You can short cryptocurrencies with up to 125x leverage on Binance.

But can you short on Binance without leverage too?

Yes, you can do that, and it is possible to short on Binance using 1x leverage.

But you don’t need to do that on the futures exchange. You can simply short cryptocurrencies without leverage on the spot exchange.

Imagine you have 5 BTC and Bitcoin is currently traded at $20,000.

You want to short Bitcoin because you think the price will soon start to go down and eventually hit $10,000.

If you just sell your 5 BTC at $20,000 on the spot exchange, you can get $100,000 cash (fiat/stablecoin) in your account.

When the Bitcoin price falls to $10,000, you can buy 5 BTC for $50,000 and have extra, free $50,000 cash (fiat/stablecoin) left in your account.

If you didn’t sell your 5 BTC, you would only have 5 BTC while the price is at $10,000 and not have that extra $50,000.

So, in short, you can sell your crypto when you think the price will go down and buy back the same amount at a lower price, ending up with the same amount of crypto and extra money.

This is equivalent of shorting without leverage and you don’t need to open a short position for that.

Or let’s say you have $20,000 fiat/stablecoin in your account and the Bitcoin price is currently around $20,000.

So you can buy 1 BTC with your money at the current price.

If you want to short Bitcoin without leverage as you think the price will go down, you don’t need to do anything, just wait.

By waiting for the price to go down, you’re basically shorting Bitcoin.

For example, if the price falls to $15,000, you can buy 1 BTC for $15,000 and have extra $5,000 left in your account as a profit.

Even if you don’t intend to buy Bitcoin and stay in cash while the price goes up and down, you’re again shorting Bitcoin and other assets that you can potentially buy.

Because if the price of the asset goes up, you will need to pay more if you want to buy it.

So holding cash is also not risk free. But you can’t lose much as you don’t use leverage, and there is no risk of liquidation.

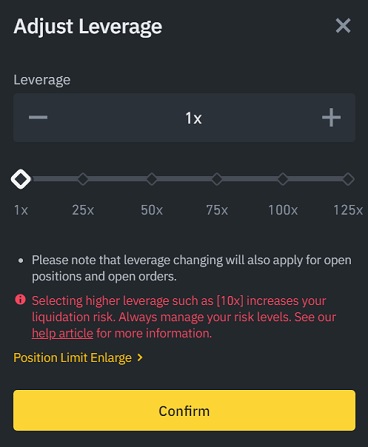

If you still want to open a short position on Binance without using leverage, you can do that by adjusting leverage to 1x.

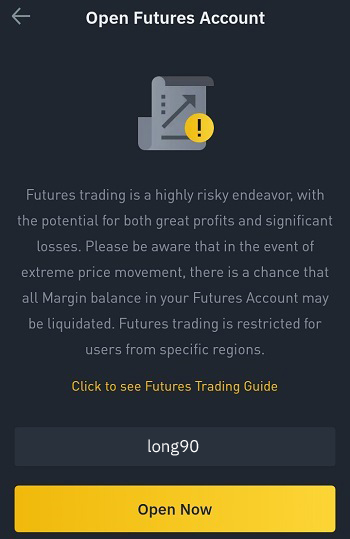

If you’ve not opened your Futures account on Binance yet, you can enter the code ”long90” when opening your Futures account and start trading on the platform.

If you don’t have a Binance account, click the button below or use the referral ID ”WRYOO8BZ” to open your Binance account with a 20% fee discount:

After selecting 1x leverage, you can open a short position with 1x leverage on Binance.

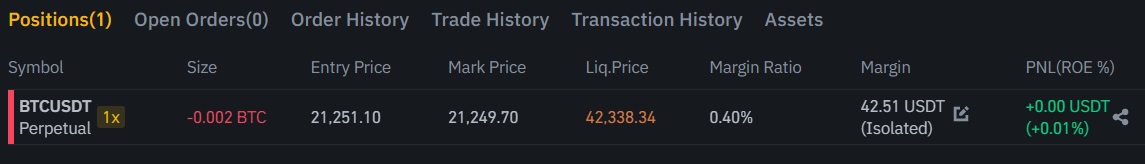

As you can see in the example above, there is still a liquidation price at which the position gets liquidated even though you use 1x leverage.

And the margin (42.51 USDT) is almost equal to the position size (0.002 BTC) as the leverage used is 1x.

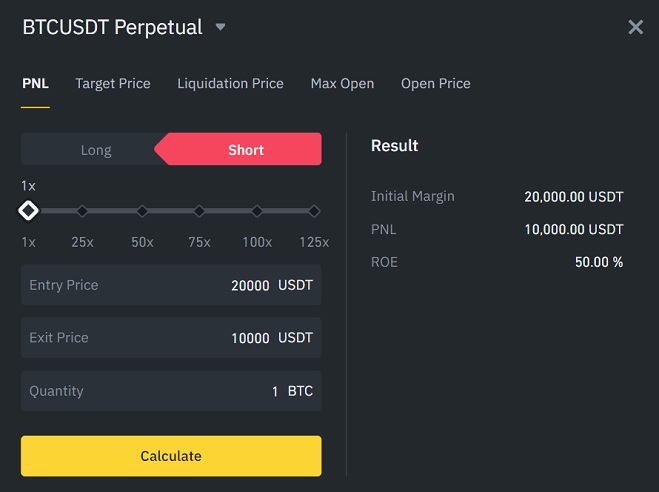

Imagine you sold your 1 BTC at the price of $20,000, and the price later doubled hitting $40,000.

At least you would still have $20,000 and can buy 0.5 BTC at the price of $40,000, no risk of liquidation.

If the price goes down and hits $10,000, you can buy back your 1 BTC for $10,000 and have $10,000 left in your account as a profit.

With a 1x leveraged short position, you again make a profit of $10,000 (PNL) as calculated below, no difference.

But there is more to it.

When you open a short position, you will also pay or receive funding every 8 hours on Binance, depending on the funding rate.

If the funding rate is positive, you can receive funding payments every 8 hours which is calculated based on your position size and the funding rate.

So some users may open a 1x leveraged short position just to receive funding payments depending on the market.

To learn how to calculate funding and trading fees, you can check out our Binance Futures tutorial.

If you want to open a short position with minimal risk, your best bet would be opening a short position with 2x leverage on Binance.

This way you can make more money when the price goes down and have a much higher liquidation price (lower risk).

To learn how to open short and long positions on Binance, check out our in-depth tutorials below which include everything you need to know: