SushiSwap is an evolved version of Uniswap with SUSHI token that functions as a protocol token and benefits holders and liquidity providers in various ways.

In addition to SushiSwap, there are several other Uniswap competitors such as Balancer and 1inch. Each AMM has a different underlying mechanism.

For example, 1inch‘s liquidity protocol tries to bring more value to liquidity providers with its different approach to exchange rates.

Well, how is SushiSwap different than Uniswap? How do SushiSwap and SUSHI token work? How to stake SUSHI?

What is the difference between Uniswap and SushiSwap? Uniswap vs SushiSwap

When you provide liquidity to SushiSwap pools, you receive SLP tokens and earn trading fees as a liquidity provider. You can also earn rewards in SUSHI tokens by staking your SLP tokens.

This is kind of similar to Uniswap‘s fee distribution and liquidity mining program. But, when you remove your liquidity from SushiSwap pools, you can still receive a portion of trading fees by staking your SUSHI tokens for xSUSHI.

So you don’t necessarily need to be a liquidity provider to directly benefit from the protocol. You can simply buy SUSHI tokens and stake them on the platform to earn trading fees.

While all of the 0.3% trading fee go to liquidity providers on Uniswap, on Sushiswap, liquidity providers receive 0.25% fee and SUSHI holders who stake their SUSHI tokens and get xSUSHI in return receive the remaining 0.05%.

If you have SUSHI tokens, you can mint xSUSHI tokens by staking SUSHI tokens on SushiSwap and start earning swap fees.

SushiSwap fees

When you swap tokens on SushiSwap, you will pay a trading fee of 0.3%. In addition to that, you also need to pay transaction fees while approving tokens, which needs to be done only once for each token.

Before making a trade on SushiSwap, you should check out the price impact. It could be high sometimes, especially when you want to make a large trade or there is no enough liquidity.

In that case, especially if you want to make a large trade, you can try trading on DEX aggregators such as 1inch and Matcha.

How to buy SushiSwap (SUSHI)?

SUSHI token is traded on various cryptocurrency exchanges. You can buy SUSHI on decentralized exchanges such as Uniswap, 1inch, Matcha, Balancer and SushiSwap.

There are also various major centralized exchanges such as Binance and Poloniex that you can use to buy SUSHI token.

In terms of liquidity, Binance is the best exchange to trade SUSHI. If you don’t have a Binance account yet, click this link or visit our step-by-step guide to open your Binance account with a 20% fee discount.

How to use SushiSwap?

If you have used Uniswap to swap tokens or provide liquidity to trading pairs before, then you will have no difficulty using SushiSwap because it is very similar to Uniswap.

You can do various things on SushiSwap: Swapping tokens, adding liquidity to pools, staking your SLP tokens to earn SUSHI and staking SUSHI for xSUSHI to earn fees.

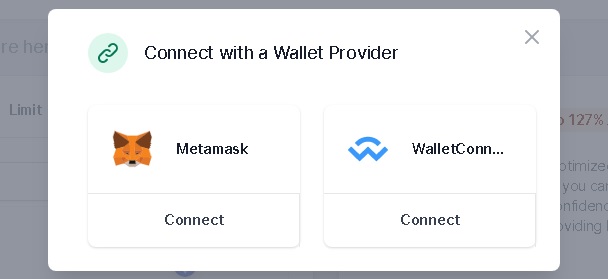

To start using SushiSwap, first visit SushiSwap and connect your wallet to the platform by clicking on the ”Connect Wallet” button. You can use MetaMask or mobile wallets such as Trust Wallet via WalletConnect to access SushiSwap.

How to trade on SushiSwap?

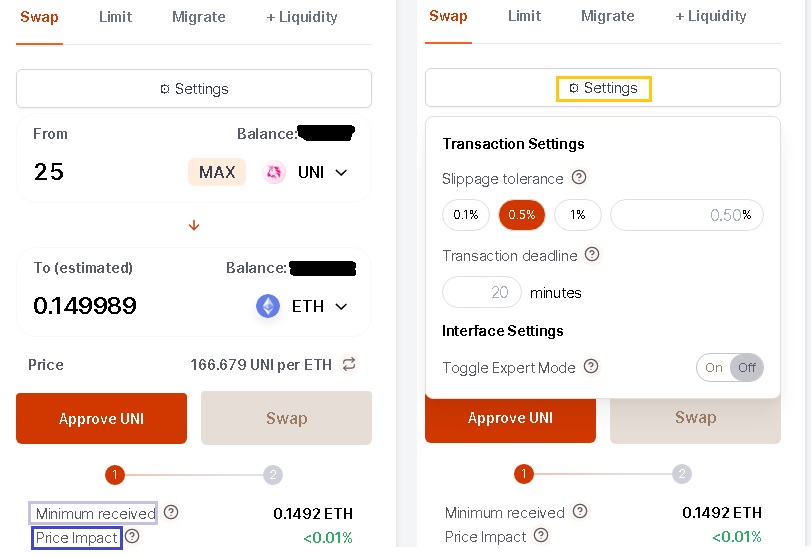

After connecting your wallet to SushiSwap, you can start swapping tokens in the ”Swap” section. To make a swap, first choose the token you want to swap and the token you want to receive in return.

After entering the amount of the token you want to swap, the amount of the token you are swapping to will be automatically calculated.

You can set a slippage tolerance and a transaction deadline in the settings. If you have not approved the token you want to swap before, you need to approve it first to be able to make the swap.

Click on the ”Approve X” button and confirm the transaction on your MetaMask wallet. After that, you can make the swap by clicking on the ”Swap” button and confirming the transaction on your wallet.

Adding liquidity to SushiSwap pools

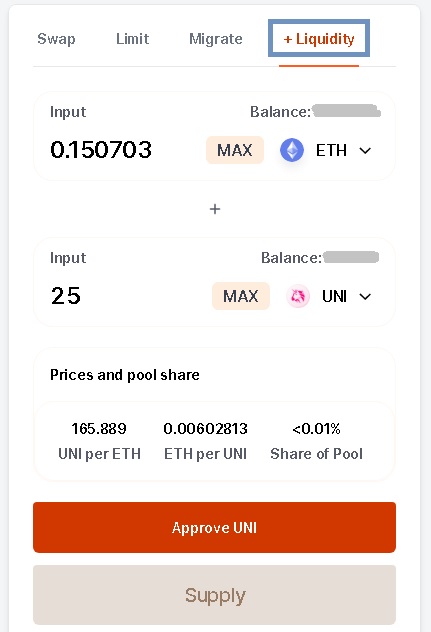

You can provide liquidity to SushiSwap liquidity pools the same way you do on Uniswap. If you haven’t provided liquidity to Uniswap pools before, you can refer to this guide to learn how to add liquidity to liquidity pools.

To add liquidity to a pair on SushiSwap, you need to deposit an equal value of each token. For example, let’s say you have $250 worth of SUSHI that you want to add to the SUSHI-ETH pair, then you’ll also need $250 worth of ETH.

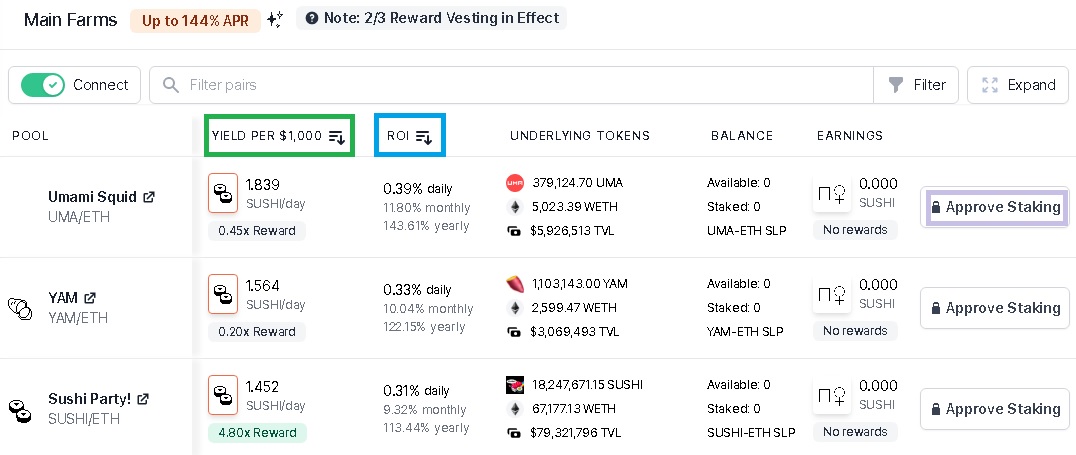

You can add liquidity to the pairs on SushiSwap by clicking on the ”+Liquidity” tab. Before doing that, you should check out the liquidity and the volume of pairs on the ”pairs” page as well as daily SUSHI rewards for each pool on the ”farms” page.

How to stake SushiSwap LP (SLP) tokens?

After you add liquidity to a SushiSwap pool, you will receive SushiSwap LP (SLP) tokens that you can stake on the ”farms” page and earn rewards in SUSHI tokens.

You can check out SushiSwap farms and daily SUSHI rewards per $1000 on the ”farms” page. To stake your SLP tokens, first click on the ”Approve Staking” button to allow SushiSwap to spend your SLP token and then you can simply stake them.

66.6% of SUSHI rewards are currently subject to 6 months of vesting. So, if you earn 100 SUSHI tokens, you can harvest 33.4 SUSHI immediately and the rest, 66.6 SUSHI tokens, 6 months later.

How to stake SUSHI? SUSHI Staking

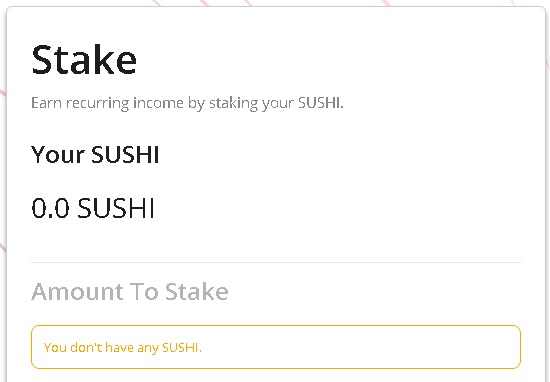

You can stake your SUSHI tokens earned by either providing liquidity to SushiSwap pools and staking LP tokens or bought in exchanges to receive a portion of swap fees.

Unlike Uniswap, SushiSwap does not distribute all of the 0.3% swap fee to liquidity providers, instead 0.05% is left for SUSHI holders who stake their SUSHI tokens for xSUSHI while the rest goes to liquidity providers.

Therefore, if you have some SUSHI in your wallet, you can stake them on SushiSwap and mint xSUSHI tokens which will accrue swap fees. You can convert your xSUSHI tokens back to SUSHI on the same page to receive the swap fees accumulated.

You can’t currently stake your SUSHI tokens on SushiSwap.fi, you need to use SushiSwap lite website. You can stake your SUSHI for xSUSHI and convert your xSUSHI back to SUSHI on the ”stake” page.

To stake your SUSHI tokens, you first need to approve the token to allow the contract to spend your tokens, after that you can stake SUSHI for xSUSHI.

SUSHI staking APY – xSUSHI APY

The APY rate for SUSHI staking is currently around 10%. You can check out the exact APY rate on this page. The ROI for SUSHI staking will also be available on SushiSwap’s website.

Check out other decentralized exchange reviews: