Holding a leveraged long position on Ethereum can be a great way to make money and increase your ETH holding when the price goes up.

In this step-by-step tutorial, we will show you how to long ETH on Binance, place stop loss and take profit orders, and calculate funding and futures fees.

You can long Ethereum on Binance using USDT or BUSD without holding ETH, or open a long position with your ETH balance and increase your ETH holding.

Opening your Binance Futures account

If you don’t have a Binance account yet, you can use the referral ID ”WRYOO8BZ” or click the button below to open your Binance account with a 20% fee discount:

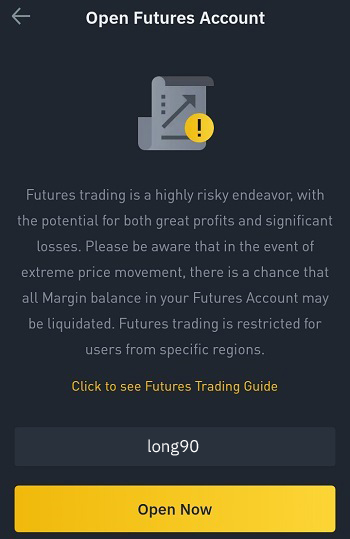

If you already have a Binance account, you can use the code ”long90” when opening your Futures account on Binance and start trading on the platform.

How to open a long position on Ethereum

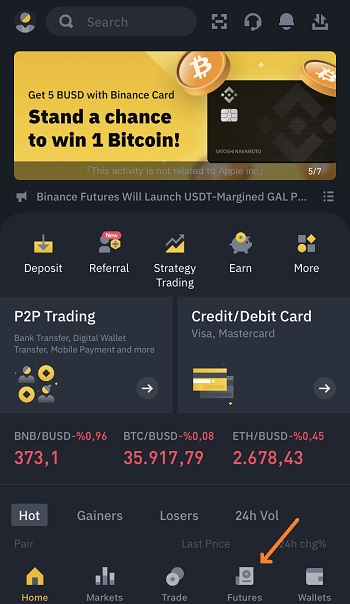

First log in to your Binance account and click the Futures tab on mobile or click USDS-M Futures under the Derivatives dropdown on the website.

If you’ve not opened your Futures account on Binance before, you can enter the code ”long90” when opening your Futures account and start trading on the platform.

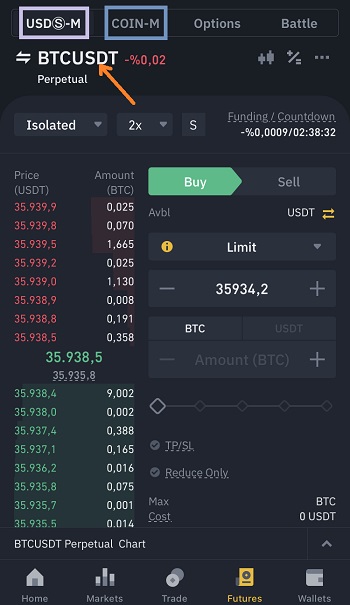

Binance USDS-M Futures vs COIN-M Futures

On the Futures page, you can click the pair and select ETHUSDT or ETHBUSD pair under the USDS-M tab, or ETHUSD pair under the COIN-M tab to open your long position on ETH.

If you want to long Ethereum with your USDT or BUSD balance and make money in USDT or BUSD when ETH price goes up, you can trade the ETHUSDT or ETHBUSD contract.

If you already have ETH and want to increase your ETH holding during upward price movements, you can trade the ETHUSD contract instead of USDS-margined ones.

Both USDS-M Futures and COIN-M Futures have a maker fee of 0.02% and a taker fee of 0.05%.

The choice between USDS-M Futures and COIN-M Futures more depends on your preferences and current holdings.

Overall, USDS-M Futures contracts are traded more and easier to understand especially for beginners.

After clicking the pair on the Futures page, you can select the pair that you want to trade.

Binance Perpetual Futures vs Quarterly Futures

You may also notice ”quarterly” futures contracts when checking the pairs on Binance Futures.

Quarterly futures contracts, unlike perpetual contracts, have an expiry date.

Perpetual contracts, on the other hand, never expire, so you can keep your positions open as long as you want.

And they are much easier to understand and trade. So it is advisable that you trade the perpetual contracts especially if you are a beginner.

Let’s first trade the ETHUSDT (perpetual) contract with USDT and then the ETHUSD (perpetual) contract.

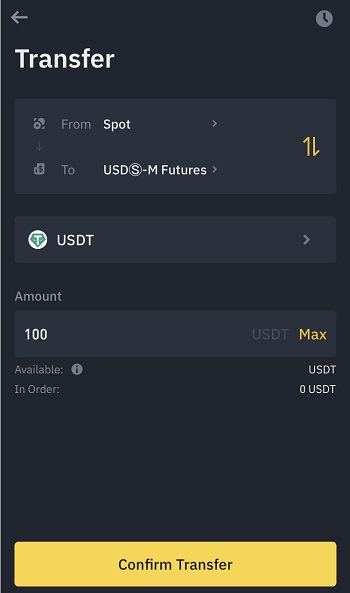

Transferring USDT from spot wallet to USDS-M Futures wallet

To open your long position on Ethereum using USDT, click the transfer icon on the Futures page and transfer USDT from your spot wallet to USDS-M Futures wallet.

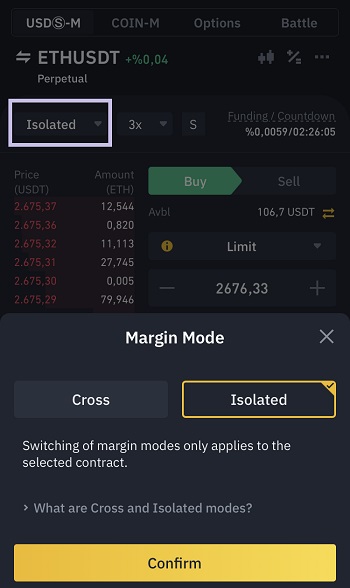

Binance isolated vs cross margin mode

After transferring USDT to your USDS-M Futures wallet, click the margin mode ”isolated” or ”cross” and select the one that you want to use before opening your position.

If you use the isolated margin mode, you can only lose your margin (cost) that you used to open your position and not your futures wallet balance in the event of a liquidation.

If you use the cross margin mode, the liquidation price is calculated based on the margin (cost) that you allocated to the position and your futures wallet balance.

So, in the cross margin mode, you may lose your margin and also remaining futures wallet balance if your position gets liquidated.

The isolated margin mode is overall less risky and easier to use.

You can use the isolated margin mode especially if you are a beginner and want to limit your risk to the margin that you use when opening your position.

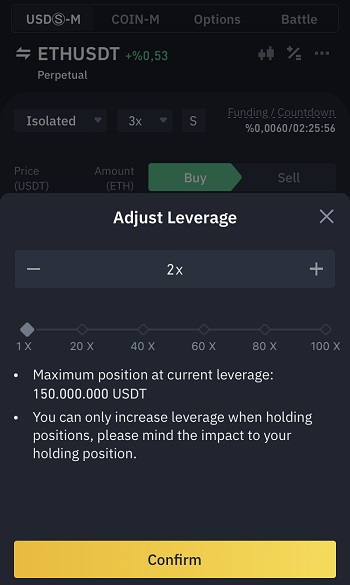

Leverage

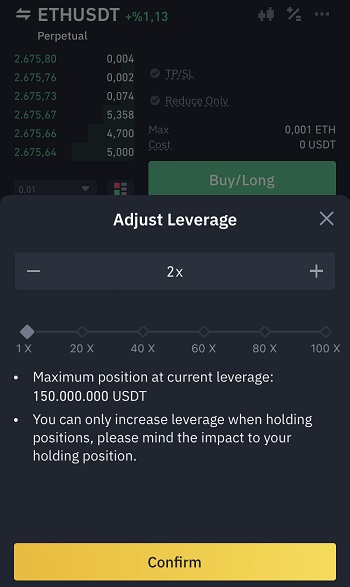

After selecting the margin mode that you want to use, click the leverage and select the leverage that you want to use.

If you’ve opened your account recently, you can’t use higher than 20x leverage. It will only increase after 60 days from account opening.

Placing a buy/long order on Binance Futures

After selecting your leverage, click ”Buy” to place your buy/long order. ”Sell” is for opening short positions or closing existing long positions.

If you click the letter ”S” beside the leverage, you can change your asset mode from the single-asset mode to the multi-assets mode.

But, if you use the isolated margin mode, you don’t need to and can’t change it to the multi-assets mode. So leave it as it is.

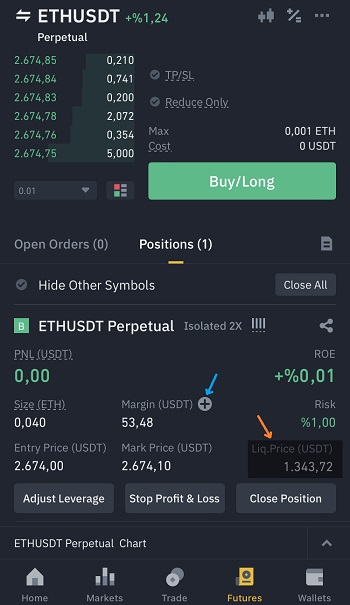

We want to open a 0.04 ETH long position at the price of 2674 USDT and the money (margin) needed to open this position is 53,48 USDT.

If you multiply the position size (0.04) by the entry price (2674), the position size that you get in USDT (106.96 USDT) should be around the cost (margin) multiplied by the leverage (53,48*2).

As we use 2x leverage, to open a 0.04 ETH position at the price of 2674 USDT, we only need 53,48 USDT.

After entering the price at which you want to open your position and the position size in ETH or USDT, you can click the buy/long button and then confirm the order.

You can also place a market order to open your long position if you don’t want to specify a price and want your order to be filled immediately.

Once your buy/long order is filled, you can see your position under ”positions”.

The liq. price (liquidation price) is the price at which your position gets liquidated and you lose your margin balance.

PNL shows your unrealized profit or loss, and ROE is its equivalent as a percentage.

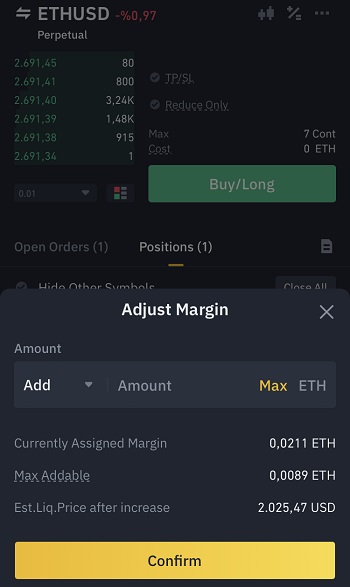

Adding margin to your long position

When you long Ethereum, your risk of liquidation may increase if the price goes below the entry price.

In that case, to lower your risk of liquidation and the liquidation price, you can add margin to your position by clicking the plus icon beside margin.

By adding margin to your position, you’re basically lowering the real leverage as the position size itself does not change, thus making the liquidation less likely than before.

Removing margin from your long position

It’s also possible to remove margin from your position, but not always. You can do so when you have some unrealized profit.

If you can’t remove any margin from your position but still want to do so, you can increase your leverage which in turn will lower the margin required for your position.

After increasing your leverage, you can remove more margin from your position. But note that if you remove margin from your position, the liquidation price will increase and your risk will be higher.

Don’t confuse increasing leverage with more profit.

The profit and loss is calculated based on your position size and the price. When you add margin to or remove margin from your position, your position size does not change.

To make more profit during price movements, you can place another buy/long order and increase your position size.

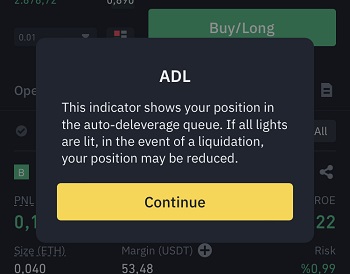

What are exclamation marks on Binance Futures (ADL)

The exclamation marks on Binance is ADL (auto-deleveraging) indicator.

During extreme price movements in the market, your position may be automatically closed especially if you have lots of profit and/or use very high leverage.

If you trade the BTC, ETH and BNB pairs, it is much less likely to happen as stated by Binance.

Overall, if you don’t use very high leverage and mostly trade major coins, you don’t need to worry about it.

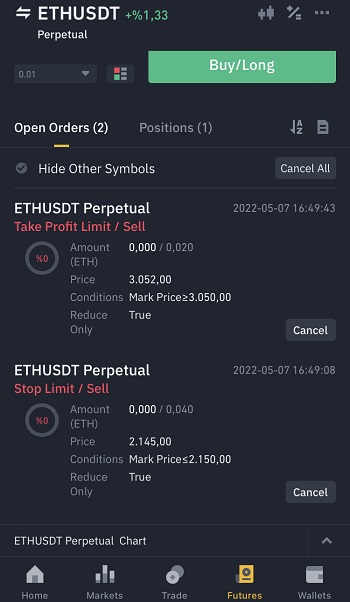

Placing stop loss and take profit orders on Binance Futures

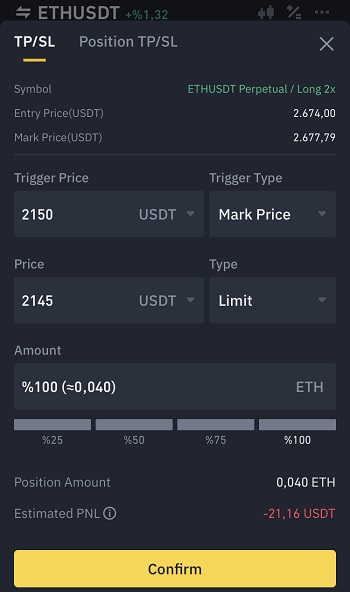

To place stop loss and take profit orders, first click the ”Stop Profit & Loss” button on the Futures page.

You can also click ”Sell” and change the order type to ”stop limit”, and place stop loss and take profit orders for your long position.

To place a stop loss order for your long position, you can enter a trigger price below your entry price and a limit price equal to or lower than the trigger price like the one below.

You can close your entire position or part of it with the stop loss order. In the example above, the order will close the entire position (100%).

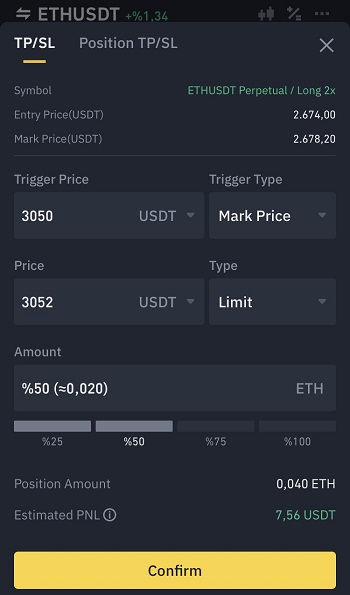

To place a take profit order for your long position, you need to enter a trigger price above the entry price and a limit price equal to or higher than the trigger price.

You can again close your entire position or just part of it to take some profit at a certain price.

When you place take profit and stop loss orders, you can view them under ”open orders”.

They are ”reduce only” orders which means that they will only serve to reduce (close) your current long position.

If you close your long position or it gets liquidated, the stop loss and take profit orders will also be cancelled.

If you place a stop loss or take profit order for your long position by clicking ”Sell” and placing a stop limit order, you can also tick ”reduce-only”.

Otherwise, they can stay active after you close your long position and may create ”short” positions later. By ticking ”reduce-only”, you avoid that.

To close your long position or place stop loss/take profit orders, you need to click ”Sell” and place ”Sell/Short” orders, or use the ”Stop Profit & Loss” button.

If you place a buy/long order while holding a long position, it will grow your current long position.

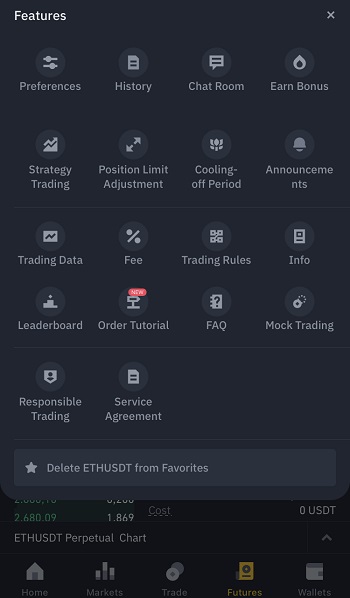

Binance Futures history

To view your trading history, funding history and other features, click the ellipsis sign on the top-right corner of the Futures page.

You can click ”history” and view your entire trade history and transactions which include fees charged and funding payments.

To change the order confirmation requirement and the position mode, click ”preferences” and change the settings as you wish.

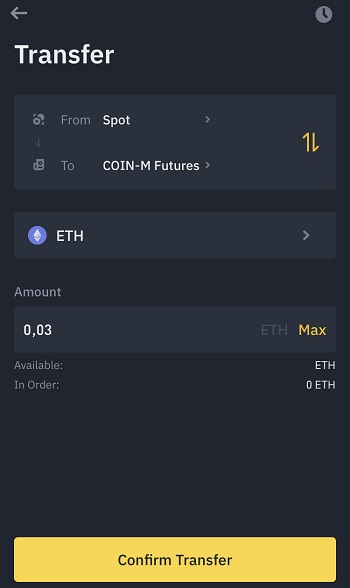

How to long ETH COIN-M Futures

To open a long position on Ethereum with your ETH balance, first click the transfer icon on the Futures page and transfer ETH from your spot wallet to COIN-M Futures wallet.

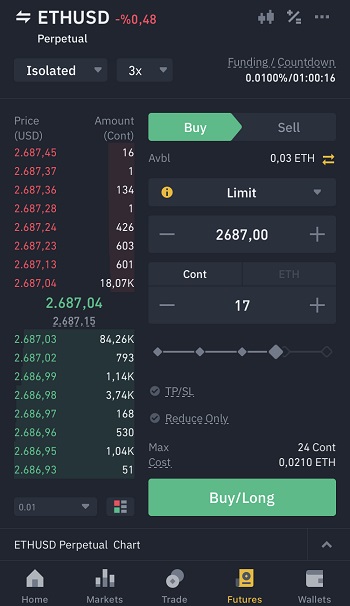

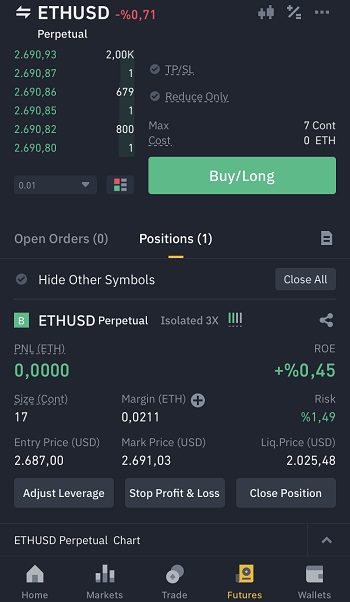

Select the ETHUSD (perpetual) contract under COIN-M Futures, and you can place your buy/long order by entering the price and the position size in contracts.

Before placing your buy/long order, you should select the margin mode (isolated/cross) and the leverage.

For the ETHUSD perpetual contract, one contract is worth 10 USD. So our position below is worth 170 USD.

If we multiply the margin by the entry price (0.0211*2687), the result (56,6957) should be around 170/3 as the leverage is 3x.

To lower the liquidation price and the risk, you can add margin to your position the same way you do when trading the ETHUSDT contracts.

But this time you need to add ETH to the position instead of USDT.

Also, the profit/loss, fees and funding will all be in ETH.

You can place stop loss and take profit orders the same way as we explained above for USDS-M Futures.

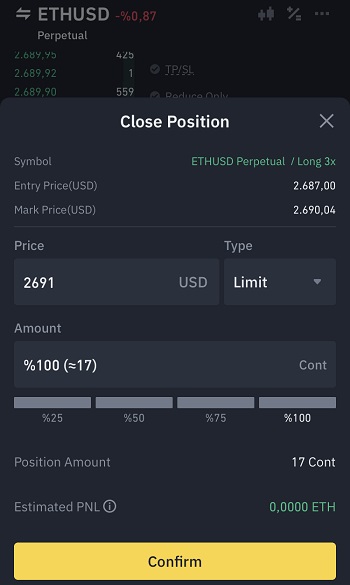

To close your position, you can enter a price at which you want to close your position and the position size in contracts.

If you want to close your position immediately at the best price possible, you can change the order type to ”market”.

Calculating Binance Futures fees

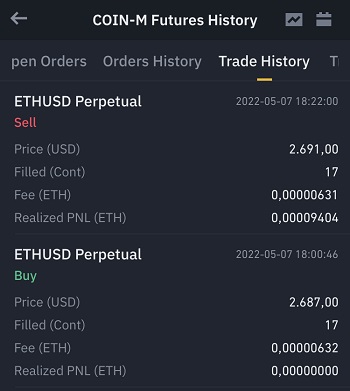

The trading fee calculation for COIN-M Futures and USDS-M Futures is very simple.

As we mentioned before, both USDS-M Futures and COIN-M Futures have a maker fee of 0.02% and a taker fee of 0.05%.

If you transfer some BNB to your USDS-M Futures wallet, you can pay fees in BNB and receive a 10% fee discount.

To calculate the trading fee you will pay when you open or close a position, first calculate your position size in USDT or ETH.

For the ETHUSD sell trade below, we should first multiply 17 by the contract value ($10) = 17*10 = $170.

And then divide 170 by the sell price (2691) to find the position size in ETH= 170/2691 = 0.06317354143.

So our position size in ETH is 0.06317354143.

We need to find the position size in ETH first to calculate the fee charged. As we trade the ETHUSD pair, the profit/loss, fees, etc. are always in ETH.

To calculate the fee, first we need to divide 0.06317354143 by 100 and then multiply it by 0.01 (maker) or 0.05 (taker).

Note that the updated maker and taker fees are 0.02% and 0.05% respectively.

As it was a maker order, the fee will be (0.06317354143/100)*0.01 = 0.00000631735.

Let’s say we have a 0.5 ETH long position that we opened at the price of 2000 USDT.

To calculate the fee charged when the buy/long order is filled and the position is opened, we should first multiply 0.5 by 2000 = 1000.

And then divide 1000 by 100 and multiply it by 0.02 (maker) or 0.04 taker).

If it is a taker order, the fee charged will be 1000/100*0.04 = 0.4 USDT.

To calculate spot and futures fees and get more information, check out our Binance fee calculator.

If you want to calculate the liquidation price and PNL for your positions and get an idea before opening a position, you can use our Binance Futures calculator.

Binance Futures funding calculation

Besides futures trading fees, there is funding which is directly exchanged between traders who have long or short positions every 8 hours.

The countdown on the Futures page on Binance refers to the time left for the next funding payment.

If the funding rate is a positive value, like 0.01%, longs pay funding and shorts receive funding.

It if is a negative value, like -0.01%, shorts pay funding and longs receive funding.

Calculating funding is also very simple. Let’s say we hold 20 ETHUSD contract (COIN-M Futures) and 0.20 ETH position (USDS-M Futures).

When the countdown reaches zero, the ETH price is $2000 USD / 2000 USDT and the funding rate is 0.01%.

For COIN-M Futures, we should first multiply 20 by the contract value, 20*10 = $200, and then divide 200 by the ETH price, 200/2000 = 0.1 ETH.

And divide 0.1 by 100 and then multiply it by the funding rate, 0.01, = 0.1/100*0.01 = 0.00001 ETH.

As our position is long and the funding rate is positive, 0.00001 ETH will be deducted from our margin balance as a funding payment.

For the 0.20 ETH position (USDS-M Futures), we should first multiply 0.20 by the ETH price to find the position size in USDT, 0.20*2000 = 400 USDT.

And divide 400 by 100 and then multiply it by the funding rate, 0.01, = 400/100*0.01 = 0.04 USDT.

We will pay 0.04 USDT funding.

To learn how to short crypto on Binance and deposit/withdraw money, check out the tutorials below:

If you have any questions or comments about longing ETH on Binance, you can leave a comment below.