There are various ways to make money on decentralized exchanges.

You can trade tokens and NFTs, provide liquidity to the platform, stake LP and native tokens, and even vote for or against governance proposals that could affect your profits.

The riskiest and most complex one among these options is providing liquidity to the exchange.

Is it worth providing liquidity on PancakeSwap?

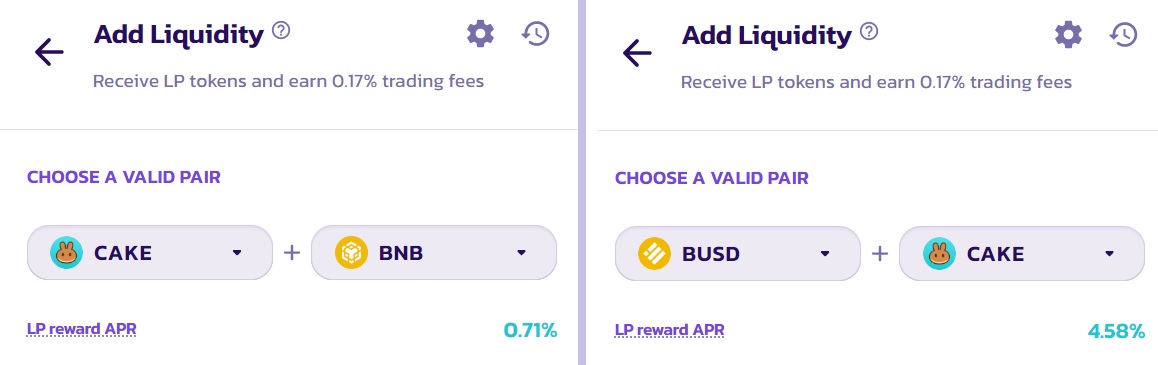

When you provide liquidity to a pair on PancakeSwap, you will earn 0.17% of all trades that take place through the pair proportional to your share in the pool.

The trading fee on PancakeSwap is currently 0.25%. But you can’t receive all of the fees as the current distribution is as follows:

- 0.17% – Liquidity providers

- 0.0225% – The PancakeSwap Treasury

- 0.0575% – CAKE buyback and burn

How much money you can make from trading fees depends on your share in the liquidity pool and the trading volume of the pair.

Trading fees

PancakeSwap currently displays APR (annual percentage rate) based on last 7 days’ performance for trading pairs:

Farming

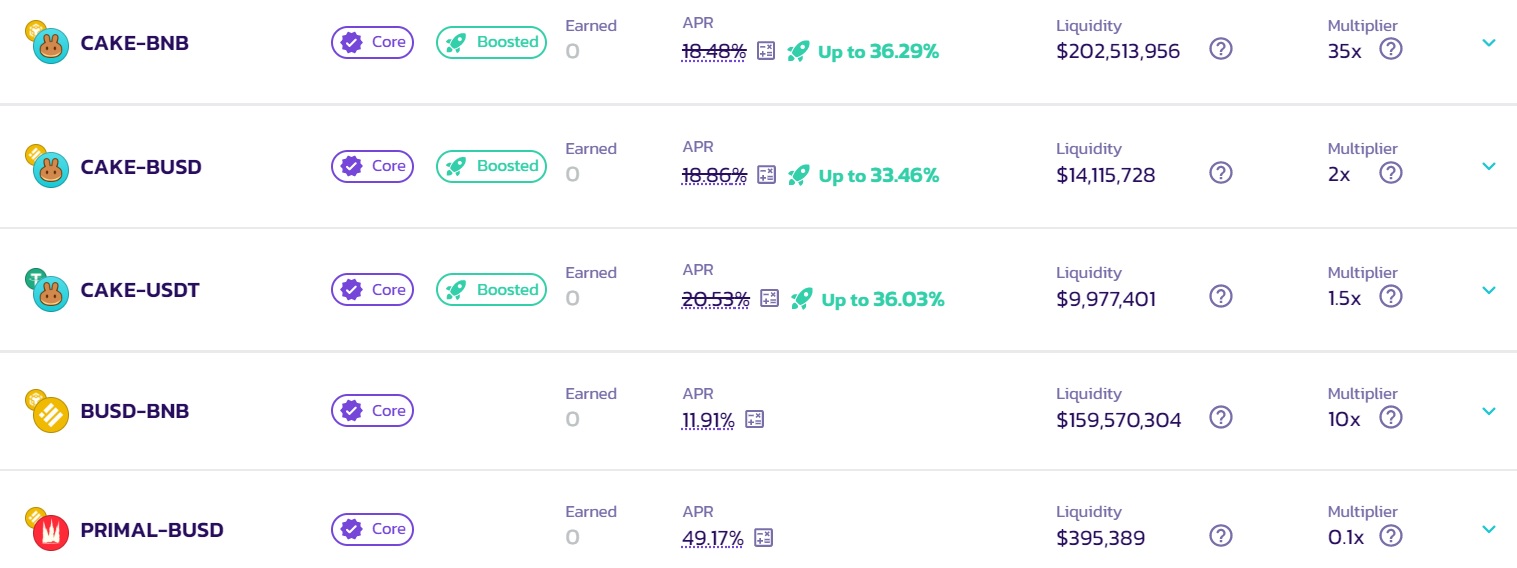

Besides, you can stake your LP (liquidity provider) tokens which you will receive after adding liquidity to a pair on PancakeSwap.

When you stake your LP tokens on the ”farms” page under the ”earn” menu on PancakeSwap, you will also earn CAKE tokens.

Note that the multiplier that you can see on the farming page is already included in the APR calculation.

You may wonder why some pairs with much lower multipliers have higher APRs.

It is about demand. The multiplier can be very high, but if a lot of people stake their LP tokens in the pool with high multiplier, the CAKE reward may not be that satisfying.

Because of that, less popular trading pairs can have much higher APRs.

The risk of being a PancakeSwap liquidity provider

So it all sounds good so far. You can provide liquidity to PancakeSwap and stake your LP tokens, and earn trading fees and CAKE tokens.

But there is a risk, and it is called ”impermanent loss”.

Let’s say you want to provide liquidity to the CAKE/BNB pair on PancakeSwap, and CAKE is traded at $4 and BNB is traded at $300.

If you want to add $1200 worth of liquidity ($600 CAKE & $600 BNB) to the pool, you will need 150 CAKE and 2 BNB.

After you provide liquidity to the pool, the exchange rate (CAKE/BNB) will change in the future as trades take place and coins change in value.

So there will be more CAKE and less BNB or less CAKE and more BNB in the liquidity pool.

And if you remove your liquidity from the pool, you will either get more CAKE and less BNB like 155 CAKE & 1.87 BNB or vice versa depending on impermanent loss.

If you calculate how much they are worth now, you may say I could be better off just holding 150 CAKE and 2 BNB.

The difference will be your impermanent loss, which changes continuously and is only realized when you remove your liquidity from the pool.

If the exchange rate gets closer to the initial rate at which you provided liquidity to the pool again, your impermanent loss will be smaller.

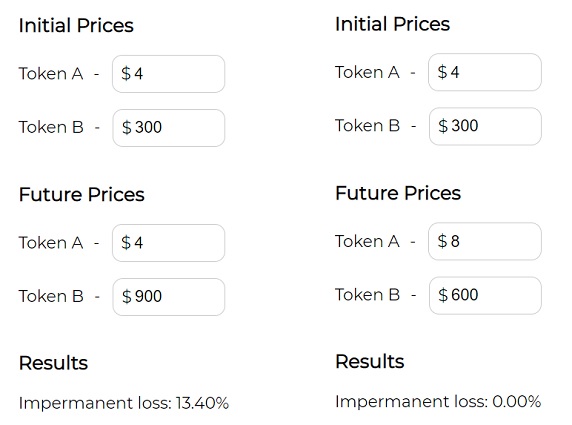

A 2x price change results in a 5.7% loss relative to holding, and a 3x price change brings about a 13.4% loss relative to holding, which you can calculate using this calculator.

Here is the calculation for 3x price change from 300/4 to 900/4, and a no impermanent loss price change scenario:

As you can see in the example above, if both coins exactly double in price, there will be no impermanent loss as the exchange rate is same and does not change.

But obviously such scenario is not that possible and you should expect impermanent loss even if it is very small.

So when you provide liquidity on PancakeSwap, there will be impermanent loss of course, whether it is small or large.

But you can also earn lots of trading fees as well as CAKE tokens.

So what you should do to make providing liquidity on PancakeSwap worthwhile is pick a trading pair that can maximize your fees and CAKE earnings and minimize potential impermanent loss.

For example, if you think CAKE/BNB price will change a lot in the next months / years during which you will keep liquidity on PancakeSwap, it may not be a good decision.

You should consider rewards too. If you can get lots of fees and CAKE rewards from a certain pair, you might be still better off in the future despite large impermanent loss.

But, in general, it is better to be conservative and not look for adventures when it comes to providing liquidity especially if you are not really experienced about this.

You can start by picking a pair consisting of tokens that are unlikely to outperform each other dramatically so that there will be no large price change and impermanent loss.

You may also prefer providing liquidity to stablecoin pairs such as USDT/USDC and USDC/BUSD, which are likely to have close to zero impermanent loss.

But of course trading fees and CAKE rewards for this type of pairs will be lower.

To learn more about impermanent loss and how to mitigate it, you can refer to our guide on impermanent loss.

If you plan to access and use PancakeSwap, you can mainly use Binance and various crypto wallets such as MetaMask.

Binance allows users to withdraw BNB and various other coins such as BTC, ETH and USDT via BSC, which then can be used on PancakeSwap.

If you don’t have a Binance account yet, you can use the code ”WRYOO8BZ” or click the button below to open your Binance account with a 20% fee discount:

To learn how to use Binance and discover the best wallets for PancakeSwap, check out our guides below: