GMX is a decentralized crypto exchange which you can use to trade BTC, ETH, AVAX and other coins with up to 50x leverage from your own wallet.

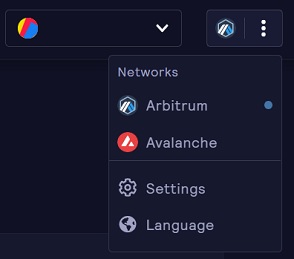

GMX supported blockchains

The decentralized platform, GMX, is currently available on Arbitrum and Avalanche chains.

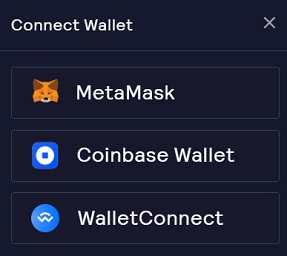

GMX supported wallets

GMX can be used with web3 compatible crypto wallets such as MetaMask, Coinbase Wallet, Ledger and various other wallets through WalletConnect.

If you don’t have a MetaMask wallet yet, you can refer to our MetaMask tutorial to learn how to set up and use MetaMask.

How to connect MetaMask to GMX

Once your wallet is ready, you can visit GMX and connect your wallet to the platform by clicking the ”connect wallet” button.

If you use MetaMask, and Arbitrum or Avalanche network is not currently added to your wallet, you can click the network on GMX and automatically add the network to your wallet via the MetaMask notification.

After connecting one of your wallet accounts to GMX, you can start trading on the platform.

But if you don’t have any tokens on the Arbitrum or Avalanche chain, you first need to fund your wallet with tokens based on these networks.

Transferring Arbitrum and Avalanche tokens to your wallet

If you use Avalanche, you will need AVAX for transaction fees and Avalanche-based tokens in your wallet.

For Arbitrum, you need ETH on Arbitrum for transaction fees and bridged tokens for trading in your address.

To get your tokens from Ethereum and other chains to Arbitrum and Avalanche, you can use Arbitrum Bridge and Avalanche Bridge, or withdraw crypto from Binance or other exchanges via these networks to your wallet.

If you don’t have a Binance account yet, click the button below or use the referral ID ”RPCUHN3S” to open your Binance account:

If you already have a Binance account, you can enter the code ”long90” when opening your Futures account on Binance and start trading on the platform.

How to trade on GMX

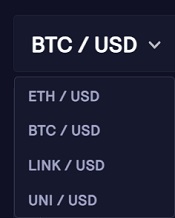

If you use GMX on the Arbitrum network, you can currently long and short Bitcoin, Ethereum, Chainlink and Uniswap.

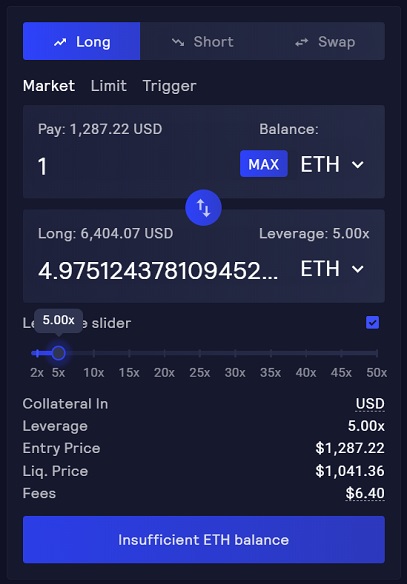

If you want to long or short ETH, for example, you can use ETH or other cryptocurrencies such as BTC, LINK, USDT, USDC and DAI as your collateral.

The snapshot of the USD value of your collateral when you open your position will be taken into consideration as your collateral, which will not change as the coin’s price fluctuates.

When opening a long position, if you use a different token as your collateral than the token that you want to long, it will be automatically swapped to the token that you want to long.

For example, if you want to long ETH with your USDT, USDT will be swapped to ETH (WETH).

When going short, only stablecoins are supported as collateral which are USDC, USDT, DAI and FRAX. If you try to open a short position with a different asset, it will be swapped into one of these stablecoins.

Long and short positions can be opened through a market order or placed at a certain price with a limit order.

After you open your long or short position, you can also place take profit and stop loss orders by clicking the ”trigger” tab.

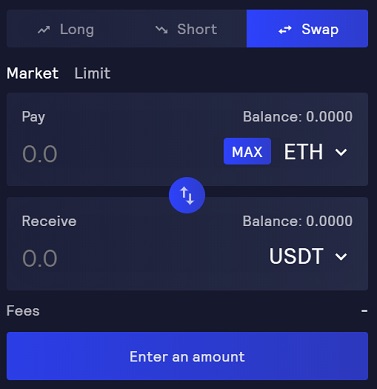

If you need to swap your cryptocurrency to other cryptocurrencies on Arbitrum or Avalanche before/after trading, you can click the swap tab and also swap your cryptocurrencies.

Besides take profit and stop loss orders, you can use the close button to exit your position partially or completely after opening a position.

GMX exchange fees

GMX charges a 0.10% fee for long and short positions, which is paid when you open or close your position.

The fee can be calculated based on your position size. For example, if the position size is 2000 USDT, the fee will be 2 USDT (2000/100*0.1).

Besides, if you use a different token as collateral than the one that you want to go long, or tokens other than supported stablecoins when going short, there will be a swap fee.

The swap fee varies from 0.2% to 0.8% and is calculated based on the collateral size (not the position size) and can be charged when opening and closing a position if a swap is needed.

Note that if you use stablecoins as collateral when shorting, and the token that you want to go long as collateral when longing, a swap is not needed.

After you open a position, the borrow fee, which can be calculated based on your position size, will be deducted from your collateral at the start of every hour.

The borrow fee which can be seen on the trading page can affect your liquidation price negatively as it is deducted from your collateral.

There is also a fee called ”execution fee” which is basically a transaction / network fee that can vary depending on the network.

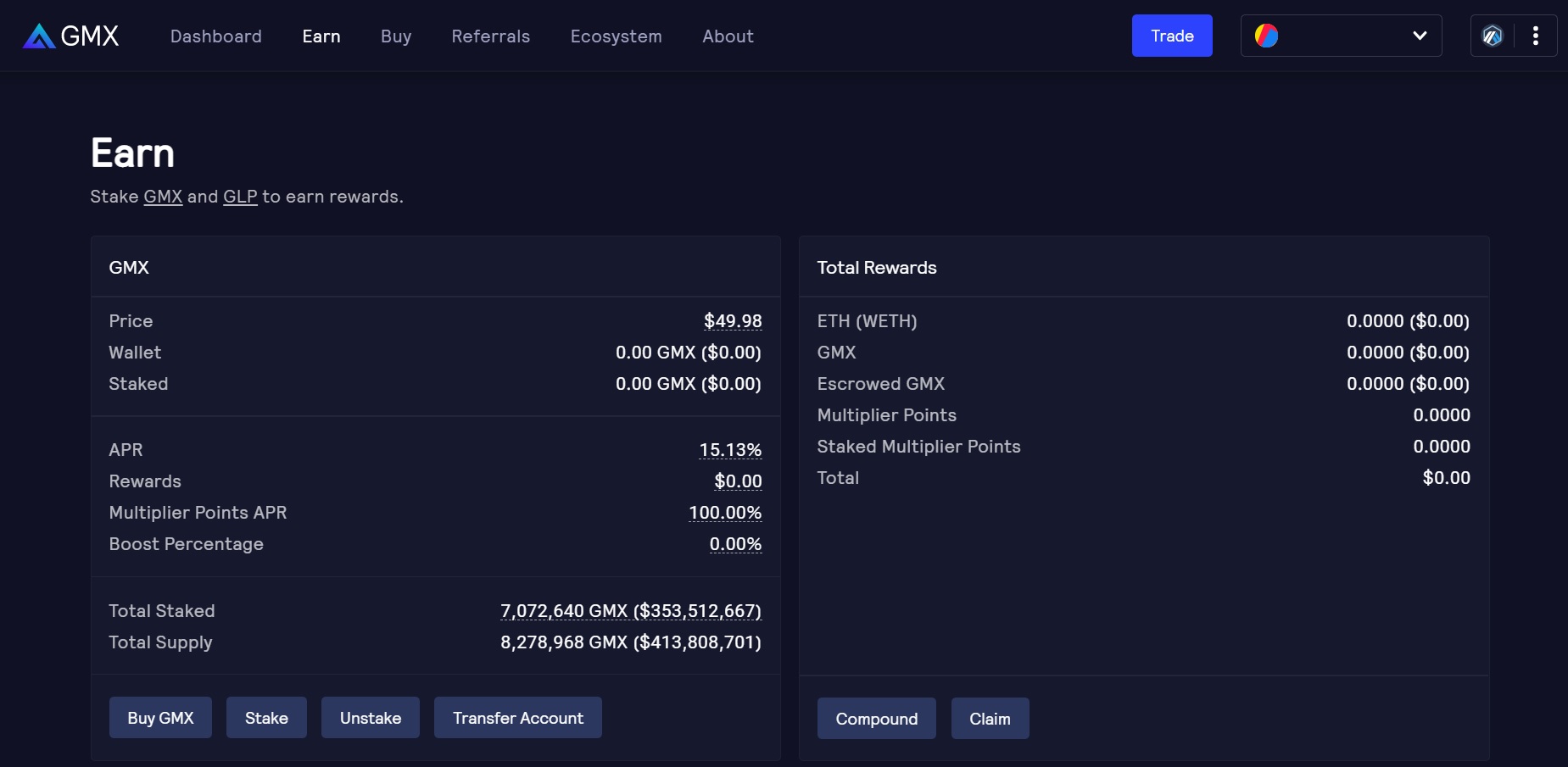

GMX staking

GMX is the exchange platform’s utility and governance token which can also be staked on the earn page on GMX to earn rewards.

To stake your GMX tokens, visit the ”earn” page on GMX.

By staking your GMX tokens, you can earn ETH or AVAX rewards depending on the network you use, escrowed GMX and multiplier points.

The rewards come from platform fees and GMX supply. To learn more about GMX rewards and how to utilize them, you can refer to this page.

GLP staking

GLP is GMX’s liquidity provider token. In addition to GMX, you can also stake GLP token on GMX to earn rewards.

70% of the platform’s generated fees and also escrowed GMX rewards go to GLP stakers.

GLP can be bought on the ”buy” page on GMX and staked on the earn page. For more information about GLP, you can refer to this page.

If you are interested in trading on decentralized exchanges, also check out 1inch and PancakeSwap tutorials below:

To trade on centralized exchanges with leverage, you can use Binance, BitMEX, Kraken and Bybit: