Uniswap is one of the most popular Ethereum-based decentralized exchanges.

As an easy-to-use, safe decentralized exchange with very high liquidity, it is the first choice for those who want to swap ERC20 tokens.

In this review & tutorial, we will show you how to use Uniswap and add liquidity to and remove liquidity from Uniswap.

We will also give you information about Uniswap fees and explain how UNI token works.

What is Uniswap?

Uniswap is an automated liquidity protocol that allows users to swap tokens from their own wallets in a trustless way.

Uniswap consists of liquidity pools of various pairs which are basically smart contracts on the Ethereum blockchain and other supported chains.

Smart contracts enable various functions such as swapping tokens, adding / removing liquidity, etc. Thanks to that, you need to trust nothing but the code.

There is no order book on Uniswap. You just need to pick the trading pair and enter the amount of token you’ll swap and then the protocol calculates how much the output will be.

This happens through liquidity pools that contain reserves of pair tokens, which require liquidity providers to add an equal value of each token to the pools for the price to be maintained.

When you swap tokens on Uniswap, the output is determined in a way that Uniswap’s constant product formula is maintained.

If you want to make large trades at possibly better rates, you can also check out DEX aggregators such as Matcha and 1inch, which aggregate liquidity from various sources including Uniswap.

With Uniswap v3, it is also possible to provide liquidity to Uniswap with a different ratio of tokens other than 50/50 if you think one will outperform the other.

Uniswap fees

When you swap tokens on Uniswap, you’ll be charged a fee of 0.30%, 0.01%, 0.05% or 1% depending on the pair you trade.

The fee is distributed to liquidity providers proportional to their share of the pool.

When liquidity providers decide to remove their liquidity from the pool, they receive transaction fees along with their contribution to the pool, and the liquidity token they received after adding liquidity to the pool is burned.

The fee calculation is quite simple.

For example, if you swap 1 ETH to another token and the fee for the pair you trade is 0.3%, you will be charged 0.003 ETH (1/100*0.3).

If you want to calculate trading fees automatically, you can use our Uniswap fee calculator.

Besides trading fees, you will also pay transaction fees for approving tokens and making trades. If Ethereum gas fees are too high, you can instead trade on centralized exchanges such as Binance.

There are also other decentralized exchanges that can offer lower trading fees and better rates than Uniswap. You can check out 1inch and Balancer for better deals.

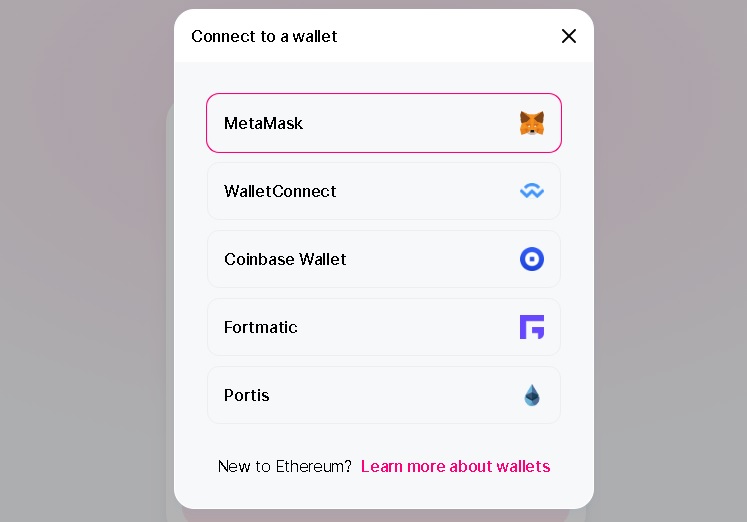

Uniswap supported wallets

As Uniswap is a dapp, you need a cryptocurrency wallet that allows you to interact with dapps to use Uniswap.

There are various wallets that you can use to trade on Uniswap.

Uniswap supports MetaMask, Coinbase Wallet, Fortmatic and Portis. You can also use Uniswap with mobile wallets such as Trust Wallet and Coinomi through WalletConnect.

If you have a hardware wallet like Ledger Nano X, you can follow our guide to learn how to connect Ledger to MetaMask.

Decentralized exchanges including Uniswap can be used in a much safer way with a Ledger hardware wallet.

Uniswap (UNI) token explained – Uniswap liquidity mining

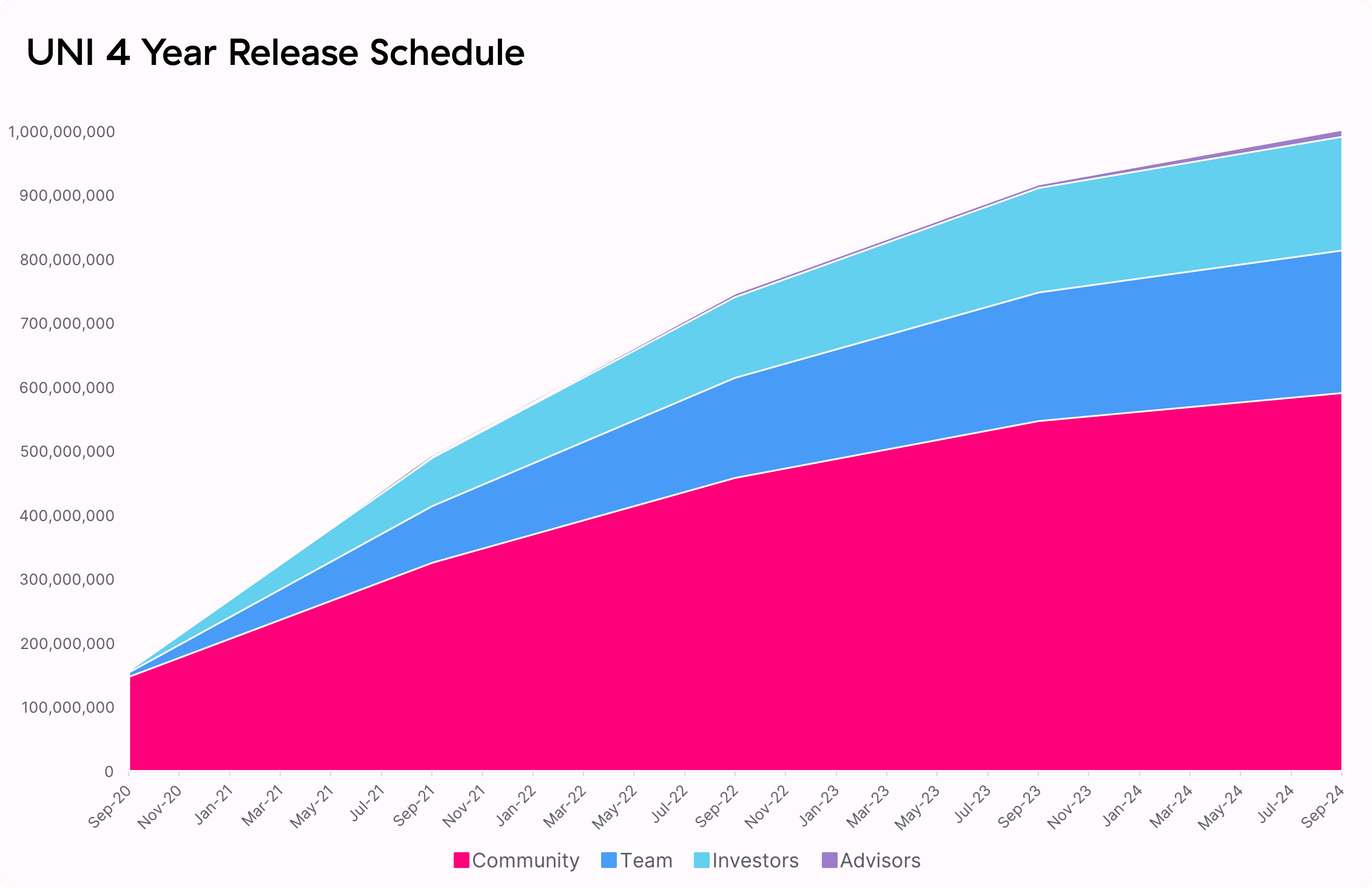

Uniswap launched its own protocol token, Uniswap (UNI), on September 16, 2020. A total of 1 billion UNI token has been minted, which is the maximum supply of UNI.

UNI tokens will be gradually distributed to the community, team, investors and advisors over the course of 4 years.

UNI token distribution

The exact Uniswap (UNI) distribution is as follows:

- 60.00% to Uniswap community members 600,000,000 UNI

- 21.51% to team members and future employees with 4-year vesting 215,101,000 UNI

- 17.80% to investors with 4-year vesting 178,000,000 UNI

- .069% to advisors with 4-year vesting 6,899,000 UNI

Those who have interacted with Uniswap or provided liquidity to liquidity pools before September 1, 2020, at 12:00 am UTC can view and claim their UNI token rewards by connecting their wallets to the dapp.

UNI token is used for governance and liquidity mining. You can stake your Uniswap LP tokens to receive UNI tokens.

The liquidity mining program is initially only available for ETH/USDT, ETH/USDC, ETH/DAI and ETH/WBTC pools.

UNI token release schedule

The UNI token release schedule below may help UNI holders value their UNI tokens and decide whether to sell, hold or buy more.

According to the chart below, it will take approximately one year from now to reach a circulating supply of 500,000,000 UNI tokens.

Considering the current market, the hype around DeFi as well as the success of Uniswap, UNI token could be easily in the top 20 or even top 10. You can do the math yourself.

If you are interested in decentralized exchange tokens, you can also check out Balancer (BAL), 1INCH, SUSHI token and CAKE token.

How to trade on Uniswap

Trading on Uniswap is quite simple. As there is no order book on Uniswap, it is much easier for beginners to use Uniswap than many other decentralized exchanges.

Step 1: Connect your wallet to Uniswap

To start trading on Uniswap, you first need to log in to your wallet and visit Uniswap and click ‘launch app”.

You can then connect your wallet to the dapp by the ”clicking ”connect to a wallet” button.

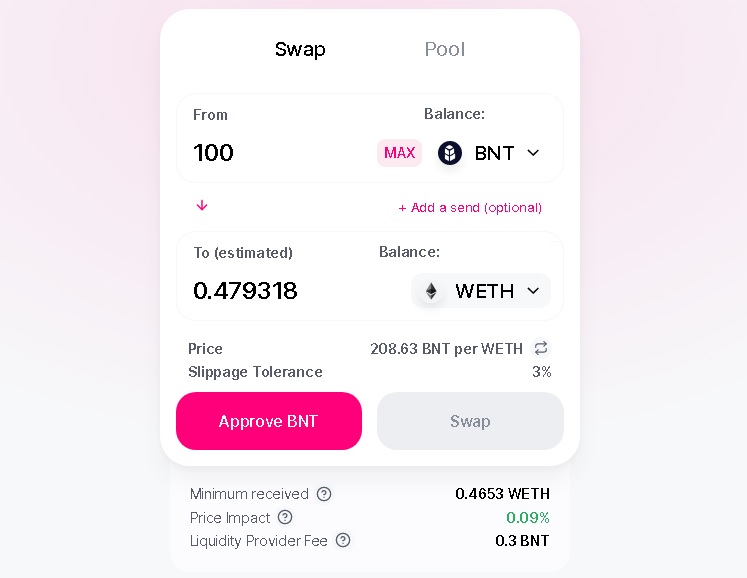

Step 2: Swapping tokens on Uniswap

To swap tokens on Uniswap, first choose the pair and then enter the amount of token you want to swap. Then you will see the estimated and minimum amount of token you’ll receive.

You first need to allow Uniswap to spend your token by clicking ”approve X token” and then confirming this on MetaMask. After that, you can swap tokens.

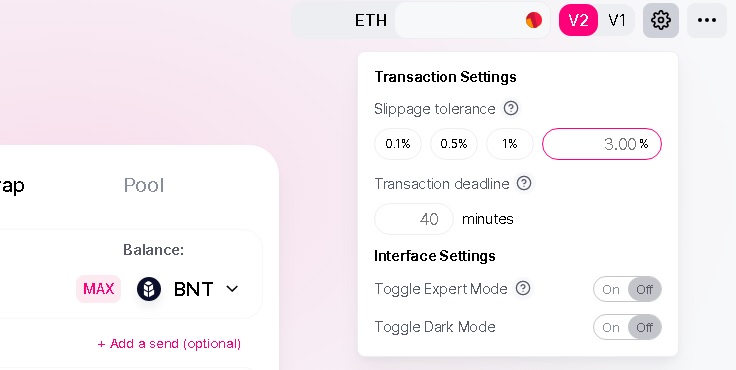

Uniswap slippage tolerance – Uniswap transaction settings

To change transaction-related settings while swapping tokens on Uniswap, click the setting icon at the top right corner of the page.

(The setting icon is now located on the swap form.)

You can change the ratio of slippage tolerance, and transaction deadline to prevent transactions from reverting.

Make sure to check the minimum amount of token you will receive based on your slippage tolerance before doing the swap.

If you’ll especially swap large amount of tokens, you can instead use 1inch.exchange. It splits orders among various decentralized exchanges such as Uniswap, Kyber and Bancor to achieve the best rates.

How to add liquidity to Uniswap

Adding liquidity to Uniswap liquidity pools is as easy as swapping tokens on Uniswap.

But you should first check out various sources on impermanent loss such as Pools.fyi and ZumZoom to find the profitable pools and also consider the risks mentioned below.

If you have no idea what impermanent loss is. You should first read our guide to impermanent loss.

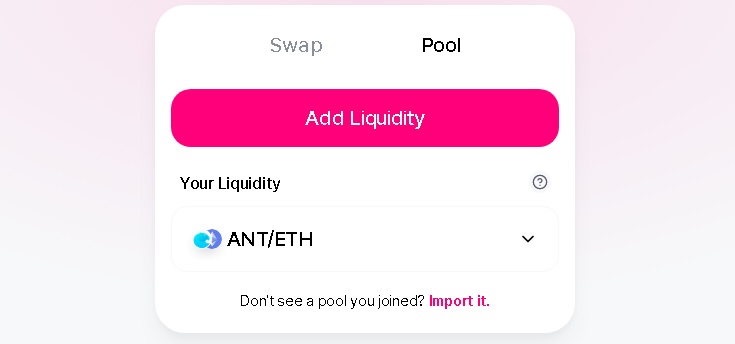

Step 1: Connect your wallet to Uniswap and click Pool

Connect your MetaMask wallet or any other supported wallet to Uniswap and click ”pool” tab.

After clicking the ”pool” tab, click the ”add liquidity” button to add liquidity to any of the pairs on Uniswap.

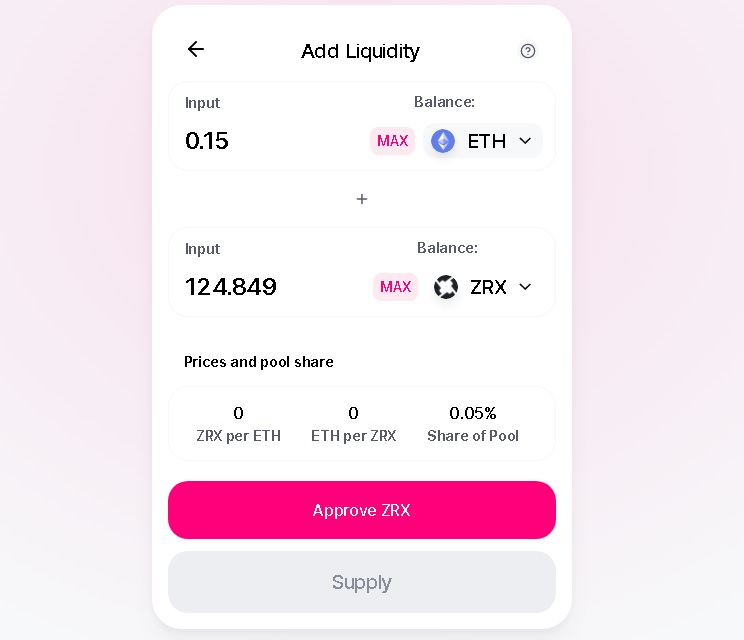

Step 2: Adding liquidity to a Uniswap liquidity pool

To supply liquidity to a certain trading pair on Uniswap, you need to deposit an equal value of each token. You can choose one of the common bases such as WETH, USDC, DAI and USDT.

When you enter the amount for one token, the amount of other token will be autofilled by the protocol. You need an equal value of each token in your wallet to be able to supply liquidity to a certain pair.

After approving the token which allows Uniswap to use the token, you can click the ”supply” button to add liquidity to the pool.

You will receive liquidity tokens in return that represent your position / liquidity in the pool and start earning swap fees.

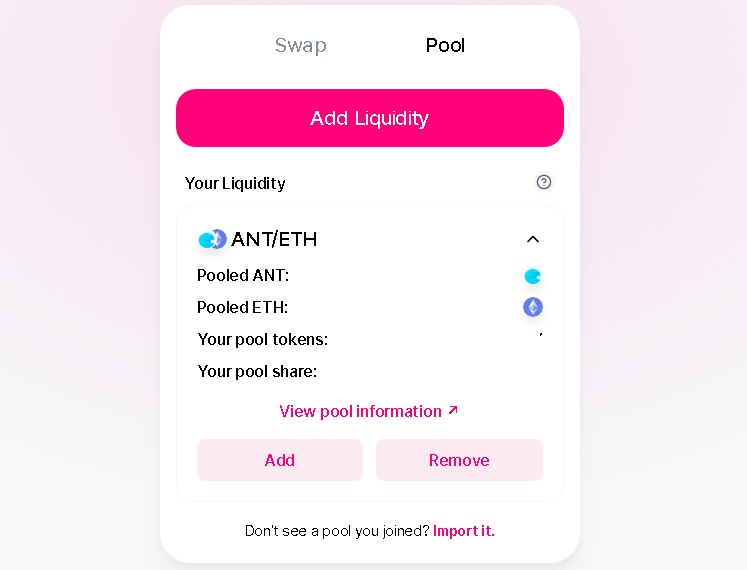

You can view the pairs you supplied liquidity to under ”your liquidity” and remove your contribution from the pool any time which will also include accrued fees.

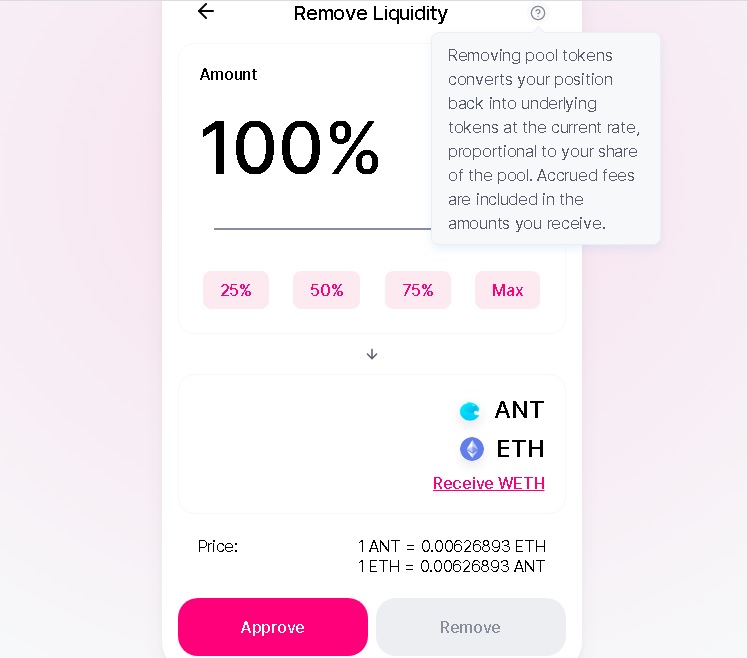

How to remove liquidity from Uniswap

After you’ve added liquidity to a Uniswap pool, you can remove your liquidity from the pool to get your tokens back along with accumulated fees.

To remove liquidity from Uniswap, follow the steps below.

Step 1: Connect your wallet to Uniswap and click Pool

Connect MetaMask or any other wallet that you use to Uniswap and click ”pool” tab, which is located at the top left corner of the page.

On the pool tab, you can see your liquidity. If it is not visible, you can try importing it.

Step 2: Removing liquidity from a Uniswap pool

Choose the amount of liquidity you want to remove from the pool and click the ”approve” button, and sign the message on MetaMask.

After that, click the ”remove” button to remove your liquidity from the pool. Your LP tokens will be burnt and you’ll receive your tokens along with accrued fees.

As the price and the amount of tokens in the pool have changed, you will receive different amount of tokens and there will be some impermanent loss.

Uniswap impermanent loss explained

To provide liquidity to a pair on Uniswap, you need to deposit an equal value of each pair token into the pool.

For example, if you’ll provide liquidity to the BAT/ETH pair and have $100 worth of BAT in your wallet, then you need $100 worth of ETH too.

The amount of tokens you need to deposit is automatically calculated depending on the exchange rate at the time of adding liquidity.

Note that, with the launch of Uniswap v3, you can deposit tokens at a ratio different than 50/50 if you expect one to outperform the other.

The slippage from the initial exchange rate of the pair in either direction will result in what is called impermanent loss.

If the rate will continue to change in one direction, your impermanent loss will grow. Your loss will be close to zero if the rate will return to its original state.

Well, how this happens? There are arbitragers who make money out of these price changes and adjust the prices on Uniswap. But the profit they make is basically the money that belongs to liquidity providers.

If both BAT and ETH rise or decrease in value at similar rates, you’ll not suffer from impermanent loss and lose much money as the initial exchange rate will not change much.

But, if one of the tokens rises or decreases in value too much in comparison with the other token, the change in the exchange rate will be higher and you’ll lose more money.

On the other side, the more trade happens, the more fee you earn as a liquidity provider on Uniswap. But the fee you earn may not outweigh your impermanent loss depending on the degree of slippage.

For more information about impermanent loss and Uniswap liquidity pool ROIs, you can refer to our guide to impermanent loss and Pools.fyi and ZumZoom.

Check out other decentralized exchange reviews: