dYdX is an Ethereum-based decentralized exchange that allows users to open long and short positions with up to 10x leverage.

You can engage in margin trading or trade perpetual contracts on dYdX exchange. There are also spot markets on the platform which you can trade without leverage.

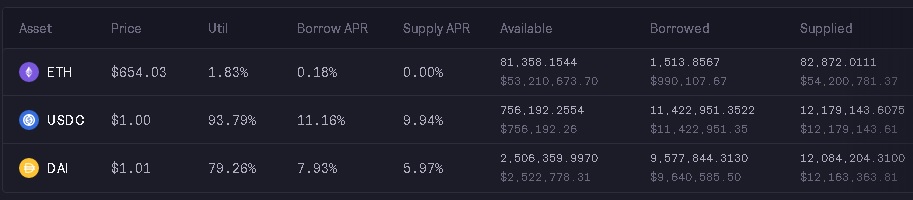

Besides trading, you can borrow ETH, USDC and DAI on the platform and earn interest by depositing supported assets into your account.

In this review, I will show you how to use dYdX exchange and give you information on dYdX fees, funding rates and other things that you need to know to trade dYdX’s perpetual contracts.

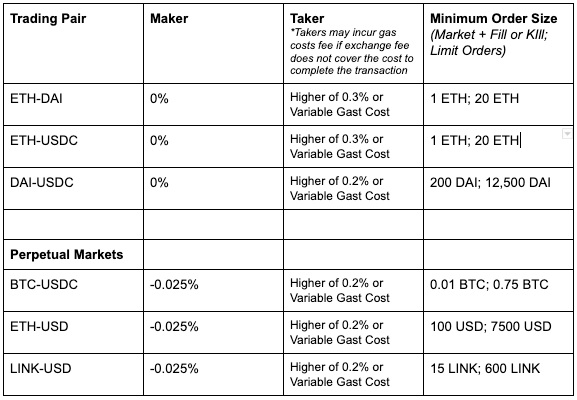

dYdX fees

dYdX does not charge any trading fees for maker orders and even pays a 0.025% fee rebate on perpetual markets.

For taker orders, the higher of 0.3%/0.2% fee or variable gas cost is charged. If the trading fee can’t cover transaction fees, you may be required to pay gas as well.

For deposits and withdrawals, there are no fees charged by dYdX. You only need to pay gas for transactions.

dYdX minimum trade size

There are also minimum trade sizes for each trading pair on dYdX, which you can see in the image below.

If you’re not interested in using dYdX but want to trade cryptocurrencies with leverage, you can instead try Binance Futures or BitMEX.

How to use dYdX exchange?

First visit dYdX’s website and click on the ‘start trading” button to open the trading page.

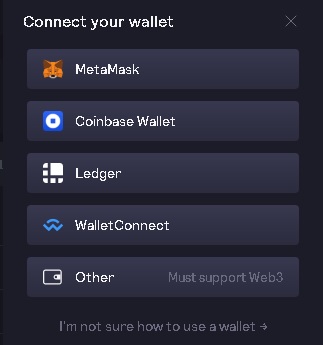

To connect your wallet to the exchange, click on the ”connect wallet” button located at the top right corner of the page.

dYdX exchange supported wallets

The platform supports MetaMask, Coinbase Wallet and Ledger. You can also use WalletConnect to trade on dYdX with mobile wallets like Trust Wallet.

The safest option among these wallets is Ledger. If you have a Ledger Nano X or a Ledger Nano S, you can connect it to MetaMask as well.

Trading on dYdX exchange – dYdX perpetuals trading

After connecting your wallet to the exchange, you can choose between spot, margin (5x) and perpetuals (10x) to start trading.

The pairs that you can trade on dYdX exchange:

- Spot markets: ETH-DAI, ETH-USDC and DAI-USDC.

- Margin markets: ETH-DAI, ETH-USDC and DAI-USDC.

- Perpetual markets: BTC-USD, ETH-USD, and LINK-USD.

In perpetual markets, you don’t trade actual assets but synthetic assets that are settled in USDC or ETH. Perpetuals also offer higher leverage (up to 10x) compared to margin trading on dYdX.

The BTC-USD and LINK-USD pairs are settled in USDC while the ETH-USD pair is settled in ETH.

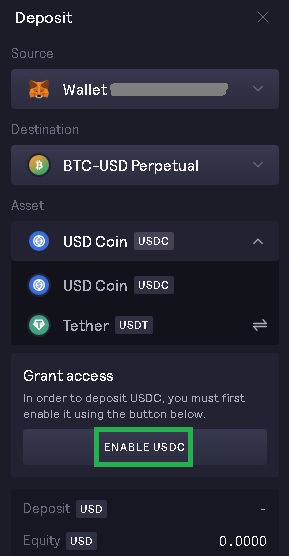

If you instead have USDT in your wallet, you can deposit it into your account (smart contract) which will be automatically converted to USDC using Curve liquidity pools.

For the difference between two stablecoins, USDT and USDC, you can refer to this article.

The maintenance margin for perpetuals is 7.5%. For margin trading, the initial collateral ratio is 125% and the minimum collateral ratio is 115% at which liquidation happens.

If you are not familiar with these terms at all, we recommend first trading on centralized derivatives exchanges like Binance Futures, BitMEX or Bybit. After that, you can try decentralized ones like dYdX.

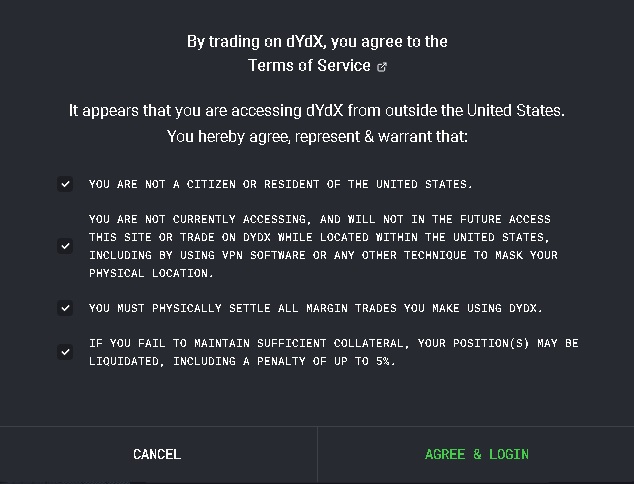

To start trading on the platform, first click on the ”deposit” button. You will be required to agree to the terms of service that can be seen in the image below. Tick all the boxes and click ”agree & login”.

You will see a signature request popping up on your MetaMask wallet or any other wallet that you’re using. Sign it and you’re done. You can now deposit supported assets into your account.

If you will engage in spot trading or margin trading, you need to deposit ETH, DAI or USDC. If you want to trade perpetual contracts, you can deposit USDT or USDC into your wallet.

To trade the ETH-USD pair, you need to deposit ETH as it is settled in ETH rather than USDC.

When you’re depositing assets into your spot or margin account, you can see the interest rates for each asset as well. To earn interest on your cryptocurrencies, you don’t need to do anything special or engage in trading.

After depositing assets into your account, you will automatically start earning interest which continuously compounds as people make trades involving the asset you’ve deposited.

dYdX interest rates

If you just want to earn interest on dYdX instead of trading, you can deposit USDC and DAI into your account. For ETH, the APR is 0% at the moment.

For lending or borrowing cryptocurrencies, also check out Compound and Aave.

The current dYdX interest rates can be seen in the image below (Dec 20, 2020):

To check out these rates, click on the ”markets” tab on the platform. APRs can also be seen when depositing assets.

Now let’s get back to trading. To fund your account, click on the ”deposit” button and choose destination, spot, margin or perpetuals.

For the BTC-USD and LINK-USD perpetual trading pairs, you can deposit USDC or USDT, but they are settled in USDC. The ETH-USD pair is an exception and settled in ETH.

So, if you want to trade the ETH-USD perpetual, you need to deposit ETH. Trading the ETH-USD pair could be much better as you don’t need to deal with stablecoins and everything including PNL is settled in the base currency ETH.

As always, you first need to allow the smart contract to spend your token. You can do it by clicking on the ”enable” button and confirming the transaction on your wallet. After that, you can deposit the asset into your account.

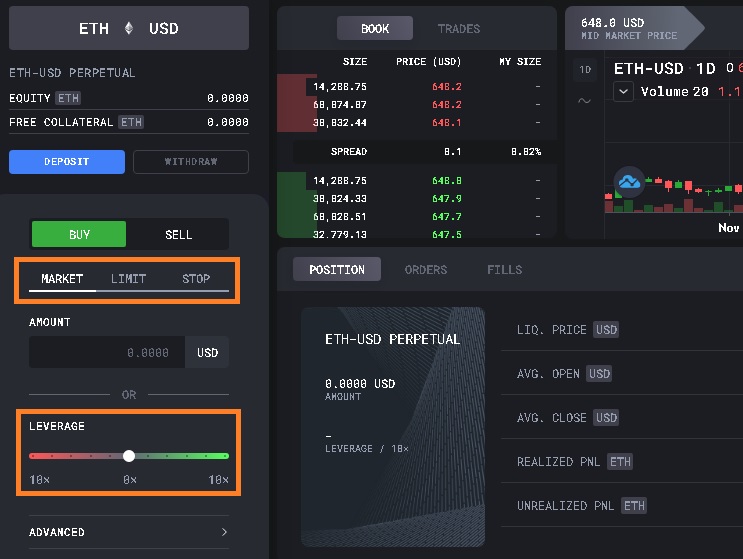

After funding your account, you can create market, limit and stop orders. First choose whether you want to go long (buy) or short (sell) and enter an amount which will be the size of your position, not the cost.

You can use up to 10x leverage using the slider and it does not need to be an exact number like 3x, the leverage could be 2.3x for example.

You will be able to see fees and other details such as liquidation price before placing your order.

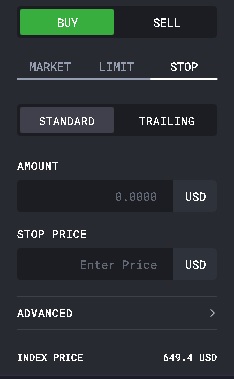

Stop orders on dYdX

You can also put stop orders for your open positions on dYdX exchange. To place a stop order on dYdX, click on ”stop” on the trade tab. Or you can also find the stop option under positions.

Choose buy or sell, and enter an amount and a stop price for your spot order. The limit price will be 5% higher for longs 5% lower for shorts than the stop price.

For perpetuals, there is also a funding payment that is exchanged between traders every 8 hours. If the funding rate is positive, longs pay shorts. And, if the rate is negative, shorts make the funding payment and longs receive it.

The maximum funding rate on dYdX exchange is 0.75%, whether it is positive or negative. For more information about the platform and to connect with the community, join dYdX’s Discord channel and follow it on Twitter.

Check out other dapp reviews: