There are over 600 cryptocurrencies, various fiat currencies such as EUR and GBP and thousands of trading pairs on Binance.

Along with very low trading fees starting from 0.1%, Binance is the best exchange to trade cryptocurrencies for many people.

In this tutorial, we will show you how to trade cryptocurrencies on Binance and engage in spot trading and futures trading.

To trade crypto on Binance, you first need to create a Binance account if you don’t have a Binance account yet.

To open your Binance account with a 20% fee discount, you can use the referral ID ”WRYOO8BZ” or click the button below:

To learn how to open your Binance account and also enable 25% BNB fee discount, you can also check out our tutorial on opening a Binance account.

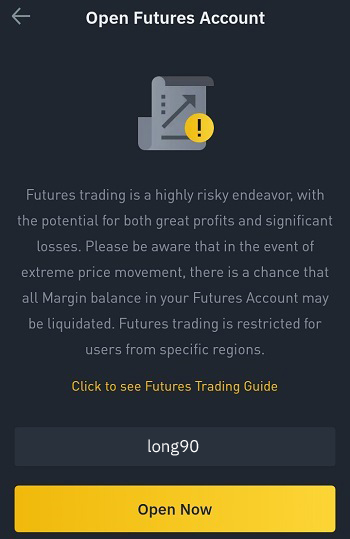

If you already have a Binance account, you can use the code ”long90” when opening your Futures account on Binance and start trading on the platform.

How to trade cryptocurrencies on Binance

To start trading on Binance, you first need to deposit cryptocurrencies or fiat currencies into your Binance account.

To learn how to deposit cryptocurrencies and fiat currencies into your Binance account, check out our tutorial on how to deposit money into Binance.

If you can’t deposit fiat currencies into your Binance account, you can buy crypto with your bank/credit card or through Binance P2P on Binance.

Alternatively, you can transfer cryptocurrencies from other platforms that you use to Binance and start trading.

How to trade spot on Binance

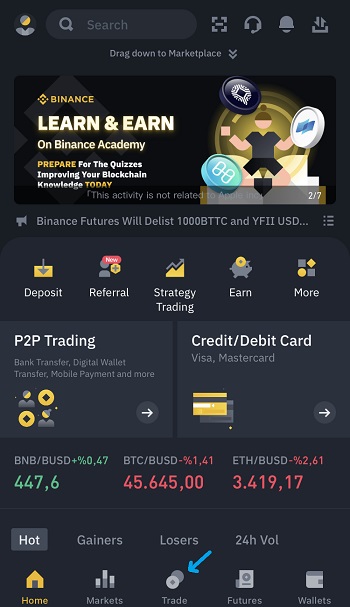

To trade spot markets on Binance, first log in to your Binance account and click the trade tab on mobile or the spot page under the trade dropdown on the website.

Trading pairs on Binance

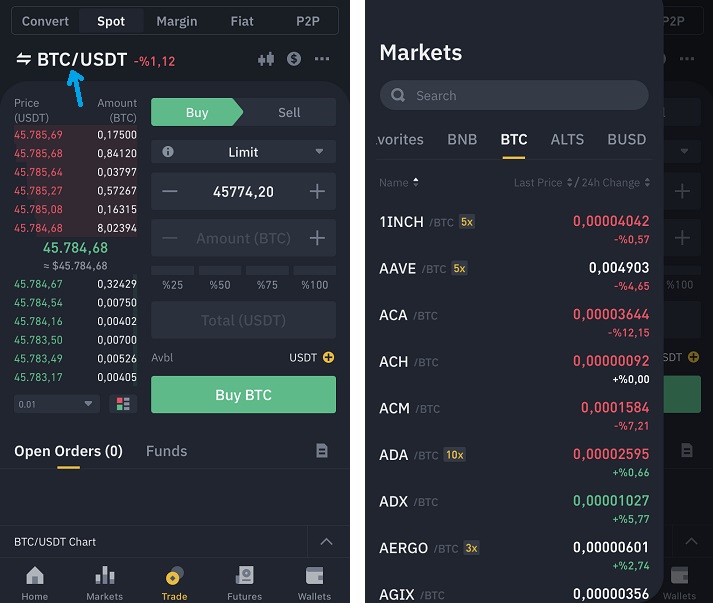

On the spot trading page, you first need to select the trading pair that you want to trade by clicking the pair.

There are thousands of trading pairs on Binance including BNB, BTC, USDT, BUSD, FIAT and various other altcoin pairs.

For example, if you want to buy BTC with your USDT or sell your BTC for USDT, you can select and trade the BTC/USDT pair.

And you can find fiat currency pairs such as BTC/EUR and BTC/GBP under the BTC or FIAT tab.

How to place a buy order on Binance

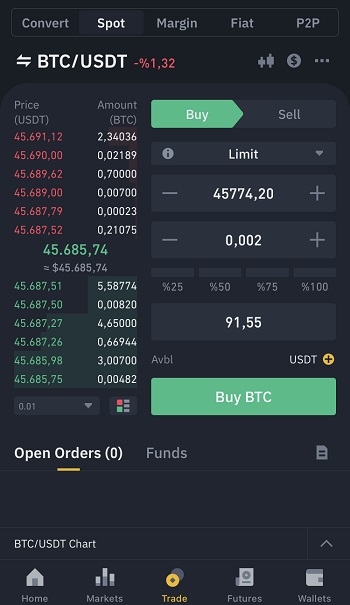

To buy Bitcoin with your USDT, you can place an order like the one below. In the example below, we’re buying 0,002 BTC for 91,55 USDT at the price of 45774,20 USDT.

Once you enter the price at which you want to buy Bitcoin and the amount of Bitcoin that you want to buy, you can click the ”Buy BTC” button and place your buy order at the market.

In the example above, if you set your buy price lower than the best sell price (45,687.52) such as 45,680, your buy order will be on the green side of the order book.

If you place a buy order at a price equal to or higher than the best sell price (45,687.52), it will be executed immediately at the best price.

So even if you set your price really high such as at 47,000, it will still be executed at the best price possible.

How to place a market order on Binance

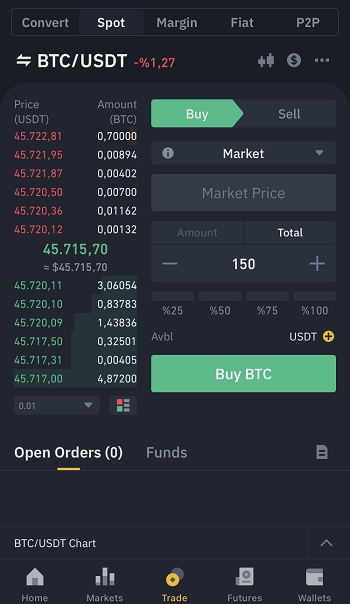

If you don’t want to enter a price for your buy order and want it to be filled at the best price immediately, you can place a market order instead of a limit order.

To place a market order, you just need to enter the amount of BTC that you want to buy or the amount of USDT that you want to sell for BTC.

In the example below, we’re placing a market order to buy 150 USDT worth of BTC.

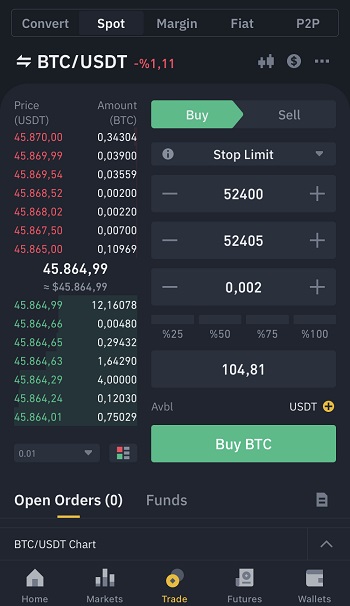

How to place a stop limit order on Binance

If you want to buy Bitcoin or any other coin only when a certain price is hit, you can place a stop limit order like the one below.

In the example below, we set our stop price at 52400 and the limit price at 52405. The buy order will be activated at 52400 if Bitcoin price hits 52400 and placed at the market.

So we basically want to buy Bitcoin (at 52405) only if Bitcoin price reaches and hits 52400. For this type of order, the limit price must be equal to or higher than the stop price.

If you have Bitcoin in your spot wallet and want to sell it if Bitcoin price goes below a certain price to minimize your losses, you can select ”sell” and place a stop limit order.

Let’s say Bitcoin is currently traded at 45000. And you want to sell it if Bitcoin price goes below 39000.

You can select ”sell” and then ”stop limit”, and place a sell stop limit order with a stop price of 39000 and a limit price equal to or lower than 39000.

As the sell order will be activated at 39000, you can’t set a limit price, the price at which the order will be executed, higher than 39000.

It must be equal to or lower than the stop price (39000) for sell stop limit orders.

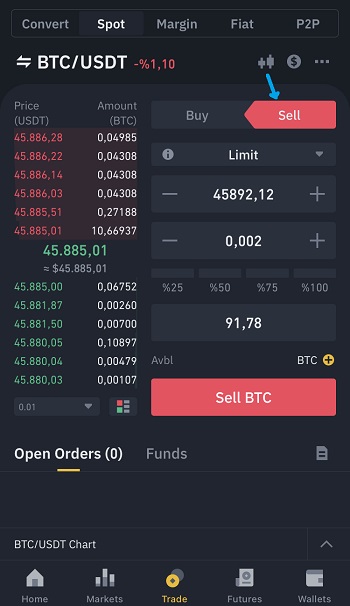

How to place a sell order on Binance

If you want to sell your BTC for USDT, you can click ”sell” and place your sell order like the one in the example below.

We want to sell 0,002 BTC at 45892,12 USDT, and will receive 91,78 USDT when the order is executed.

The price chart and depth on Binance Mobile

To see the price chart, the depth and other useful details, click the trading bar icon on the trading page.

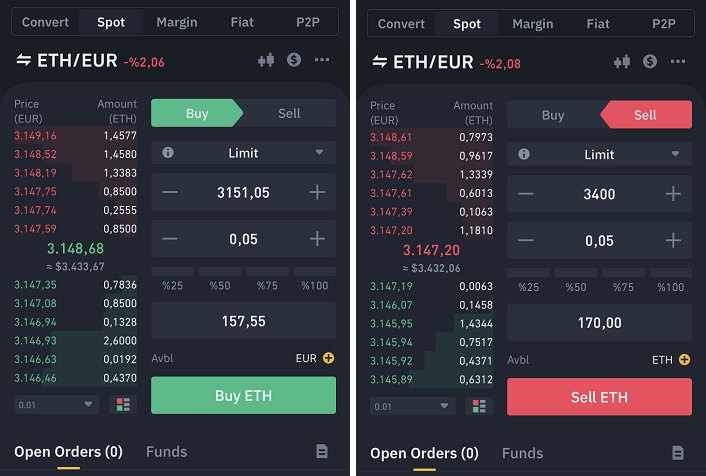

Buying ETH with Euro and selling ETH for Euro on Binance

Let’s say you have ETH and you want to sell it for Euro, or you have Euro in your spot wallet and you want to buy ETH.

You can place buy and sell orders like the ones below to buy ETH with your Euro or sell your ETH for Euro.

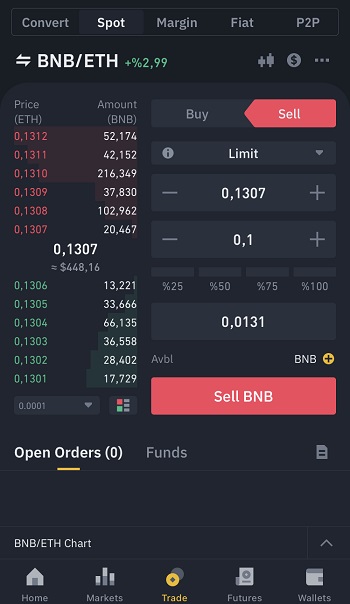

Trading altcoin pairs on Binance

Let’s say you have BNB in your wallet and you want to exchange it with another altcoin, in other words sell BNB for a different cryptocurrency.

You can first check if the coin that you want to buy has a pairing with BNB.

For example, if you want to sell your BNB for ETH, you can select the BNB/ETH pair and place your sell order.

In the example below, we’re placing a sell order to sell 0,1 BNB at the price of 0,1307 to get 0,0131 ETH.

If the coin that you want to buy has a pairing only with USDT for example, you can first sell your BNB for USDT and then buy the coin that you want to buy with USDT.

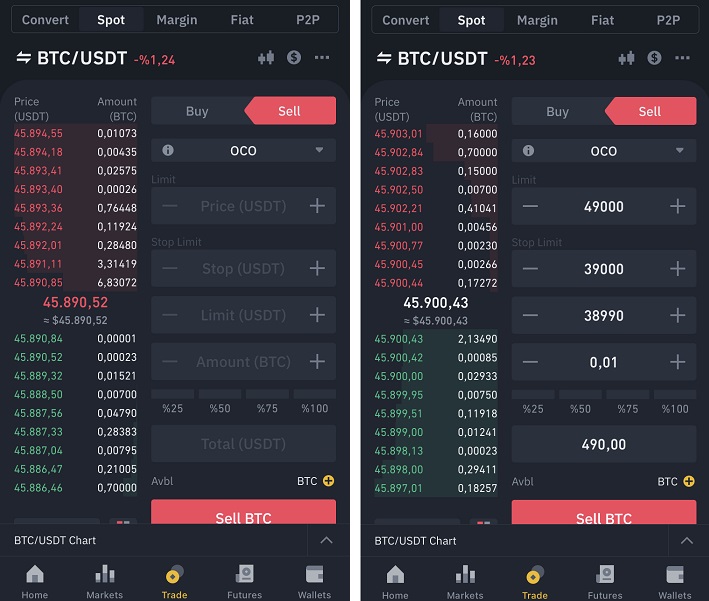

How to use OCO orders on Binance & Placing OCO orders on Binance

When trading cryptocurrencies on Binance, you can also place OCO orders to place stop limit and limit orders at the same time.

For example, let’s say you have USDT in your wallet and want to buy BTC at a good price. But what happens if the price goes higher and breaks a certain resistance level.

If you have such concern, you can place buy OCO orders instead of limit or market orders.

In the example below, we want to buy BTC at 38000 (limit price). Also we include a stop limit order with a stop price of 52400 and a limit price of 52405.

So, if the price does not fall to 38000 and instead rise to a certain level such as 52400, we can buy BTC at 52405 with our stop limit order activated at 52400 before BTC goes even higher.

The OCO order can be used when placing a sell order as well.

In the example below, we want to sell our BTC at 49000 (limit price). But we also want to sell our BTC if BTC price falls to 39000 as we think it might go much lower if 39000 is hit.

How to trade futures on Binance

In addition to spot trading, you can also engage in futures trading on Binance and open long and short positions with leverage.

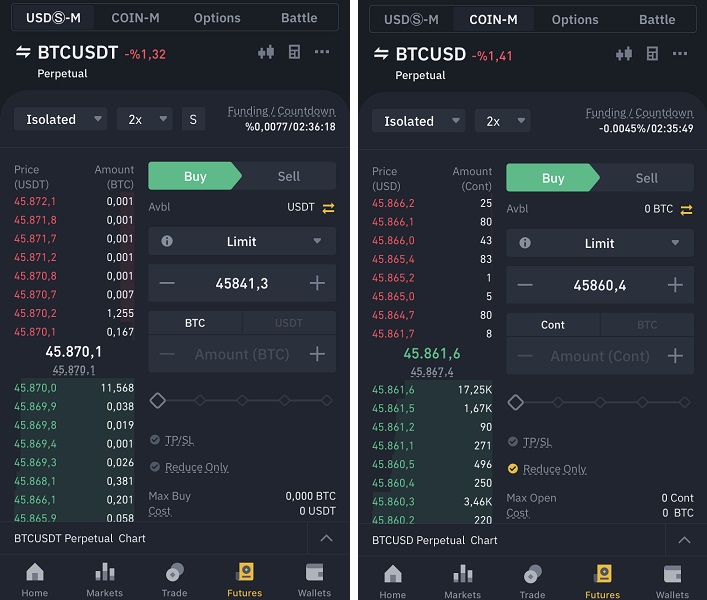

To trade futures on Binance, first click the Futures tab on mobile or click USDS-M Futures or COIN-M Futures under the derivatives dropdown on the website.

If you already have a Binance account, you can use the code ”long90” when opening your Futures account on Binance and start trading on the platform.

Note that depending on your country of residence, you may not be able to trade futures on Binance.

After clicking the Futures tab, you can select ”USDS-M” if you want to open long and short positions with your USDT or BUSD balance.

If you want to open long and short positions with the coin itself such as BTC, ETH, BNB, etc. you can use the COIN-M pairs.

You can use, for example, your Bitcoin to open a long position on Bitcoin and increase your BTC holding when the price goes up.

Or you can use USDT to long or short Bitcoin and increase your USDT holding if the price goes in the direction you desire.

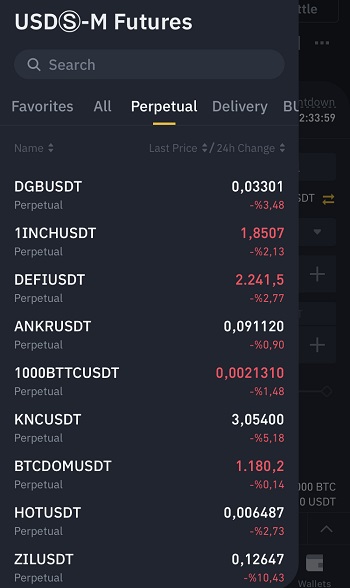

To open a long or short position, first click the pair on the Futures page to select the pair you want to trade.

Perpetual contracts don’t have an expiry date, so you can keep your positions open as long as you want if you trade the perpetual contracts.

Also, perpetual contracts are easier to trade and there are many perpetual contracts (pairs) as you can see on Binance.

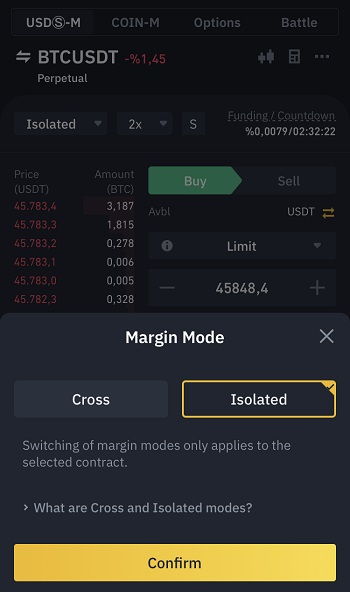

After choosing the pair that you want to trade, you should select your margin mode and adjust the leverage before opening a position.

Isolated and cross margin modes

In the isolated margin mode, you only lose your margin/cost, the amount that you use when opening your position, and don’t not lose your futures wallet balance in the event of a liquidation.

In the cross margin mode, you can lose your wallet balance too if the position gets liquidated, but the wallet balance is also taken into consideration when calculating the liquidation price.

The isolated margin mode is easier to use and safer for most users. If you want to limit the risk to only the amount that you use when opening a position, you can select the isolated margin mode.

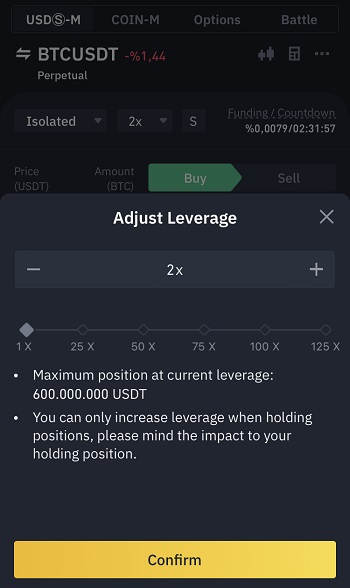

Leverage

After selecting the margin mode, adjust your leverage. If your account is new, you can’t use higher than 20x leverage and it will gradually increase after 60 days.

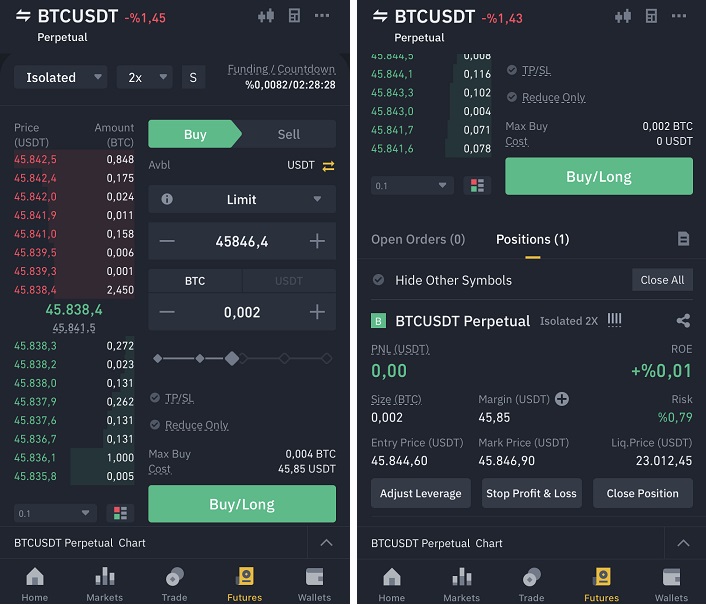

Longing on Binance

To long Bitcoin and other coins if you think the price will go up, you can place a buy/long order like the one below.

The cost is the required amount to open a certain position which depends on the price, position size and leverage.

As we use 2x leverage in the example below, our position size should be around 91.7 USDT (45.85×2).

You can calculate the position size in USDT by multiplying the size by your entry price (45844.60*0,002).

When the price goes up the entry price, you will earn USDT, but if the price goes down the entry price, there will be a loss.

If the price hits the liquidation price (23012.45), your position will be liquidated and you will lose all of your margin.

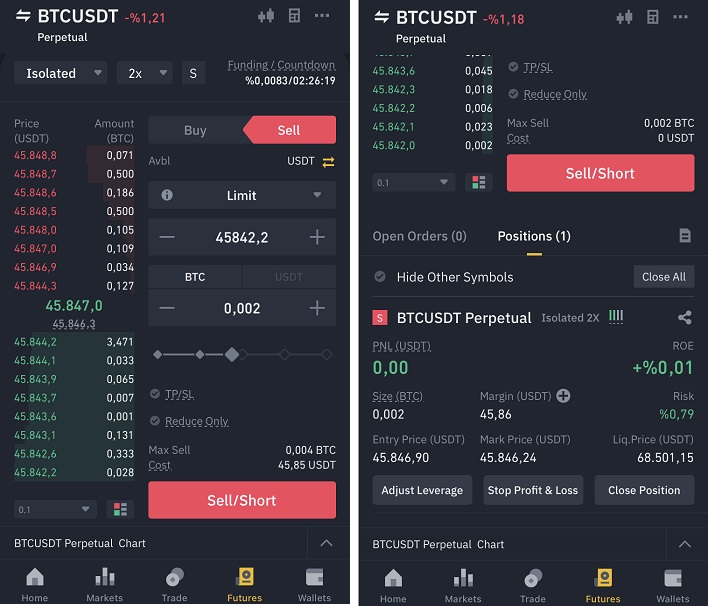

Shorting on Binance

You can also short Bitcoin and other coins if you think their prices will go down. As the price goes down, you will make a profit.

To short cryptocurrencies on Binance, you need to click ”sell” and place sell/short orders on the futures trading page.

After selecting the margin mode and adjusting your leverage, you can place a sell/short order at any price you want.

Once your sell/short order is executed, you can see it under positions.

When you short cryptocurrencies, you will make a profit when the price goes below the entry price.

If the price goes in the other direction and rise, there will be a loss. And at a certain price which is called the liquidation price, your position will be liquidated.

Trading futures is much riskier and requires much more information and experience.

To learn everything you need to know to open long and short positions on Binance such as Binance Futures fees, funding, stop loss and take profit orders, adding/removing margin and closing positions, check out our in-depth tutorials below: