Thanks to smart contracts, today it is possible to borrow and lend cryptocurrencies without trusting any person or entity. In this guide, you’ll learn how to take cryptocurrency loans and lend cryptocurrencies with the magic of decentralized lending products allowing people to borrow and lend Ethereum-based tokens while they are in control.

The number of current lending projects for Ethereum and ERC-20 tokens keeps rising. Dharma, Compound and ETHLend can be given as examples of lending protocols that can be used to lend tokens including stablecoins to earn interest and take loans.

In addition to lending protocols, Bloqboard, as a platform for cryptocurrency lending, aggregates orders from Dharma, Compound and MakerDAO protocols and provides a user interface to access them.

Besides making lending and cryptocurrency loans possible without taking control of user wallets and requiring trust to central party through non-custodial smart contracts, these lending protocols, which are more or less similar despite using different approaches, are transparent/auditable and reduce the risk for lenders with overcollateralization.

Dharma currently offers up to 11% interest for decentralized stablecoin Dai and 2.5% for Ethereum to lenders. Compound’s interest rates float each block based on supply and borrowing demand, which are currently 5.70% for Dai, 0.09% for WETH (Wrapped Ether), 0.19% for BAT and 0.9% for ZRX.

How to borrow and lend cryptocurrency on Dharma – a step-by-step guide

Step 1: Enter your e-mail address on Dharma to register an account to start using Dharma.

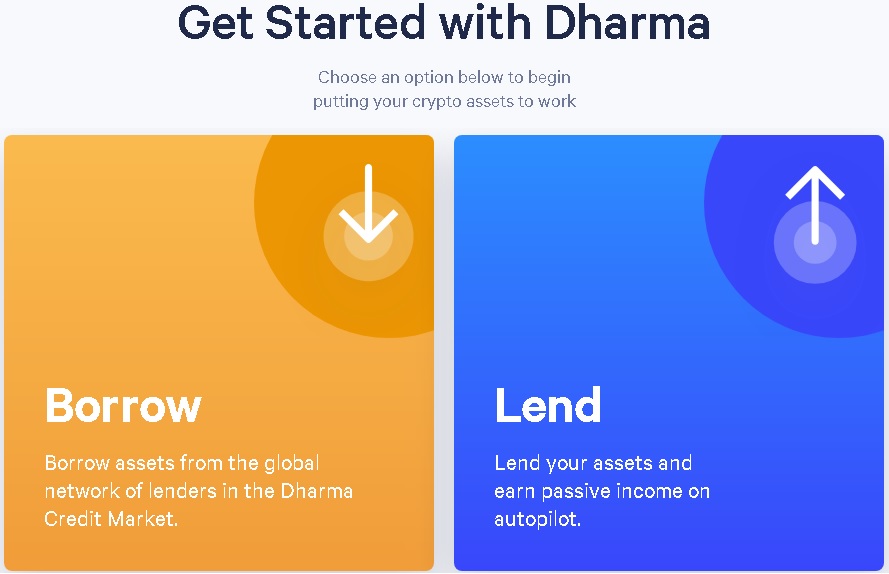

Step 2: After completing the registration process, you will be landed on the dashboard page of Dharma, which looks like below:

Step 3: You can choose to either borrow or lend cryptocurrency.

Step 3: You can choose to either borrow or lend cryptocurrency.

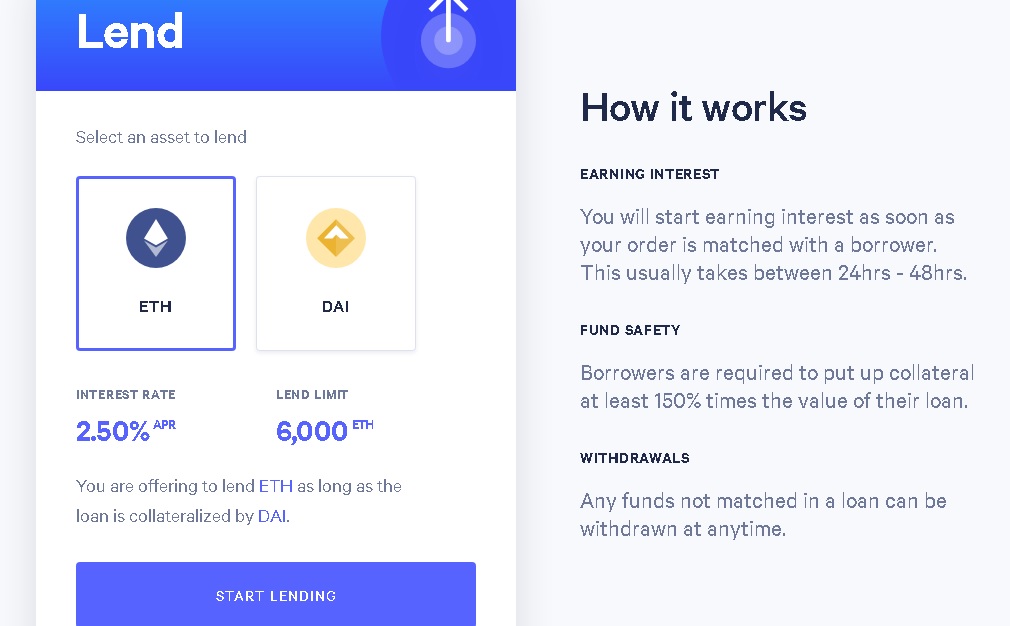

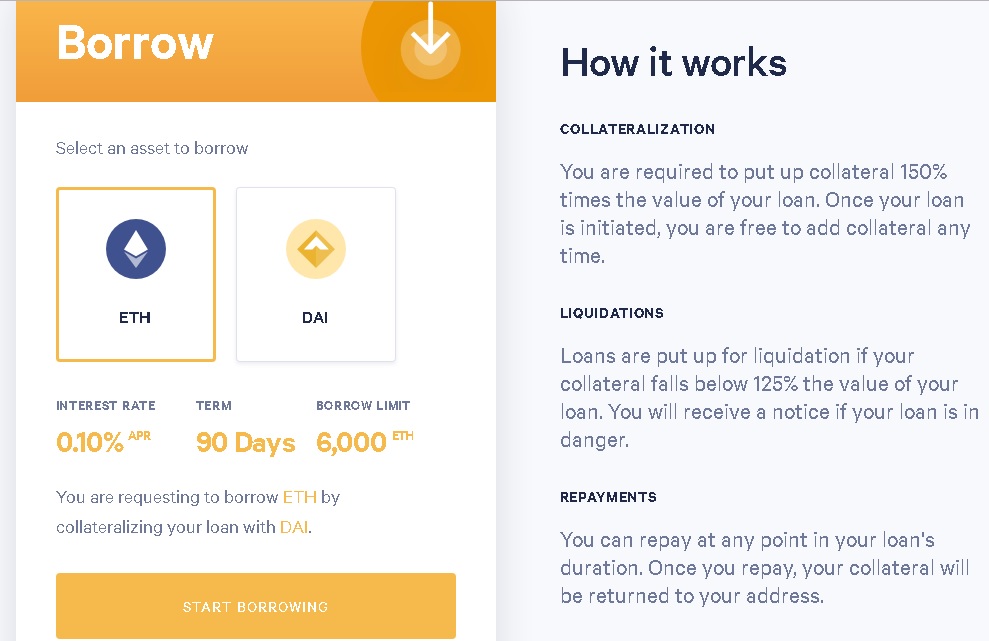

In the lending page, you can see the interest rates and the limits. Your orders needs to be matched with a borrower. Borrowers have to collateralize their loans with Dai or Ethereum which is 150% times the value of the loan, and they are automatically liquidated if it falls below 125% the value of the loan, so the loans provided by lenders are always safe through overcollateralization.

Borrowers can also put up more collateral when taking a loan so as to minimize the risk of collateral’s value falling below 125% the value of the loan.

After taking a loan, borrowers can take their collaterals back by repaying the loan within the duration of the loan which is 90 days.

Lending on Dharma:

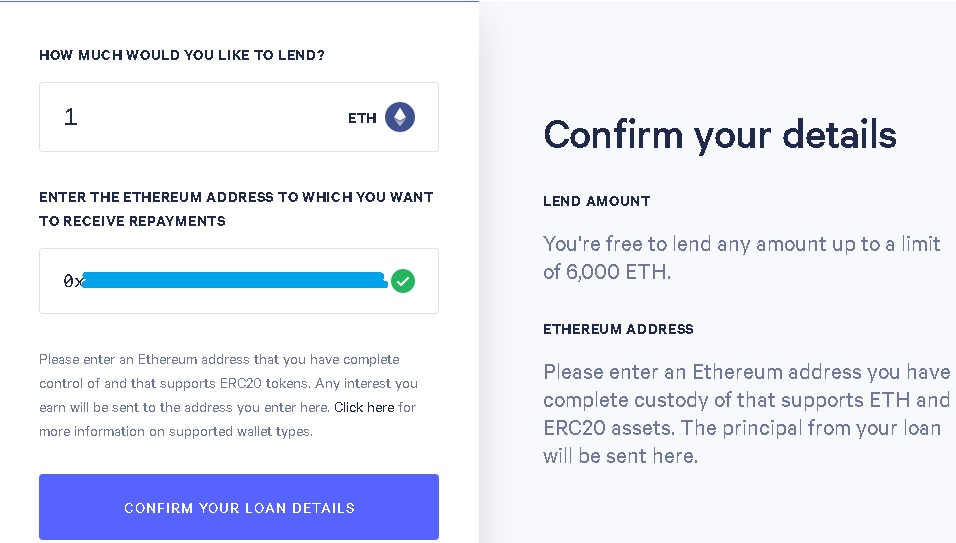

Enter the amount of ETH you would like to lend and your Ethereum address that you control the private key.

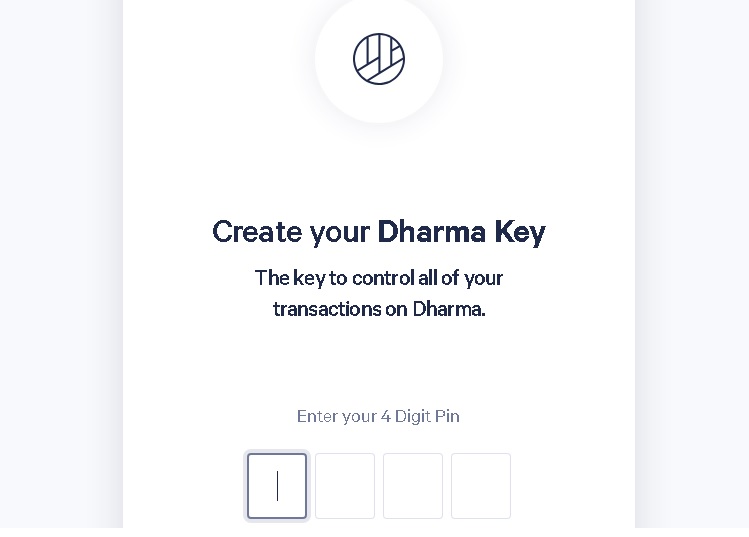

Create your Dharma key which you will use to control your transaction.

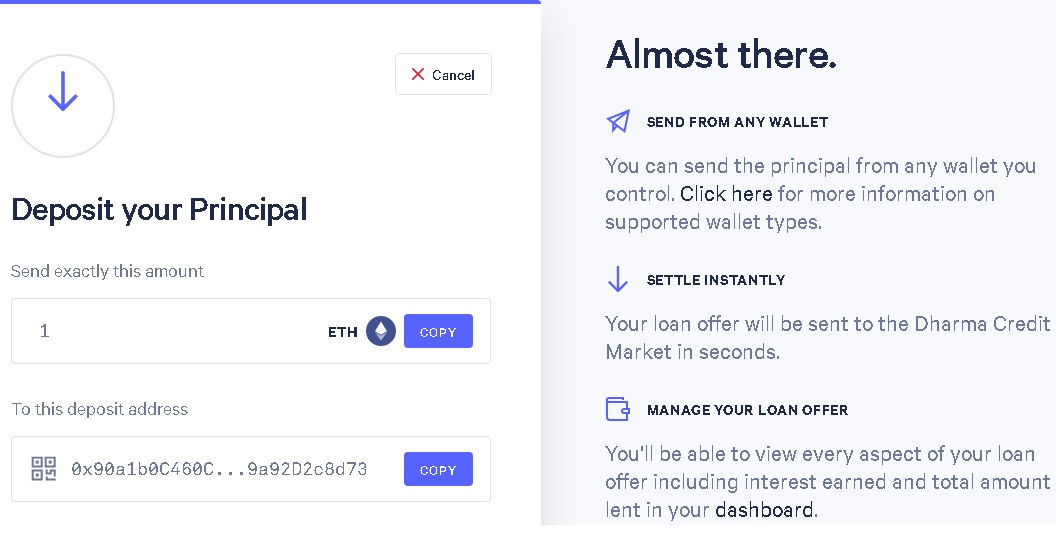

After sending Ethereum to the contract address, you can view all kind of details related to your loan in the dashboard. Your offer will be matched with a borrower and this takes 24-48 hours. Matching time depends on the order size and the market activity.

Taking cryptocurrency loan on Dharma

You think the value of ETH will rise? Then you can take a ETH loan by collateralizing your Dai and repay when you make a profit with Ethereum. Cryptocurrency exchanges offer this through margin trading, but with Dharma and other lending protocols, you don’t need to trust an exchange that can be hacked or manipulate your positions.

Choose the option of borrow on Dharma and select a cryptocurrency you want to borrow ETH or DAI:

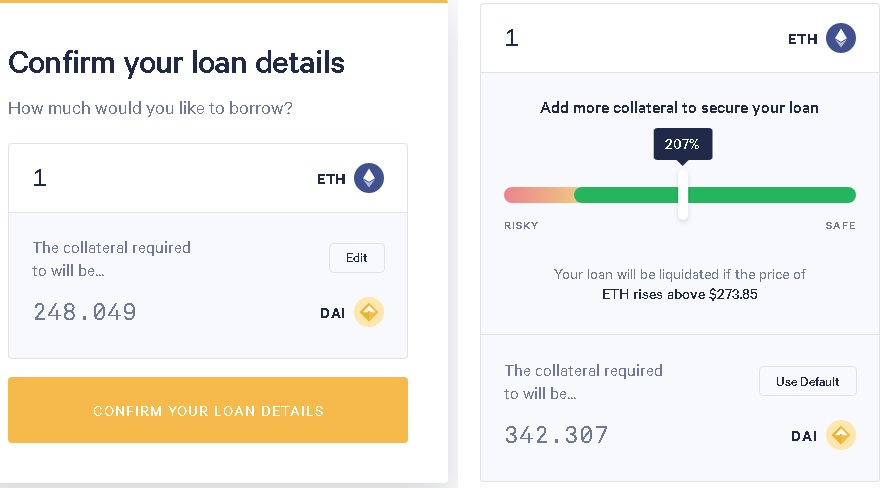

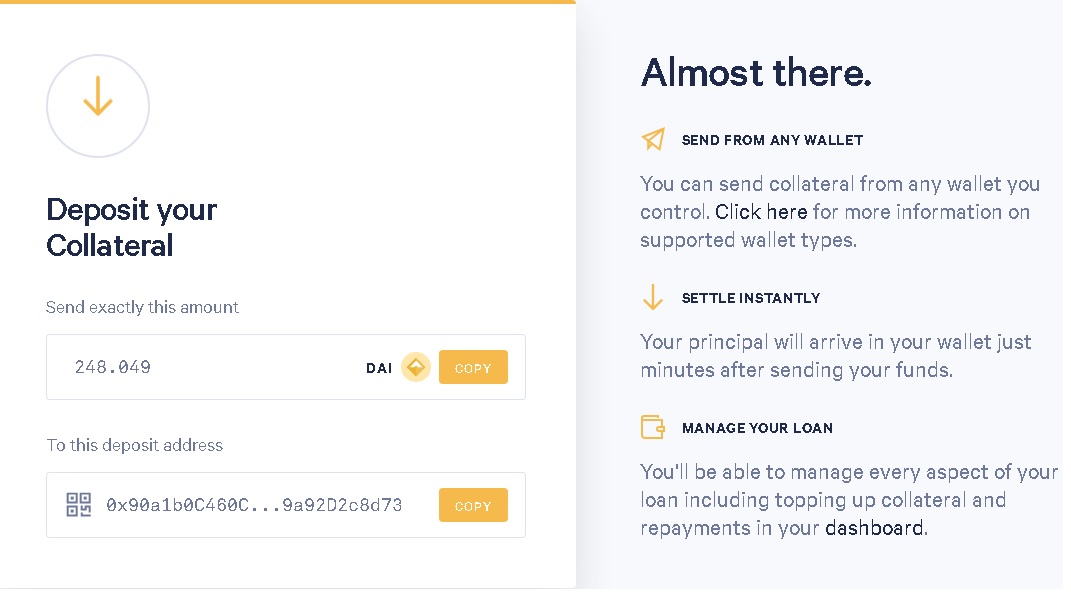

For 1 ETH, you need to provide 248.049 DAI as collateral with the default 150% collateralization rate. But, you can click on edit and increase this rate to secure your loan.

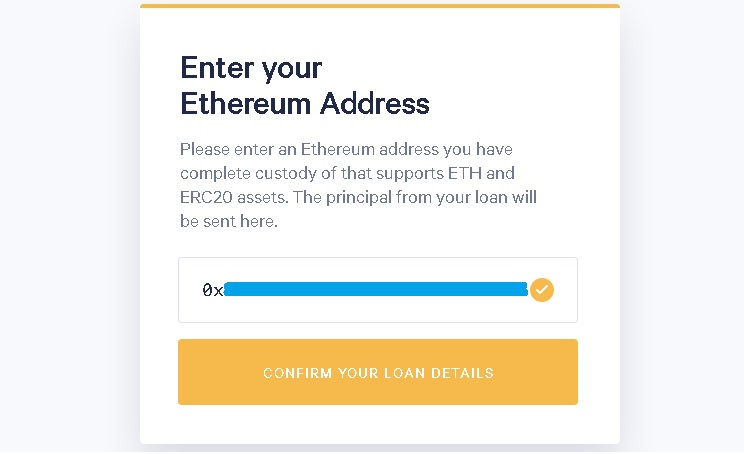

Enter your Ethereum address to confirm your loan details, after that you will be required to create or enter your Dharma key.

Lastly, you need to deposit your collateral to receive your principal. You will get a much faster match and receive your ETH in a few minutes according to Dharma.

Dharma, Compound, ETHLend and other protocols and platforms allow any person to securely lend their cryptocurrency to other people and take cryptocurrency loans in a decentralized manner. Using different protocols, it is possible to borrow and lend many Ethereum-based tokens such as WETH, BAT, DAI and ZRX.