Whether you are a Binance user or not, you may ask the following question: Can I short crypto on Binance?

Yes, you can.

And shorting crypto on Binance is actually quite simple despite always being considered complex.

The difficult thing is not using the platform and shorting cryptocurrencies but making a profit while doing that.

Here are all the steps you need to follow to short crypto on Binance.

Open your Binance account

If you don’t have a Binance account yet, click the button below or use the referral ID ”WRYOO8BZ” to open your Binance account with a 20% fee discount:

If you already have a Binance account, you can proceed to the next step below to open your Futures account on Binance.

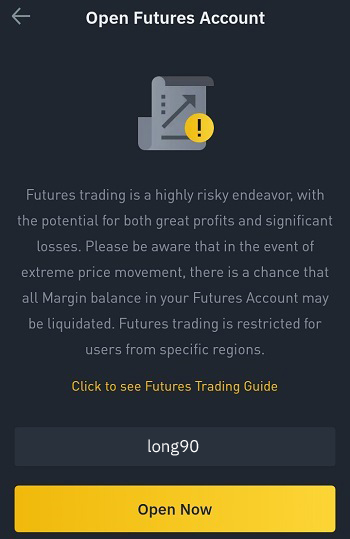

Open your Futures account on Binance

To short crypto on Binance, you first need to open your Futures account on Binance.

To open your Futures account, click the USDS-M Futures page under the derivatives menu on the website or click the Futures tab on mobile.

Use the code ”long90” when opening your Futures account and start trading on the platform.

Note that depending on your country of residence, you may not be able to open a Futures account and/or trade futures on Binance.

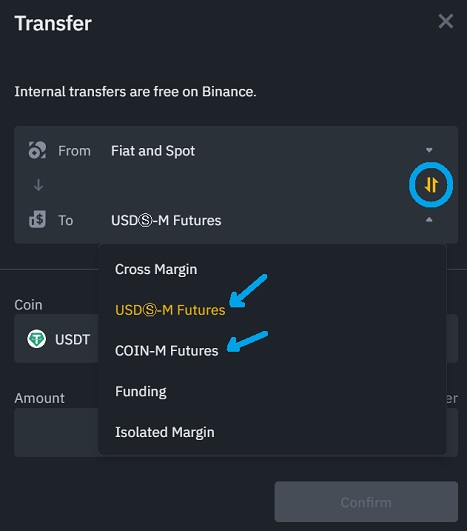

Transfer crypto to your Futures wallet

To short crypto on Binance, you need to transfer crypto to your USDS-M Futures or COIN-M Futures wallet.

If you’ve just opened your Binance account and don’t know how to deposit crypto into your account, you can refer to our tutorial on how to deposit crypto into Binance.

You can short cryptocurrencies with USDT or BUSD, or you can use the coin itself to short it, like using BTC to short BTC.

If you want to short BTC, ETH and many other altcoins with your USDT or BUSD, trade USDT/BUSD-margined perpetual contracts, you should transfer USDT or BUSD from your spot wallet to COIN-M Futures wallet.

Or, for example, if you want to short ETH and do it with your ETH, trade coin-margined perpetual contracts, you need to transfer crypto to your COIN-M Futures wallet.

Click the transfer icon on the Futures page on Binance and transfer USDT or BUSD to your USDS-M Futures wallet or transfer the coin that you want to short to your COIN-M Futures wallet.

You can also transfer BNB to your USDS-M Futures wallet and pay trading fees with your BNB.

This way you can get a 10% fee discount.

Open a short position on Binance

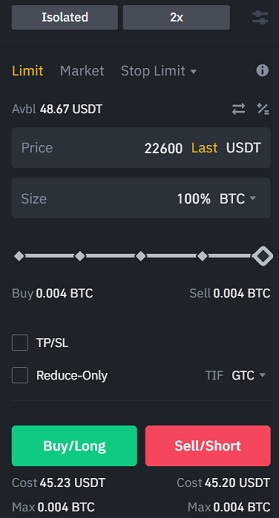

Let’s say you’ve transferred USDT to your USDS-M Futures wallet and want to open a short position on Bitcoin.

First select the BTCUSDT perpetual contract, BTC/USDT pair.

Select your margin mode and adjust your leverage.

![]()

If you only want to risk the money that you use when opening a short position, you can use the isolated margin mode.

This way, if your position gets liquidated, you only lose the money (your cost/margin) that you use when opening your position, and your futures wallet balance and other positions are not affected.

To open your short position, enter the price at which you want to open your short position, and drag the slider to determine your position size and check your cost while doing that.

In the example above, we need and use 45.20 USDT (located under the sell/short button) to open a 0.004 BTC short position.

0.004 BTC at the price of 22600 USDT is worth 90.4 USDT. But we only need 45.20 USDT to open this position as we use 2x leverage.

After clicking the sell/short button, your order will be placed on the order book.

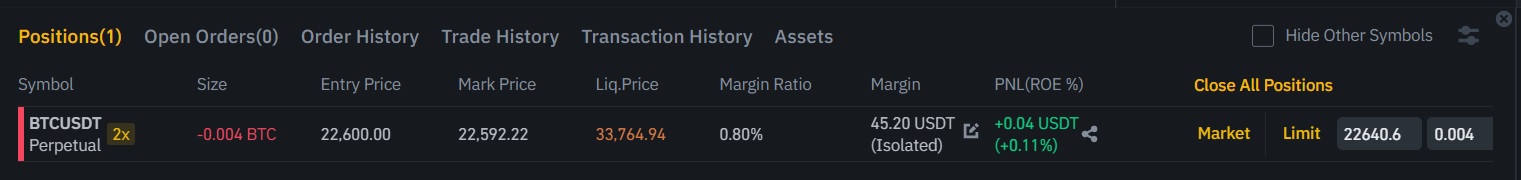

You can find your sell/short order under ”open orders” till it gets executed and under ”positions” once it gets executed.

You may also prefer trading COIN-M Futures and use coins themselves such as BTC, ETH and BNB to open short positions on them.

Let’s say you want to open a short position on Bitcoin with your BTC, you can first select the BTCUSD perpetual contract under ”COIN-M”.

After selecting the trading pair, select your margin mode and adjust your leverage.

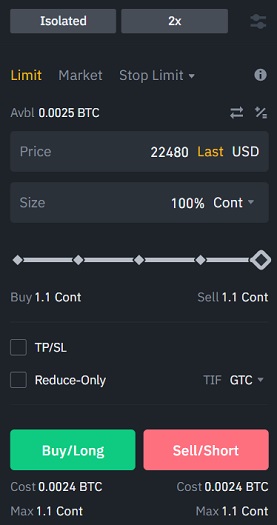

![]() Enter the price at which you want your sell/short order to get executed, and drag the slider to determine your position size in contracts and check your cost while doing that.

Enter the price at which you want your sell/short order to get executed, and drag the slider to determine your position size in contracts and check your cost while doing that.

After entering the price and choosing your position size, click the sell/short button to place your order on the order book.

As you can see in the image below, we used 0.0022 BTC to sell/short one BTCUSD contract which is worth 100 USD.

For a 100 USD worth of short position, we needed only 0.0022 BTC, which is worth 49.45 USD at the price of 22480 USD, around half of the value of our position.

Shorting crypto on Binance and opening short positions are this easy.

But there are more things that you need to learn to better trade futures.

Some of them which you can find in our in-depth Binance Futures tutorials are adding/removing margin, placing stop loss and take profit orders, calculating fees, funding and the liquidation price.

To learn basically everything you need to know in detail to open short and long positions on Binance, check out our tutorials below:

To calculate the profit and loss (PNL) and the liquidation price, you can use our Binance Futures calculator.

If you have any questions about shorting crypto on Binance, feel free to leave a comment below.