If you don’t have a Binance account yet, you can enter the code ”WRYOO8BZ” in the referral ID field when opening your Binance account and receive a 20% fee discount for spot (max) and a 10% fee discount for futures (max).

If you don’t have a Binance account yet, you can enter the code ”WRYOO8BZ” in the referral ID field when opening your Binance account and receive a 20% fee discount for spot (max) and a 10% fee discount for futures (max).

You can simply click the button below to open your Binance account with a 20% fee discount:

How to use the Binance Futures calculator

Step 1: Enter your cost / margin in the ”cost / margin” field. Let’s say you have 7,500 USDT in your USDⓈ-M Futures wallet and you want to open a long or short position with 6,500 USDT, you can enter ”6,500”.

Or let’s say you trade the BTCUSD coin-m contract and want to open a long or short position with 0.085 BTC, you can enter ”0.085”.

Step 2: Choose your position type.

Step 3: Choose your margin mode.

Step 4: Enter your leverage. If you want to use 7x leverage, you can enter ”7” in the leverage field.

Step 5: Enter your USDⓈ-M or COIN-M Futures wallet balance if you use the cross margin mode. Let’s say you have 7,500 USDT in your USDⓈ-M Futures wallet and you want to open a long or short position with 6,500 USDT, you can enter ”1,000” as your wallet balance.

For an ETHUSD position with a wallet balance of 0.15 ETH, ”0.15” can be entered in the wallet balance field.

If you use the isolated margin mode, leave it blank.

Step 6: Select the type of futures contract that you trade.

If you trade coin-margined futures contracts, enter your position size (the number of contracts bought / sold) and the value of one contract in USD.

For reference, each BTCUSD contract is worth 100 USD and each ETHUSD contract is worth 10 USD, which can be found on the trading page as well.

Step 7: Enter your entry price.

Step 8: Enter your exit price. If you leave it blank, you can ignore the negative PNL.

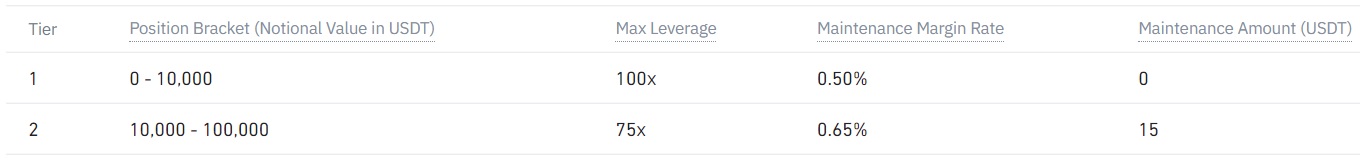

Step 9: Select your maintenance margin rate and enter your maintenance amount, which vary depending on the pair you trade and your position size.

You can find the maintenance margin rate and the maintenance amount based on the pair you trade and your position size on this page.

For example, if you trade the ETHUSDT (perpetual) contract and have a 4,000 USDT position, you can select 0.50% as your maintenance margin rate and enter 0 in the maintenance amount field.

If your position size is higher than 10,000 USDT for the ETHUSDT perpetual contract, something like a 12,000 USDT position, you should select 0.65% as your maintenance margin rate and enter 15 in the maintenance amount field.

If you don’t know your position size, you can calculate it either by multiplying your cost (margin) by your leverage or multiplying your position size in crypto by your entry price.

Step 10: Click the calculate button.

Note: Due to the maintenance margin rate that varies depending on your position size and the pair you trade, the actual liquidation price for your long positions may be a bit higher and the actual liquidation price for your short positions may be a bit lower than the liquidation price calculated here.

If you refer to this page and find your maintenance margin rate and maintenance amount based on the pair you trade and your position size and enter them into the calculator, the liquidation price will be calculated more accurately.

Calculating liquidation price after adjusting margin

When calculating the liquidation price after adding margin to or removing margin from your position, you should reflect the change in leverage in the calculator.

For example, let’s say you have a 1400 USDT position with 2x leverage and your margin (cost) for the position is 700 USDT (1400/2).

If you add 100 USDT margin to your position, you should also change your leverage besides entering ”800” in the cost/margin field.

After you add 100 USDT margin to your position, your real leverage will change from 2x to 1.75x (1400/800). So you should enter ”1.75” in the leverage field instead of ”2”.

If you enter ”2” in the leverage field and enter ”800” in the cost/margin field, your position size will be calculated as 1600 (800×2).

So the liquidation price will be calculated inaccurately because your position size does not change when you add margin to or remove margin from your position.

In addition to the position size, your entry price also does not change when you add margin to or remove margin from your position.

So when calculating the liquidation price after adjusting your margin, you should only reflect the change in your margin and leverage in the calculator.

As a side note, when calculating your position size, you should multiply your position size (in coins) by your entry price.

If you trade coin-margined futures contracts, you can multiply the amount of contract you hold (size) by the value of one contract in USD.

Calculating liquidation price after increasing your long / short position by placing a new order

Imagine you have a 3x leveraged long position with values below:

- Margin: 400 (USDT)

- Entry price: 25000

- Position size: 1200 (400×3)

And you want to place a new buy/long order with 200 USDT (margin) using 3x leverage at the price of 22000.

First you need to calculate your new entry price.

To do that, multiply the entry price of your position by the position size and multiply the entry price of your new order by the order size, and sum these values and divide it by the total position size.

((25000×1200)+(22000×600))/1800 = 24000 (new entry price)

Now you can use the values below to calculate your new liquidation price:

- Margin: 600 (400+200)

- Entry price: 24000

- Leverage: 3x

If you use a different leverage when placing a new order, you should also calculate the new (real) leverage beside the new entry price.

Let’s say you want to place a new buy/long order with 200 USDT (margin) at the price of 22000 but using 4x leverage this time.

The new entry price can be calculated as 23800 using the same formula: ((25000×1200)+(22000×800))/2000 = 23800.

To calculate new (real) leverage which is basically between 3x and 4x, you need to calculate your initial position size and new order size in coins.

Initial position size in coins: 0.048 (1200/25000)

New order size in coins: 0.03636 (800/22000)

So the new position size in coins will be 0.08436 (0.048+0.03636).

To calculate new (real) leverage, we should multiply the position size in coins by the new entry price and then divide it by the new margin.

(0.08436×23800)/600 = 3.34628 (new (real) leverage)

Now the new liquidation price can be calculated in the calculator using the values below:

- Margin: 600 (400+200)

- Entry price: 23800

- Leverage: 3.34628x

To learn how to calculate Binance Futures fees and funding, check out our Binance fee calculator and Binance funding fee calculator.