Opening a leveraged long position is a great way to make more money during upward price movements and in bull markets.

You can long Bitcoin and many other cryptocurrencies on Binance, the best and largest crypto derivatives exchange in the market.

Though futures trading might seem a bit confusing for beginners, longing on Binance is very easy and simple.

In this tutorial, we will show you how to long on Binance and open long Bitcoin positions with leverage up to 125x.

Opening your Binance and Futures accounts

If you don’t have a Binance account yet, first click the link or the button below to go to Binance’s registration page and open your Binance account and receive fee rebates while trading:

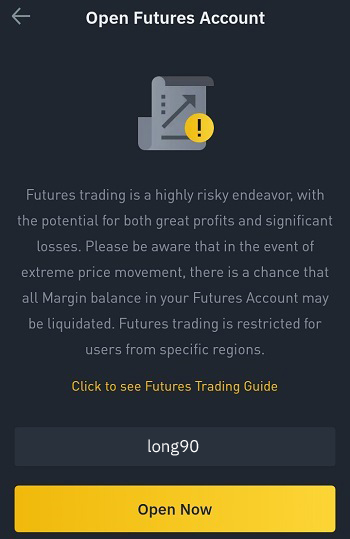

If you already have a Binance account but have not opened your Futures account on Binance yet, you can use the code ”long90” when opening your Futures account and start trading on the platform.

If you’ve opened your Binance account with the code ”SPOT90”, you don’t need to enter an additional code when opening your Futures account.

How to long on Binance

First log in to your Binance account on mobile or the website and click ”Futures” or Derivatives > USDS-M Futures.

If you’ve not opened your Futures account before, you can enter the code ”long90” when opening your Futures account.

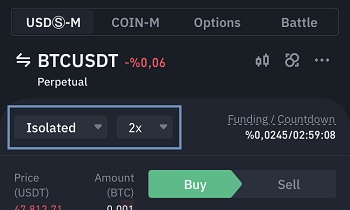

Choosing the BTCUSDT perpetual pair in USDS-M Futures

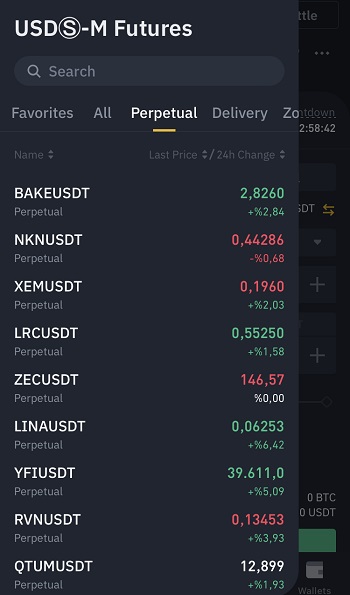

You can click the USDS-M tab to find USDT-margined contracts and open long positions on various cryptocurrencies with USDT.

In the COIN-M tab, you can find coin-margined contracts and use cryptocurrencies themselves such as Bitcoin and Ethereum to open long positions.

USDS-M Futures include many more trading pairs and are more widely used and preferred. Let’s first use USDT pairs and long Bitcoin with leverage.

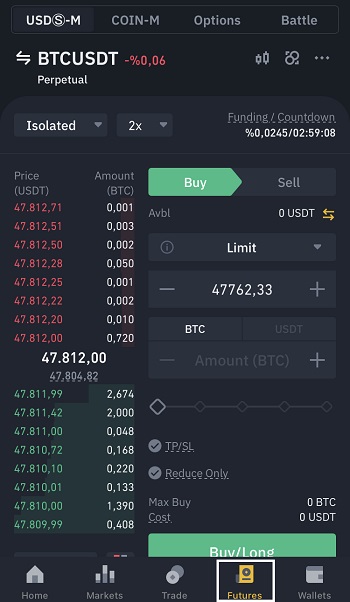

First click the pair on the Futures page and then choose the pair that you want to trade under the perpetual tab.

Delivery contracts have expiration dates while perpetual contracts never expire. Perpetual pairs have more volume and trading perpetual contracts is easier in general.

To open a long position on Bitcoin, choose the BTCUSDT perpetual pair. You can also choose other pairs if you want to go long on other cryptocurrencies.

Setting leverage and choosing the isolated/cross margin mode

After choosing the pair, you should choose the margin mode and set your leverage before opening a long position.

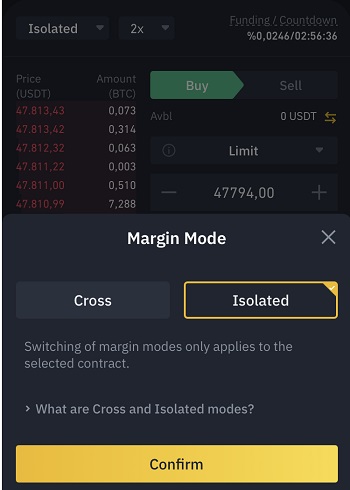

You can use the isolated or cross margin mode to open a long position on Binance.

In the isolated margin mode, you can only lose the money (cost/margin) that you used to open your position if you ever get liquidated.

In the event of a liquidation, your wallet balance and other positions are not affected. But, in the cross margin mode, you risk losing your wallet balance and other open positions.

The isolated margin mode is easier to understand and safer for beginners. After choosing the margin mode, you need to set your leverage before opening your long position.

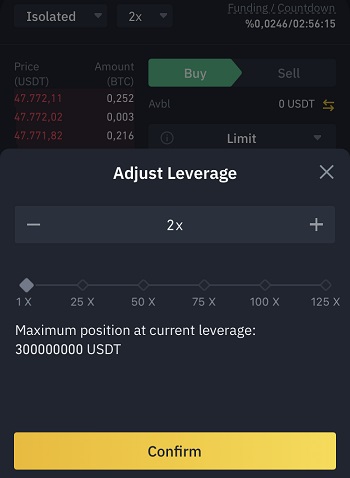

You can set your leverage by clicking ”2x”, which could be also set at ”5x” or ”10x” when you first start using Binance Futures.

After choosing the pair and margin mode, and setting your leverage, you should click the ”Buy” (green) button to open long positions.

When you click ”Buy”, you can enter the price and your position size and place your buy/long order at the market by clicking the ”Buy/Long” button.

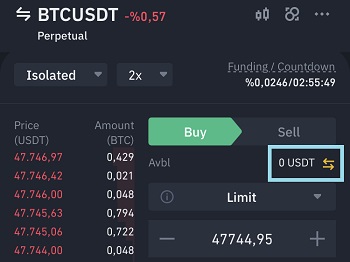

But, before that, you need to click the transfer icon beside ”0 USDT” and transfer USDT from your spot wallet to USDS-M Futures wallet.

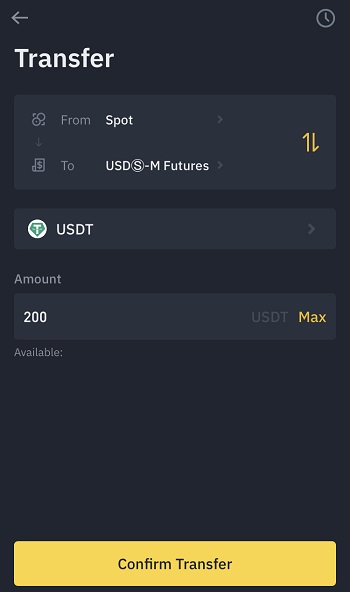

Transferring USDT from spot wallet to USDS-M Futures wallet

After clicking the transfer icon, transfer USDT from your spot wallet to USDS-M Futures wallet to open long positions on Binance.

You can also transfer some BNB to your USDS-M Futures wallet and pay fees in BNB.

If you have BNB in your USDS-M Futures wallet, you’ll receive a 10% fee discount on futures trading fees by paying fees in BNB.

Placing a buy/long order

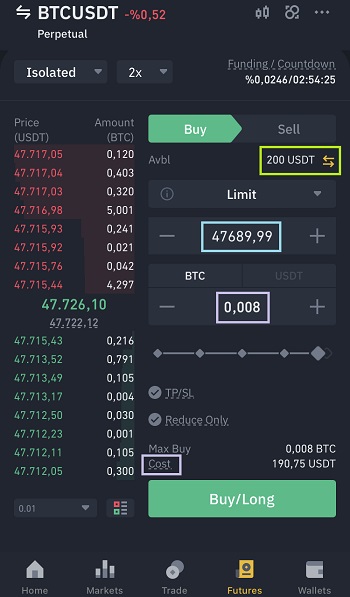

To open a long position on Bitcoin, click the ”Buy” button first and enter the price that you want to open your position at and the position size in BTC.

You should check your cost when setting your position size in BTC. It should not be higher than your wallet balance.

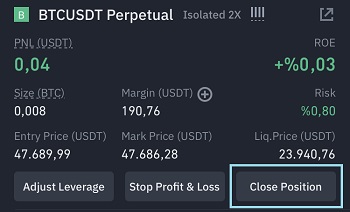

In the example above, I open a 0.008 BTC long position and my cost for this position will be approximately 190 USDT.

0.008 BTC is 381.51 USDT at the price of 47,689 USDT. As I use 2x leverage, my cost is around 190 USDT (381.51/2=190.75).

When everything looks okay, you can click the ”Buy/Long” button and place your buy/long order at the market.

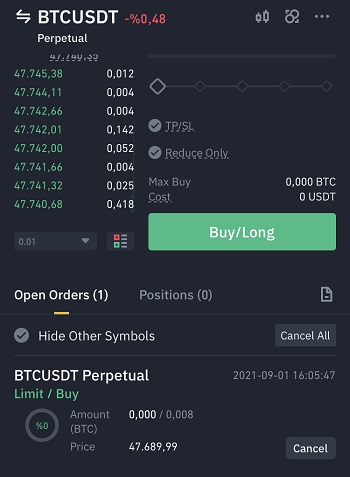

When placing a buy order (long), if the price you enter is higher than or equal to the lowest sell price (red), it could be filled immediately and you can see your long position under ”positions”.

If the price you enter is lower than the lowest sell price, your order will be included in the order book (green) and you will see your order under ”open orders” till it gets executed.

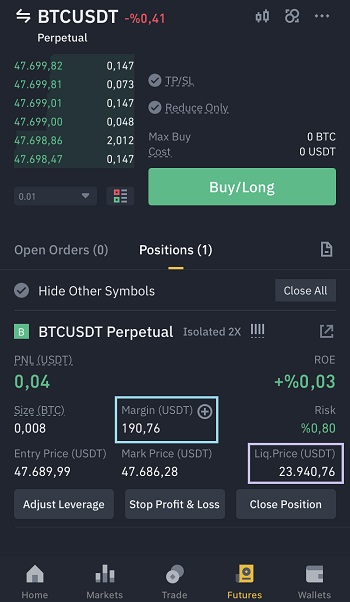

After your buy/long order gets executed, you can see your long position under ”positions”.

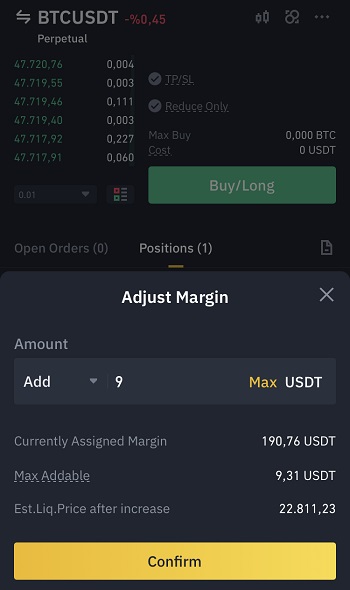

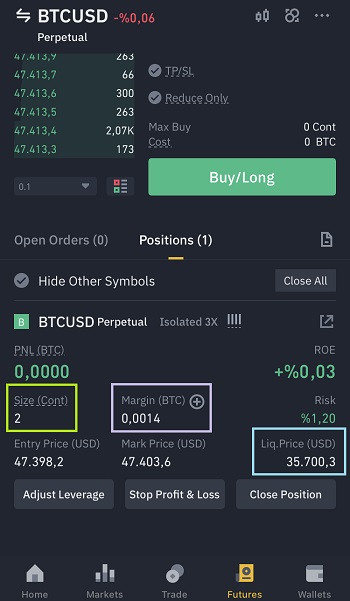

Liquidation price and adding margin

Liq. price (liquidation price) is the price at which your position gets liquidated and you lose all of your margin.

For long positions, the liq. price is below the entry price. And the risk percentage shows your risk of liquidation. When it reaches 100%, your position gets liquidated.

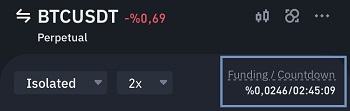

After opening your long position, you’ll pay or receive funding every 8 hours as indicated by the funding rate and the countdown.

With funding payments, your margin (USDT) will increase or decrease over time which will change the liquidation price.

If there is an increase in your liquidation price making it closer to your entry price which increases the risk of liquidation, you can add margin to your position and lower the liquidation price.

To add margin to your long position, you need to click the plus icon besides ”Margin (USDT)”.

Adding margin to your long position will decrease your liquidation price and risk as you can see in the example above.

Placing stop loss and take profit orders

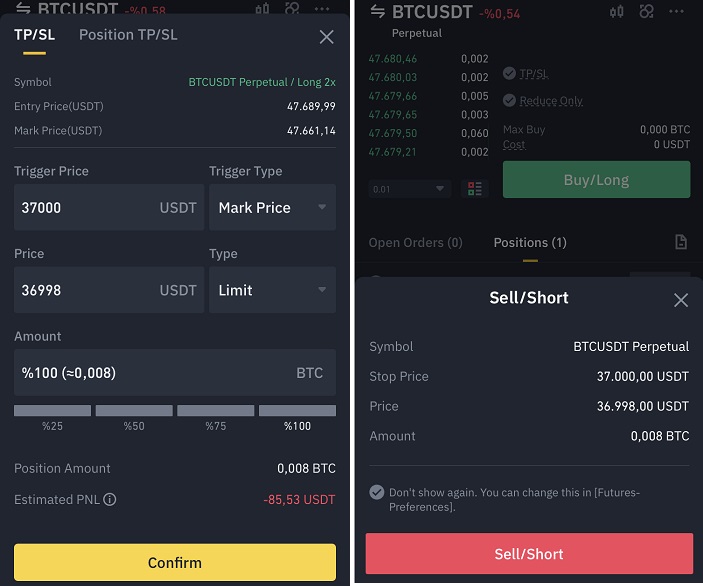

When you open a long position on Bitcoin or other cryptocurrencies, there will be a loss if the price falls below your entry price.

To limit your loss in the event of a price fall, you can place a stop loss order by clicking the ”Stop Profit & Loss” button.

For long positions, your trigger price and limit price must be set below the entry price as you make a loss when the price falls below the entry price.

And the limit price must be lower than or equal to the trigger price when placing a stop loss order for your long position.

You can see an example of stop loss order for a long position with an entry price of 47.689,99:

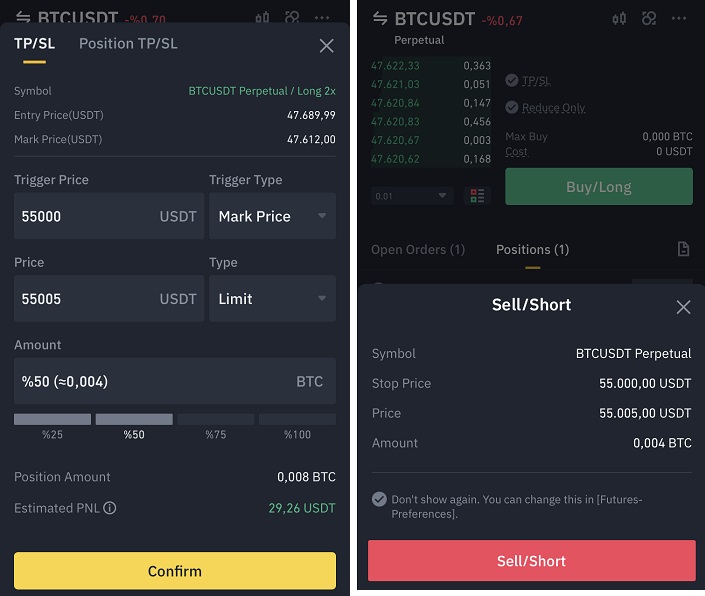

You can also place a take profit order for your long position after clicking the ”Stop Profit & Loss” button.

For a long position with an entry price of 47.689,99, you can place a take profit order like the one below.

The limit price must be equal to or higher than the trigger price when placing a take profit order for your long position.

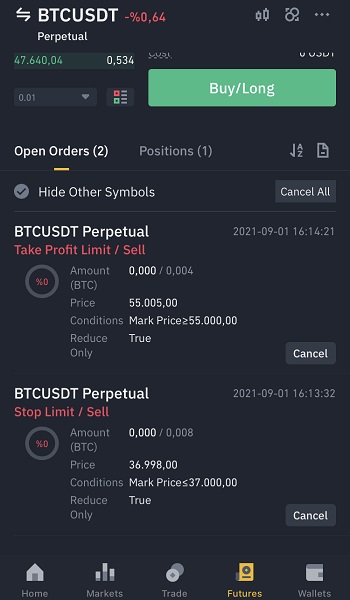

You can see your take profit and stop loss orders under ”Open Orders” on the Futures page.

How to calculate funding

Now let’s look at how to calculate funding. My position size is 0.008 BTC and the funding rate is 0.0246%.

Let’s assume the funding rate has not changed when the countdown reaches 0.

As the funding rate is positive, I’ll pay funding as my position is long. If the funding rate is negative, I’d receive funding instead.

To calculate funding I’ll pay, first I should divide 0.008 by 100 and then multiply it by 0.0246: 0.008/100*0.0246 = 0.000001968 BTC.

I’ll pay a funding fee of 0.000001968 BTC, but it will be paid in USDT. So I need to multiply 0.000001968 by the market price when the countdown reaches 0, like 0.000001968*48000 = 0.094464 USDT.

To sum up, you should divide your position size by 100 and then multiply it by the funding rate, and lastly multiply it by the market price to calculate funding.

Closing a long position

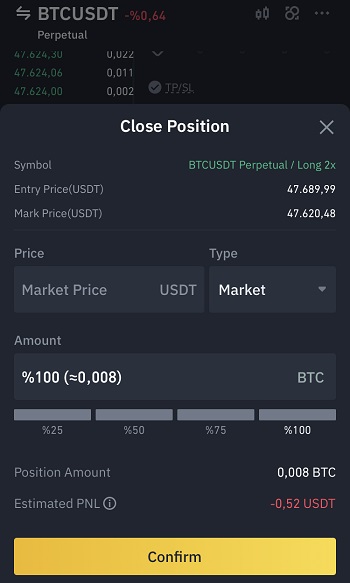

To close your long position, first click the ”close position” button.

You can close part of or your entire (100%) long position at the market price by placing a close market order.

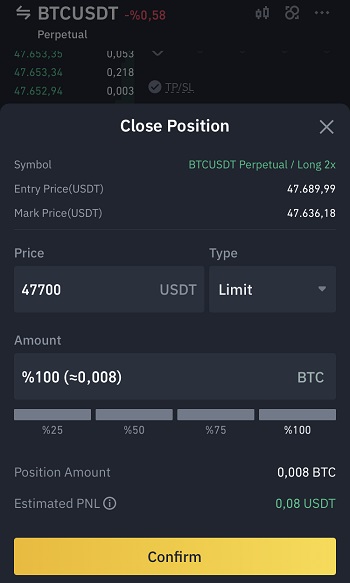

Or you can choose the limit order and enter a price at which you want to close your long position.

After entering the amount, you can place your close order at the market by clicking the confirm button.

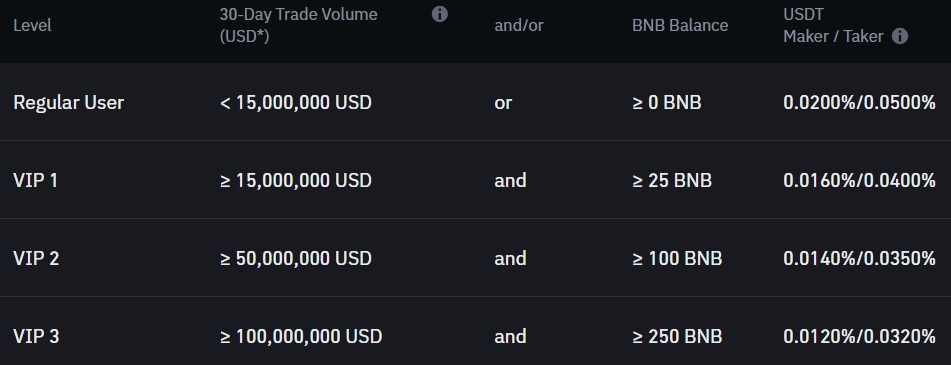

How to calculate futures trading fees

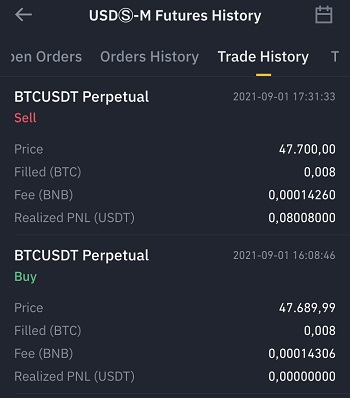

After closing the long position, now let’s look at how the trading fee is calculated.

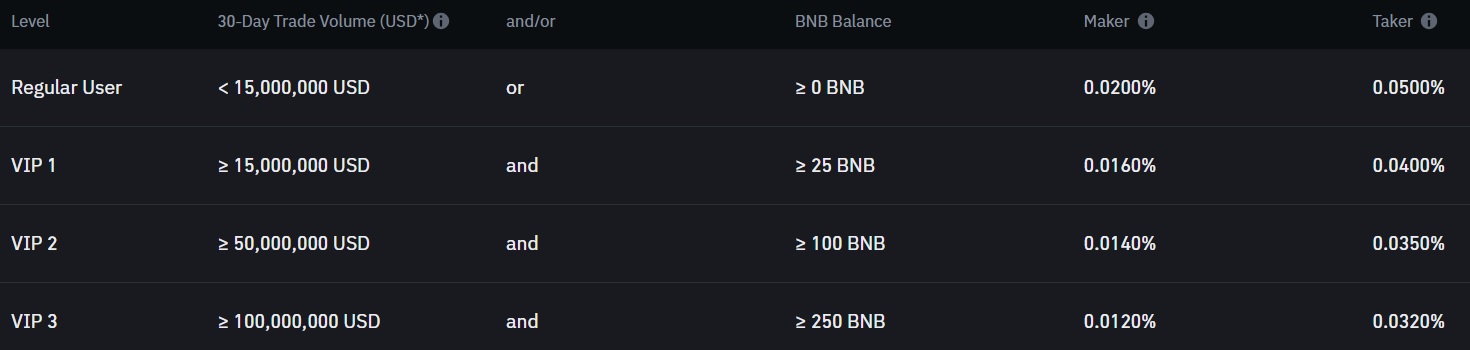

If you have BNB in your USDS-M Futures wallet, you’ll pay fees in BNB and receive a 10% fee discount on futures trading fees as you can see in the trade history below.

To calculate the trading fee you’ll pay when opening or closing your long position, you should first divide your position size by 100: 0.008/100 = 0.00008.

And then multiply it (0.00008) by the USDS-M Futures fee rate (0.02% for makers and 0.05% for takers): 0.00008*0.02 = 0.0000016 BTC (assuming it is a maker order.)

Now you can multiply 0.0000016 by your entry or close price to actually calculate the trading fee you’ll pay in USDT.

For my close order, in the example above, it should be around 0.07632 USDT fee paid in BNB (0.0000016*47700).

If you have BNB in your USDS-M Futures wallet and pay futures trading fees in BNB, you should take into consideration the 10% fee discount when calculating trading fees.

(USDS-M Futures fees with a 10% fee discount: 0.0180% / 0.0450% (M/T) ).

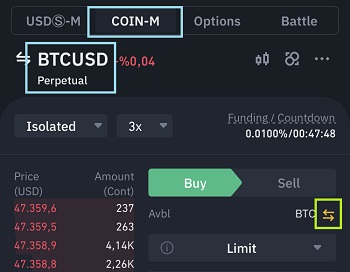

Trading the BTCUSD perpetual pair in COIN-M Futures

You can also open a long position on Bitcoin using your Bitcoin instead of USDT. First click the COIN-M tab and then choose the BTCUSD perpetual pair.

After choosing the BTCUSD pair, you should transfer BTC to your COIN-M Futures wallet by clicking the transfer icon.

After clicking the transfer icon, transfer Bitcoin from your spot wallet to COIN-M Futures wallet to open a long position on Bitcoin.

Choose the margin mode (isolated/cross) and set your leverage. After that, you can place a buy order to open your long position on Bitcoin.

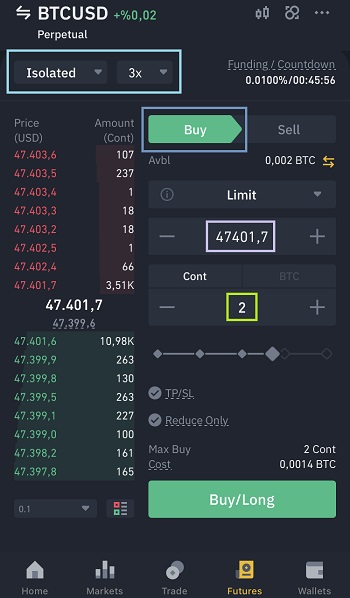

You should enter the price at which you want to open your position and the position size in contract or BTC.

When determining your position size, you can check the cost which should not be higher than your available balance.

For the BTCUSD pair, 1 contract equals to 100 USD which varies depending on the pair. To place your order at the market, you can click the ”Buy/Long” button.

After opening your long position on Bitcoin, you can see your liquidation price and other details about your position.

When you trade the BTCUSD contract, your profit/loss, trading fees and funding will be in BTC instead of USDT. So the calculation will be a bit different than USDS-M Futures.

How to calculate funding in COIN-M Futures

Let’s say the funding rate is 0.01% when the countdown reaches zero, to calculate funding, first multiply your contract size by the contract value which is 100 USD for the BTCUSD perpetual contract: 2*100 = 200 USD.

Divide it by 100 and then multiply it by the funding rate : 200/100*0.01 = 0.02 USD. I’ll pay 0.02 USD funding as I have a long position and the funding rate is positive, but it will be paid in BTC.

Let’s say the BTC price, when the countdown reaches zero, is 48,000 USD. Then you need to divide 0.02 by 48,000 to calculate funding: 0.02/48000 = 4.16666667e-7.

You can again place stop loss and take profit orders by clicking the ”Stop Profit & Loss” button in the same way I did for the long Bitcoin position in USDS-M Futures.

To close your long position, click the ”Close Position” button and place your market or limit order. You can close only part of your position or the entire position.

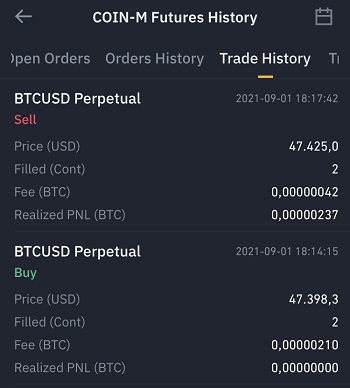

Now let’s look at how to calculate trading fees for COIN-M Futures.

How to calculate COIN-M Futures trading fees

To calculate trading fees when opening or closing your long position in COIN-M Futures, first multiply your contract size by the contract value: 2*100 = 200 USD.

And then divide it (200) by 100 and multiply it by the COIN-M Futures trading fee (0.02% / 0.05%): 200/100*0.02 = 0.04 USD (if it is a maker order).

As the fee will be paid in BTC, you should divide 0.04 by the entry or close price.

Note that the trading fees in the futures history above has been calculated based on the older fees (0.01% / 0.05% m/t).

If you have any questions about longing on Binance, you can leave a comment below.

To learn how to short on Binance and how to cash out from Binance, check out the tutorials below: