Shorting cryptocurrencies is a great way to make money when the market is red.

You can short Bitcoin and other cryptocurrencies on Binance and make money as cryptocurrencies fall.

There are various derivatives exchanges such as Binance, BitMEX as well as decentralized ones like dYdX that you can use to short Bitcoin and altcoins.

In this tutorial, I will show you how to short Bitcoin on Binance and give you information on everything you need to know to open short positions on Binance such as fees, funding and stop loss.

If you don’t have a Binance account yet, click this link to open your Binance account.

Or you can also visit our step-by-step guide on how to open a Binance account to open and set up your Binance account.

How to short Bitcoin on Binance

Shorting Bitcoin on Binance is quite easy, but you should first open your Futures account. After that, you can start opening long and short positions on Binance.

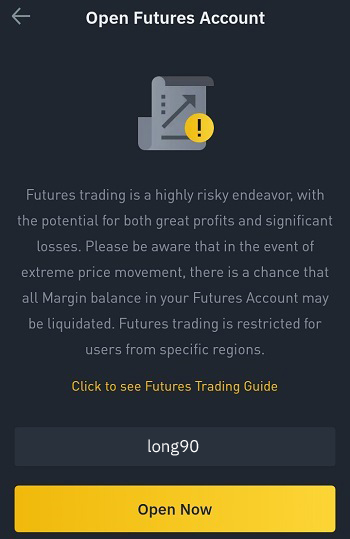

First visit the Futures tab on Binance and enter the code ”long90” to open your Futures account on the platform.

If you don’t have a Binance account yet, simply click the button below or use the referral ID ”SPOT90” to open your Binance account and receive fee rebates while trading:

Open your Futures account

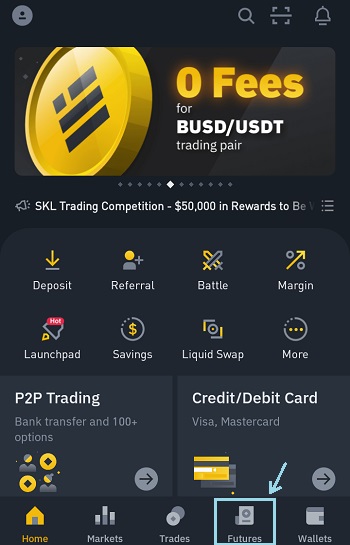

If you are on mobile, click the Futures tab on Binance’s mobile app to open your Futures account. If you’re using the website, click USDs-M Futures under the derivatives menu.

Enter the code ”long90” and open your Futures account. You may also be required to complete a test regarding risks.

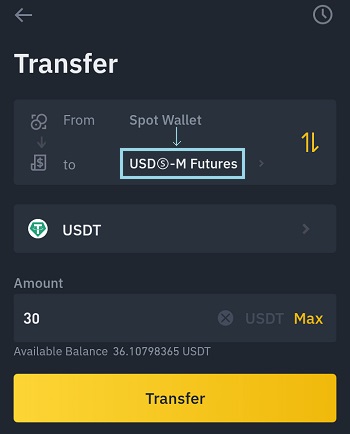

Transfer USDT or BUSD to your USDs-M Futures wallet

To short Bitcoin on Binance, first click the Futures tab on the mobile app. If you’re going to short Bitcoin using the website, you can click ”USDs-M Futures” under ”Derivatives”.

Click on the transfer icon on the Futures page and transfer USDT or BUSD from your spot wallet to the Futures wallet.

You can short Bitcoin using the BTC/USDT or the BTC/BUSD pair. You can also use coin-margined (COIN-M) pairs such as BTC/USD to short Bitcoin.

But, as you think Bitcoin will decrease in value, it is better to hold stablecoins such as USDT and short Bitcoin using USDT or BUSD margined pairs.

If you already have Bitcoin in your spot wallet and want to short Bitcoin, you can transfer BTC from your spot wallet to COIN-M Futures wallet.

After transferring BTC to your COIN-M Futures wallet, you can select the BTCUSD perpetual pair and open a short position with your BTC instead of USDT or BUSD.

This way when Bitcoin price falls, you will increase your Bitcoin stack.

Binance Futures margin mode

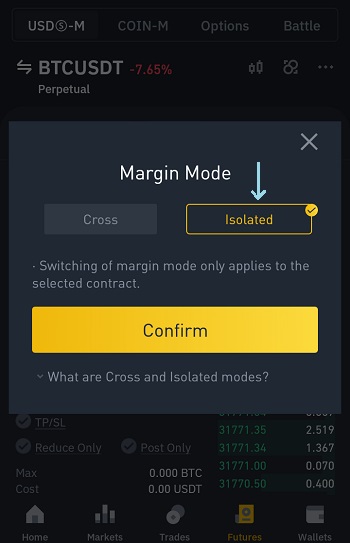

Before opening your short position on Binance, you should choose the margin mode and set your leverage.

You can use cross or isolated margin mode on Binance.

Cross margin mode is riskier as you can lose your futures wallet balance in addition to your margin in the event of a liquidation.

But, in isolated mode, your risk is limited to the margin you use (cost) when opening your position. You can’t lose your wallet balance or more money than your margin.

Choose the isolated margin mode if you are a beginner and don’t want to take much risk or still not sure which one to use.

Binance Futures leverage explained

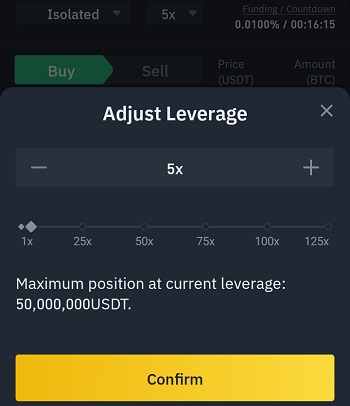

After choosing the margin mode, you need to set your leverage. As you are going to short Bitcoin, you can use up to 125x leverage.

If you are a new user on Binance, the maximum leverage that you can use will be 20x and gradually increase after opening your Futures account.

In this tutorial, I’m using 5x leverage for my short position on Bitcoin. The higher the leverage, the higher the risk will be.

The logic behind leverage is pretty simple. Let’s say you have 200 USDT and you are using 10x leverage, your position size will be around 2000 USDT (200*10).

As the price changes in the desired direction, you’ll earn much more money as your position size is 2000 USDT instead of 200 USDT.

But, when the price does not go in the direction you desired, you will lose money and you can’t lose more money than your margin (200 USDT).

So there is a price at which your position gets liquidated which is called liquidation price. If you use very high leverage, the liquidation price will be closer to your entry price.

To calculate the liquidation price for your positions, you can use our Binance Futures calculator.

Opening a short position on Bitcoin on Binance

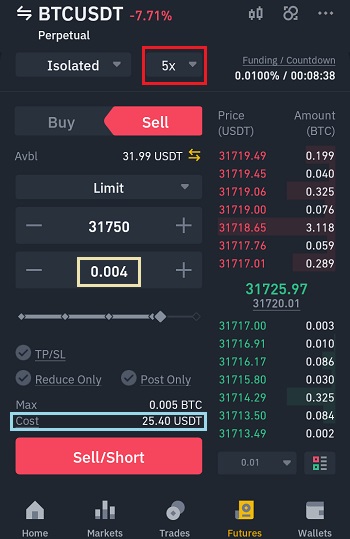

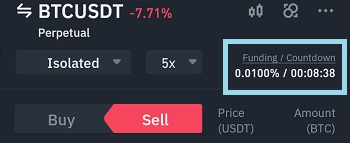

I set the margin mode as ”isolated” and the leverage at ”5x” as you can see in the image below. Now I’m going to open a short position on Bitcoin.

To short Bitcoin and make money as Bitcoin price decreases, you need to make a sell/short order. I set my limit price at 31750 and my position size will be 0.004 BTC.

As can be seen in the image above, the cost is only 25.40 USDT for my short position. As I am using 5x leverage, I can open a 0.004 BTC short position at the price of 31750 USDT with only 25.40 USDT.

After entering your limit price and position size and checking the cost, you can click the ”sell/short” button to place your order in the market.

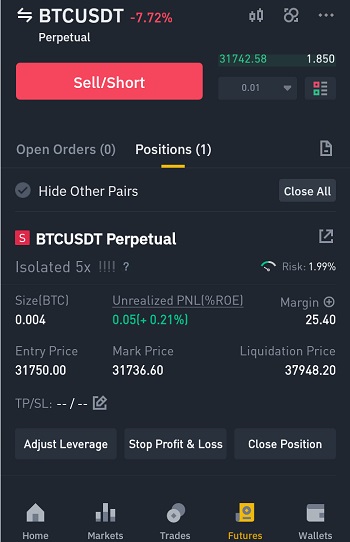

When your sell/short order is executed by other users, your position can be seen as in the image below.

As it is a short position, the liquidation price is above the entry price. When Bitcoin price rises to 37,948.20 (the liquidation price), there will be a loss almost equal to our margin (25.40), so the position will be liquidated.

If Bitcoin price goes below our entry price (31,750), we will make profit which will be shown as ”unrealized PNL”.

To minimize your loss in the event of a price change in the positive direction or take profit, you can place stop loss and take profit orders.

TP/SL orders can be placed when opening your position by clicking TP/SL, but if you want to enter a certain amount for your TP/SL orders, you can do it after opening your position instead.

The reduce only option is used to make sure any buy/long order you place after opening your short position can only reduce your position.

This way even if you close your short position, your existing buy/long orders can’t turn into a long position and can only reduce your short position, which makes them ineffective after the position is closed.

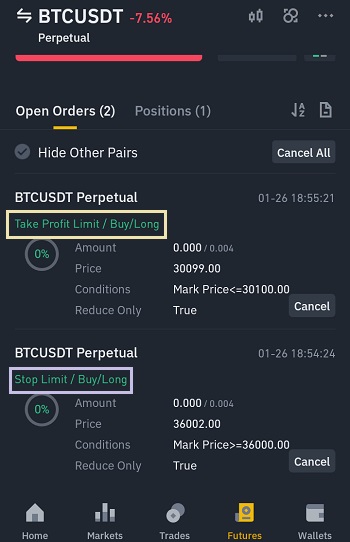

Placing stop loss and take profit orders on Binance Futures

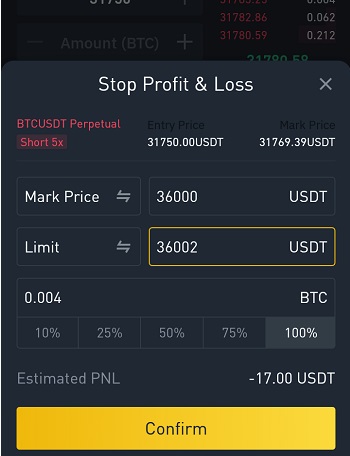

You can place stop loss and take profit orders using the ”stop profit & loss” button. Or you can place buy stop-limit orders in a similar way you opened your position.

As you’ve opened a short position, you need to enter ”buy/long” orders to place stop loss/take profit orders or close your position.

In the example below, as my liquidation price is 37,948.20, I set the stop price (mark price) at 36000 and the limit price at 36002 at which the buy order will be executed.

When you have a short position, the limit price should be higher than or equal to the stop price for a stop loss order.

Instead of getting liquidated and losing the whole margin, this stop loss order will basically allow me to close the position with an estimated loss of 17 USDT.

If you want to take profit at certain prices, you can place take profit orders by entering a stop price that is below your entry price and a limit price equal to or below your stop price.

When I close my short position at 30099, I will make an estimated profit of 6.60 USDT, which does not take funding into consideration.

When you place both spot loss and take profit orders, your open orders will be shown under ”open orders” like this:

As you can see in the image above, take profit and stop loss orders that are placed using the stop profit & loss button are automatically reduce only orders.

If you don’t use this button and instead place limit / stop limit / stop market orders using the green buy/long button, you can tick ”reduce only”.

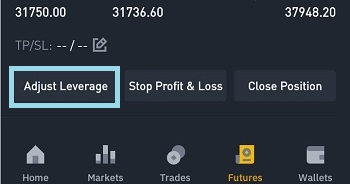

Binance Futures adjust leverage explained

After opening your position, you can change your leverage by clicking the ”adjust leverage” button. But it will not immediately change your liquidation price.

Instead, when you increase your leverage, the margin that you can remove from your position will increase.

You can remove more margin from your position which in turn will lower your liquidation price (if you’ve opened a short position).

If you want to make more money during price movements, you should instead place a new sell/short order to increase your position size.

Binance Futures adjust margin explained

You can add margin to your open position by clicking on ”margin”. If you add margin to your short position on Binance, your liquidation price will increase.

So you can decrease your risk of getting liquidated by adding more margin to your position using the adjust margin option.

The margin you add to your position will basically lower your leverage and risk and not change your position size.

As your position size does not change after adding margin to your position, it will not change your potential profits and losses.

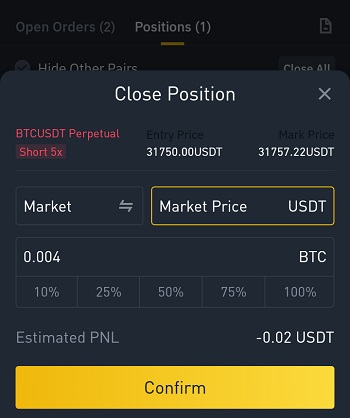

How to close positions on Binance

You can close your positions on Binance by clicking the ”close position” button and entering a limit price or using the market price option.

You can also close your open position by entering an opposite order. For example, if you have a short position, you need to enter a buy/long order to close your position.

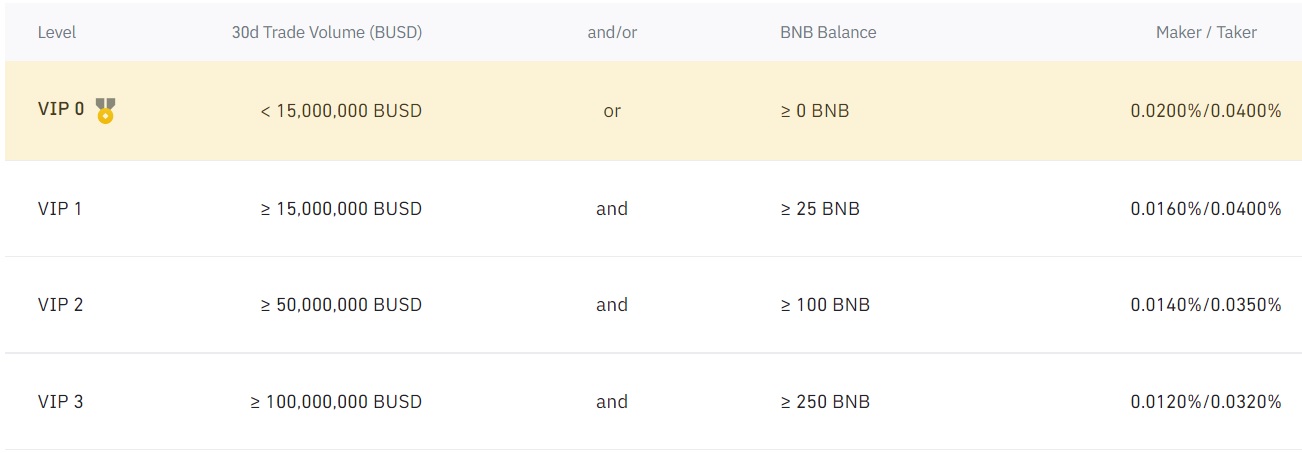

Binance Futures fees and funding

When you open a short or long position on Binance, you’ll be charged a trading fee when your order is executed at the market, in a similar way to spot markets.

The USDs-M Futures fees depending on your trade volume in the last 30 days can be seen in the image below:

For example, if you’ve opened a 0.5 BTC position at 32000 USDT. You’ll be charged a 3.2 USDT trading fee if it is a maker order. The calculation: (0.5*32,000)/100*0.02

There is also funding that traders pay or receive every 8 hour, which is actually more important than trading fees.

Funding is a payment that is exchanged directly between traders who have long or short positions every 8 hours. It exists to avoid price divergence between futures and spot markets.

The rate below ”funding” shows the funding rate and the countdown shows the time left for the next funding payment.

If the funding rate is positive, longs are charged a funding fee and those who have a short position receives funding fee. If the rate is negative, shorts pay and longs receive funding.

If the funding rate is positive, longs are charged a funding fee and those who have a short position receives funding fee. If the rate is negative, shorts pay and longs receive funding.

Let’s say you have a 0.5 BTC short position and Bitcoin is traded at 35,000. If the funding rate is 0.01%, you will receive a 1.75 USDT funding ((0.5*35,000)/100*0.01).

Binance Futures order history

When you open or close long/short positions on Binance, you can see your orders and other details in the order history.

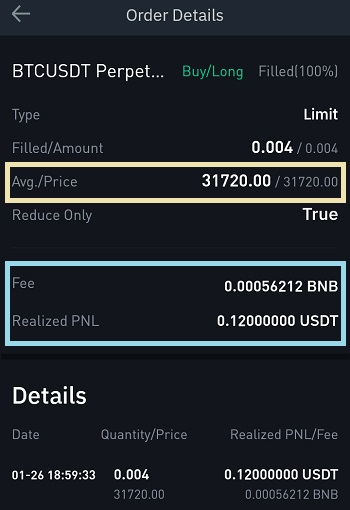

When I close my short position, it is shown as ”filled” and my stop loss and take profit orders are shown as ”expired” since they got no chance to be executed.

When you click on the order, you can see the average price at which the order is executed and your realized PNL (profit) and the fee charged.

If you have any questions about shorting cryptocurrencies on Binance, leave a comment below.

To learn how to deposit money into your Binance account and use Binace, you can check out our in-depth Binance tutorial.