

When you trade coin-margined futures contracts, your PNL (profit and loss), margin and fees paid will all be in the coin that you short.

Binance Futures fees and funding

For USDS-M Futures contracts on Binance, the trading fee for maker and taker orders are 0.02% and 0.05% respectively.

Calculating trading fees that will be charged when opening and closing a position is very simple.

Let’s say you want to open / close a position of 0.08 BTC with an entry / close price of 32000 USDT, you can calculate the fee by following the formula below:

(Position size * entry/close price) / 100 * fee rate = (0.08*32000)/100*0.02 = 0.512 USDT.

Basically, you should multiply your position size by the entry or close price and then divide it by 100 and multiply it by the fee rate.

When opening or closing your position, if the order is considered a taker order, you will be charged a 0.05% fee instead.

For coin-margined (COIN-M) futures contracts, the trading fee for maker and taker orders are 0.02% and 0.05% respectively.

To calculate the fee that will be charged when opening and closing a position, first multiply the amount of contract that you buy / sell by the contract value.

For example, if you have a short / long Bitcoin position of 50 contract, you should multiply it by the contract value ”100 USD” = 50*100 = 5000 USD.

Divide 5000 by 100 and then multiply it by 0.02% or 0.05% depending on whether the order is a maker or taker order.

5000/100*0.02 = 1 USD.

As fees will be paid in the coin that you trade, you should divide 1 by the entry or close price. If you close your position, let’s say, at 25000 USD, the fee will be 1/25000 = 0.00004 (coin).

Besides trading fees, you will either pay or receive funding payments every 8 hours after you open a position on Binance.

If you have a short position, you will receive funding when the funding rate is positive. When it is negative, you will pay funding and longs will receive it.

![]()

Let’s say the funding rate is 0.01% and you have a short position of 0.05 BTC.

When the funding countdown hits zero and the market price is 27000 USDT, the funding fee will be (0.05*27000)/100*0.01 = 0.135 USDT.

As it is a short position and the funding rate is positive, 0.0135 USDT will be added to your margin.

To better understand funding fees and liquidation price and learn how to calculate it, you can use our Binance Futures funding calculator and Binance Futures calculator.

If you’re interested in trading futures contracts and opening long/short positions on Binance, check out our other tutorials as well:

In addition to Binance, you can also use other crypto exchanges that allow shorting such as BitMEX.

Have any questions about shorting crypto on Binance? Leave a comment below.