If you have provided liquidity to AMMs (automated market makers) such as Uniswap and PancakeSwap or you plan to do so, you might have heard of the term ”impermanent loss”.

Well, what exactly is impermanent loss? How to avoid impermanent loss?

In this guide, I’ll explain what impermanent loss is without going into complex technical details and give you some tips to help you minimize impermanent loss as a liquidity provider.

What is impermanent loss? Impermanent loss explained

As you probably know, in order to add liquidity to a trading pair on Uniswap, PancakeSwap or other similar decentralized exchanges, you need to deposit an equal value of each token in a pair into the pool.

Let’s say you have $500 worth of ETH and $500 worth of UNI in your wallet, and you want to add liquidity to a UNI-ETH pool.

Depending on the price of each cryptocurrency, let’s say you currently hold 0.83 ETH and 128 UNI.

Now 1 ETH equals to 154.21 UNI. But, after you deposit your ETH and UNI into the pool, this ratio will change as both cryptocurrencies will change in value and trades take place.

As a result, there will be more UNI and less ETH or vice versa in the pool.

So what happens when the exchange rate deviates from the initial rate at which you provided liquidity to the pair?

You have impermanent loss. But how does it happen?

As the initial exchange rate and the amount of each token in the pool have changed, when you remove your liquidity from the pool, you will have more ETH and less UNI or less ETH and more UNI.

Something like this: 0.60 ETH and 150 UNI or 1 ETH and 105 UNI.

Now what happens is that if you just hold your 0.83 ETH and 128 UNI in your wallet instead of depositing them into a liquidity pool, you could make more money in USD.

To calculate your impermanent loss, you should calculate how much would 0.83 ETH and 128 UNI be worth right now if you just hold, and how much, let’s say, are 0.60 ETH and 150 UNI worth right now (your removed liquidity).

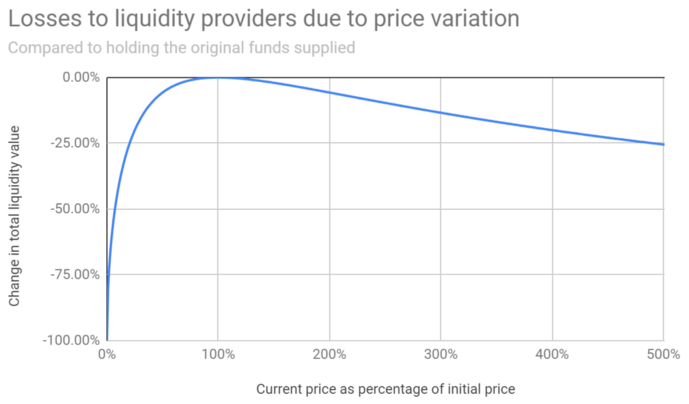

The graph below can give you an idea about how big your impermanent loss could be depending on the price change:

A 2x price change results in a 5.7% loss relative to holding, and a 5x price change brings about a 25.5% loss relative to holding.

You earn trading fees when you add liquidity to a liquidity pool which is the main reason why liquidity providers exist.

Also, on some decentralized exchanges such as PancakeSwap, SushiSwap and 1inch, you can stake your LP tokens and earn protocols’ native tokens in addition to swap fees.

But, most of the time, as cryptocurrency pairs can be quite volatile, impermanent loss exceeds fee earnings leaving liquidity providers with losses.

How to calculate impermanent loss & Impermanent loss calculators

There are various impermanent loss calculators that you can find on the internet.

They are easy to use, but you should still know how to use them and understand how it works.

To calculate impermanent loss, you can use the free calculators below:

- Daily Defi impermanent loss calculator

- DecentYields impermanent loss calculator (the site went offline)

I’ll show you how to use them and calculate impermanent loss and the amount of tokens you will get when you remove liquidity from a pool with a few examples.

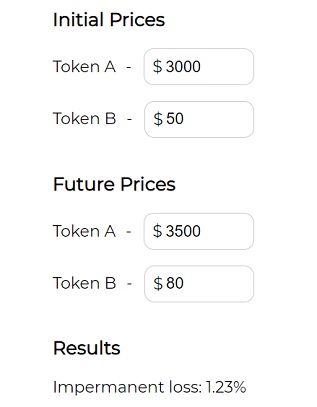

Let’s say you want to add liquidity to an ETH-UNI pool, and 1 ETH = $3000 and 1 UNI = $50.

To add a total liquidity of $6000, you need deposit 1 ETH and 60 UNI into the pool.

After you deposit 1 ETH and 60 UNI into the pool at these prices, the price of both tokens and the ETH/UNI ratio will change.

Let’s say, after a few months, 1 ETH = $3500 and 1 UNI = $80. Now you can obviously understand that the ETH/UNI ratio has changed and there is impermanent loss.

Daily Defi’s impermanent loss calculator shows a 1.23% impermanent loss. And you know that you should normally have $8300 without impermanent loss (if you would just hold) (3500+80*60).

So, with a 1.23% impermanent loss, now you have $102.19 loss (8300/100*1.23).

And if you remove your liquidity from the pool, you will get $8197.81 worth of tokens.

To calculate the amount of each token you will get when you remove liquidity from the pool, you can simply divide $8197.81 by 2 and then the price of each token.

1 ETH and 60 UNI now turned into 1.177 ETH (4098.905/3500) and 51.236 UNI (4098.905/80).

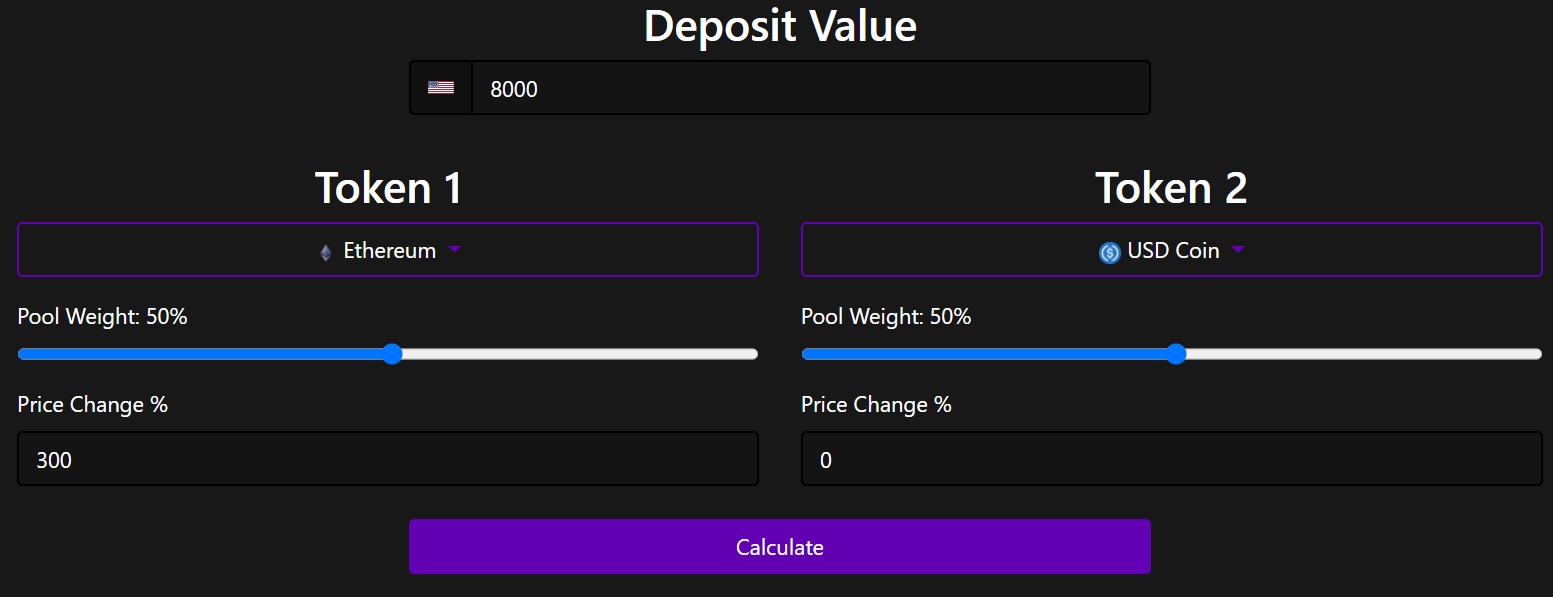

Let’s give another example and use DecentYields’s impermanent loss calculator this time.

You have 2 ETH and 4000 USDC and you want to provide liquidity to an ETH-USDC pool. 1 ETH equals 2000 USDC, so you have an equal value of each token.

A few days/months after you’ve provided liquidity to the ETH-USDC pool, Ethereum, let’s say, has experienced a 300% price increase and now 1 ETH equals 8000 USDC.

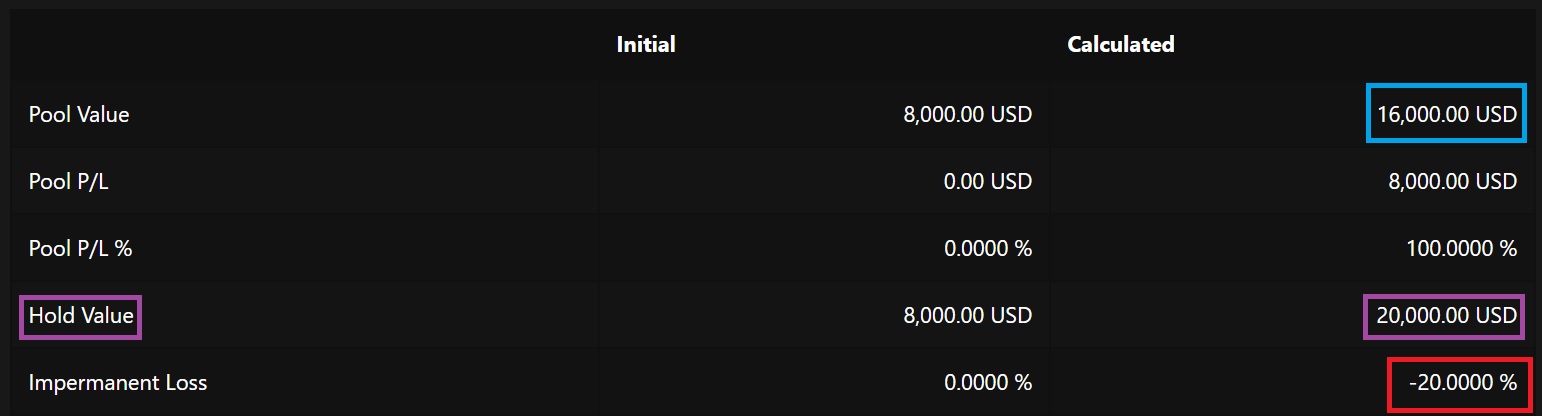

You should have $20,000 USDC worth of tokens in total without impermanent loss (just holding) (2*8000+4000).

The calculator shows 20% impermanent loss. So if you remove liquidity from the pool, you get $16,000 instead of $20,000.

To calculate the amount of ETH and USDC you get when you remove liquidity from the pool, you can simply divide 8000 (16,000/2) by prices of ETH and USDC.

As 1 ETH equals 8000 USDC, you have now 1 ETH (8000/8000) and 8000 USDC ((8000/1) with 20% impermanent loss.

How to avoid impermanent loss

A lot of people ask this question. But, unfortunately, you can’t actually avoid impermanent loss.

But there are various ways to mitigate it. Here are 6 ways to mitigate your impermanent loss as a liquidity provider.

1- Providing liquidity to stablecoin pairs

You can provide liquidity to liquidity pools that consist of two stablecoins such as USDC-USDT. This might be the best way to get rid of impermanent loss.

But this way you can’t enjoy the rise in the crypto market as you hold stablecoins.

In a bull market, it might not be a good idea to hold stablecoins and provide liquidity to a such pair as you will not be exposed to crazy returns.

But, in a bear market, you can provide liquidity to a pair like USDC-USDT and earn trading fees while not losing any money in the falling market.

Also make sure not to pick a stablecoin pair that includes a risky, more experimental stablecoin which might go to zero like TerraUSD (Luna).

2- Avoiding risky and volatile cryptocurrency pairs

Let’s say you want to provide liquidity to the LINK-ETH pair on Uniswap.

If you think that LINK will significantly outperform ETH or vice versa, don’t do it because you will be more exposed to impermanent loss.

If both LINK and ETH rise or decrease in value relative to each other, then you’ll be fine as the initial exchange rate will not change much.

The idea here is not to avoid volatile cryptocurrencies but to consider the future performance of both cryptocurrencies in a pair against each other.

3- Providing liquidity to pools with unevenly weighted cryptocurrencies

If you want to earn fees by providing liquidity to liquidity pools, you don’t necessarily need to do it on Uniswap.

There are many other AMMs such as Balancer, SushiSwap, PancakeSwap and 1inch Liquidity Protocol.

Most AMMs are forks of Uniswap with new features and/or underlying mechanisms. But they are overall very similar to Uniswap.

Among Uniswap (v2) competitors, Balancer is very different than other AMMs in that it allows users to create pools with more than two tokens, set different weights for each token and charge a trading fee between 0.0001% and 10%.

While every pool on Uniswap consists of two tokens with equal weights, you can find pools with unevenly weighted tokens such as 75% MKR 25% WETH on Balancer.

Well, what’s the importance of this with regard to impermanent loss? What happens when you provide liquidity to a 75% MKR 25% WETH pool instead of a 50%-50% one?

If you provide liquidity to a 75% MKR 25% WETH pool and MKR rise against WETH, you will suffer less from impermanent loss compared to providing liquidity to a 50% MKR 50% WETH pool.

So, if you are bullish on MKR and think it will outperform ETH, instead of providing liquidity to a 50% MKR 50% WETH pool, you can provide liquidity to a pool like 75% MKR 25% WETH on Balancer.

In this way, you can suffer less from impermanent loss when the token you are bullish on rises.

But, if things don’t go as you expected and ETH outperforms MKR, your impermanent loss will be greater in a 75% MKR 25% WETH pool compared to a pool with equally weighted MKR and WETH.

You should also consider the liquidity and the volume in the pool that you will add liquidity to.

If the liquidity/volume ratio in the less risky pool is high (high liquidity/low volume), then you may go for the pool that is more risky in terms of impermanent loss but offers higher fees.

With Uniswap v3, you can also do various adjustments similar to those Balancer offers when providing liquidity on Uniswap, but it requires active management.

4- Providing liquidity to incentivized pools and participating in liquidity mining programs

With the DeFi explosion, there are now a lot of DeFi apps and decentralized exchanges, and many have issued their own native tokens.

All of the popular AMMs have their own tokens which are distributed to liquidity providers through liquidity mining programs.

Among them, the most popular ones are UNI, SUSHI and CAKE.

In order to minimize your losses as a liquidity provider, you can participate in liquidity mining programs (farming) or provide liquidity to incentivized pools.

Some platforms distribute their tokens to those who provide liquidity to a certain pair on the exchange such as Uniswap and Balancer, which you can check out here.

Uniswap‘s first liquidity mining program has recently ended. 1inch has an ongoing liquidity mining program which you can participate in and earn 1INCH tokens.

If you provide liquidity to SushiSwap pools, you can stake your LP tokens and earn SUSHI in addition to fee earnings.

Liquidity providers on Balancer also receive weekly BAL token rewards.

PancakeSwap, the leading DEX on BNB Smart Chain (BSC), also distributes CAKE rewards to liquidity providers who stake their LP tokens in the farm.

5- Providing liquidity to Mooniswap (1inch Liquidity Protocol)

Mooniswap is an AMM launched by the 1inch team.

As a Uniswap competitor, it aims to lower impermanent loss for liquidity providers with its different approach to exchange rates.

Mooniswap introduces virtual balances which decreases the profit of arbitrageurs due to temporarily mispriced pools, leaving more profit for liquidity providers.

According to Mooniswap’s whitepaper, the team expects Mooniswap to generate from 50% to 200% more income for liquidity providers than Uniswap due to redirection of price slippage profits.

As of now, there is a total liquidity of $100M on Mooniswap while Uniswap has a total liquidity of $1.78B. As expected, there is much less volume on Mooniswap which means less fees for liquidity providers.

So, if you want to provide liquidity to a pair on Mooniswap, you should also consider the volume and liquidity of that specific pair on Uniswap.

Update: With the launch of 1INCH token, Mooniswap has been deprecated and rebranded to 1inch Liquidity Protocol.

You can check out our 1inch exchange review to learn how to use and add liquidity to 1inch exchange.

6- Not removing liquidity till the exchange rate returns to the initial rate

After you provide liquidity to a pair, the initial rate at which you provided liquidity to the pair will change, which is quite normal.

But, if the exchange rate even more deviates from the initial rate, your impermanent loss will be much greater.

You can wait for the exchange rate to return to the initial rate and exit the liquidity pool with almost no impermanent loss.

But it is not as easy as it might seem considering the volatility in the cryptocurrency market.

Instead, you should assess the cryptocurrency market and carefully research about each token in a pair before providing liquidity into a pool.

Also, you should be willing to exit the liquidity pool with some impermanent loss at some point.

To learn how to add liquidity to decentralized exchanges, check out our decentralized exchange reviews below:

To buy and trade decentralized exchange tokens, you can also use centralized exchanges such as Binance and Kraken: