BitMEX is a cryptocurrency exchange where you can trade Bitcoin with up to 100x leverage.

In addition to Bitcoin, you can also trade other cryptocurrencies such as Ethereum, XRP, SOL, BNB and LINK with leverage on the platform.

BitMEX is one of the most popular cryptocurrency derivatives exchanges and currently among the top exchanges by trading volume.

Trading with leverage might seem complicated at first to those who only engage in spot trading. But it is actually very easy. The harder part is making profit.

In this tutorial, you will learn everything you need to know to trade on BitMEX: Opening long & short positions on BitMEX, BitMEX fees and funding, stop loss orders and profit/loss & liquidation calculator.

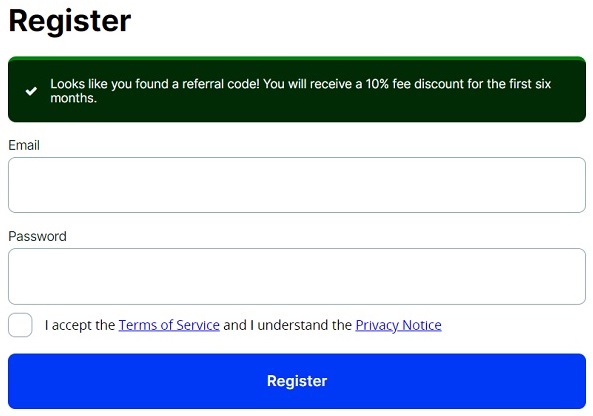

How to open a BitMEX account in 2026 & Registering on BitMEX (Get a 10% fee discount)

You can open your BitMEX account with a 10% fee discount by following the steps below. You will pay 10% lower trading fees for your long and short positions for the first six months.

First go to BitMEX’s registration page by clicking the link or the button below: Open a BitMEX account

Enter your email address and password, accept the terms of service by checking the box and click on the ”register” button.

After creating your BitMEX account, click the link that is sent to your email address by BitMEX to verify your email address.

BitMEX requires all users who want to trade, deposit or withdraw to complete the identity verification process.

After verifying your identity, you can deposit Bitcoin, USDT and other cryptocurrencies into the platform and start trading.

How to use BitMEX & Trading on BitMEX

BitMEX, which used to only accept Bitcoin deposits, now allows users to deposit various coins such as ETH and USDT in addition to Bitcoin.

To trade on the platform with leverage, you can first deposit Bitcoin or USDT into your BitMEX account.

If you want to trade on BitMEX’s spot exchange as well, you can deposit supported cryptocurrencies such as ETH, LINK, MATIC and SOL into your account.

You can find your crypto deposit addresses by clicking the wallet icon and then the deposit button on the exchange.

The minimum amount of Bitcoin you can deposit into your account is 0.0001 BTC.

BitMEX uses the abbreviation ”XBT” for Bitcoin instead of BTC, don’t get confused, both are same.

How to open leveraged long and short positions on BitMEX

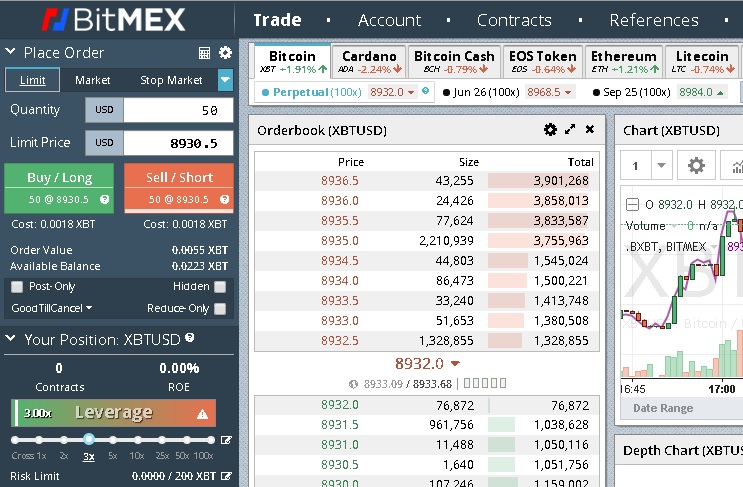

I will show you how to open a long position with 3x leverage on BitMEX.

You can set your leverage using the slider on the trading page. As I am using 3x leverage in the example below, my initial margin (cost) will be 0.0018 XBT.

My position size is 50 USD. As I use 3x leverage, I need only around 16 USD (8930.5×0.0018) worth of Bitcoin (XBT) to open this position.

If you think Bitcoin will rise, you need to go long, otherwise you can open short positions. Short positions allow traders to make money while coins decrease in value.

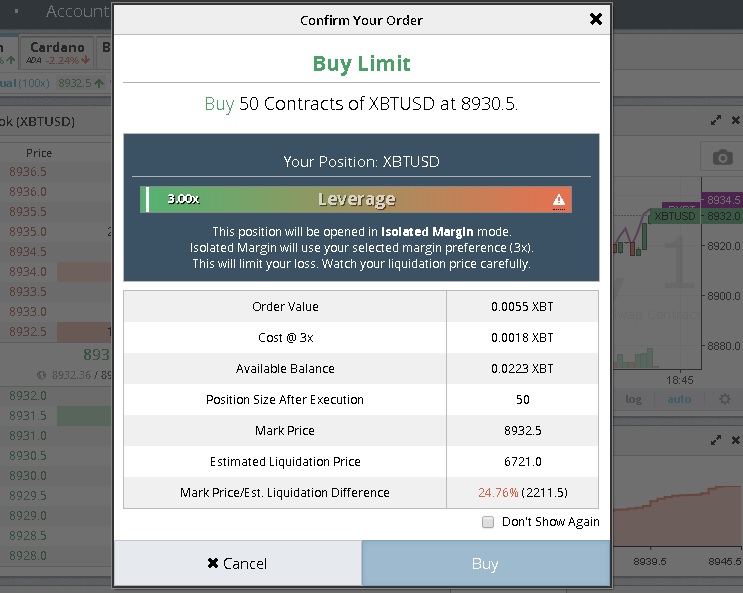

After clicking on the buy/long or short/sell button, make sure to check out the values such as liquidation price and leverage before confirming your order.

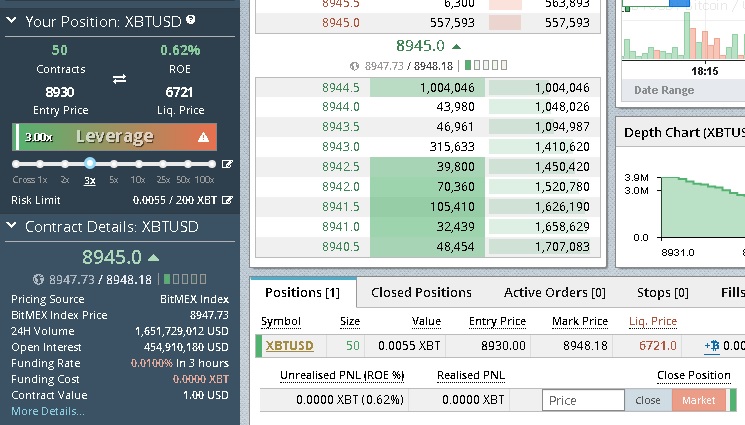

When your order is filled, you can see your open position under ”positions”.

Unrealized PNL shows your profit or loss based on price changes. Liq. price refers to the price at which your position will be liquidated.

As I’ve opened a long position, if things don’t go as I expect and BTC price will go down, my position will be liquidated when BTC hits 6721 USD.

You can close your position by clicking ”market” or entering a limit price and clicking ”close”.

BitMEX stop loss explained

Imagine you have a 100 USD worth of long position on Bitcoin like the one below:

The entry price is 20,283.50 USD and the liquidation price is 13,554 USD.

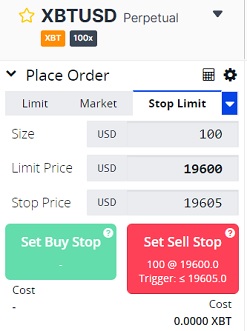

If you want to place a stop loss order for your long position, let’s say, at the price of 19,600 USD, you can place a stop limit order like this:

If you don’t want to close your entire position, you can adjust ”size” accordingly.

Stop price is the price at which your stop limit order will be activated and put into the order book. And the limit price should be the price at which you want to close your position.

When you place a stop limit order for your long or short position, it will be shown as below:

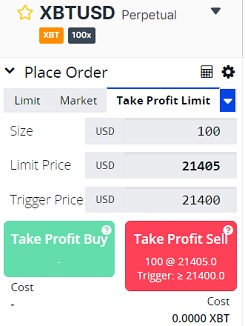

If you want to close part of your position at a certain price and take profit, you can place take-profit limit orders as shown below:

To close your entire position at a certain price or the market price, you can use the limit and market buttons.

BitMEX leverage calculator & BitMEX profit calculator

How to calculate BitMEX liquidation price

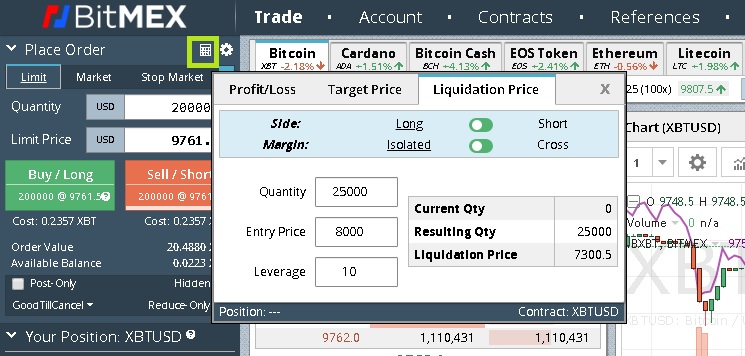

Before opening long or short positions on BitMEX, you can calculate the liquidation price of a specific order by using BitMEX’s liquidation price calculator.

In the example below, my long position with 10x leverage will be liquidated at 7300.5 USD. As the leverage is 10x, my initial margin (cost) should be around 2500 USD.

BitMEX profit & loss calculation

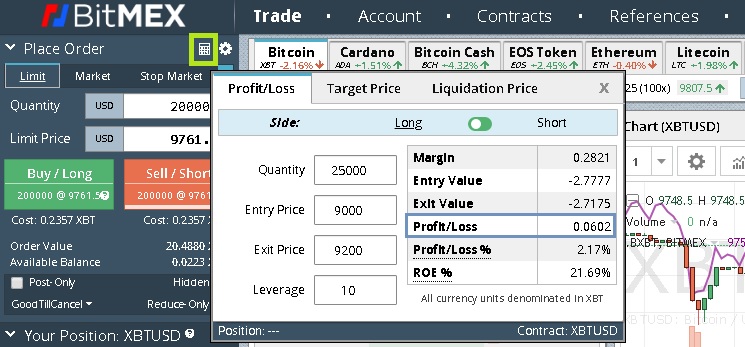

You can calculate your expected profit by entering your entry price, exit price and other values into the profit/loss section of the BitMEX calculator.

It will allow you to see how much profit you can make on certain price changes before actually opening a long or short position.

For the values that you can see below, if I close my long position when Bitcoin rises by $200 and hits $9200, I am making a profit of 0.0602 BTC.

My initial margin (cost) for this position is around 2500 USD (0.2821×9000) and the leverage is 10x.

BitMEX stop limit order explained

You can incorporate stop limit and take profit limit orders into your trading habit to limit losses and have a better control of your positions.

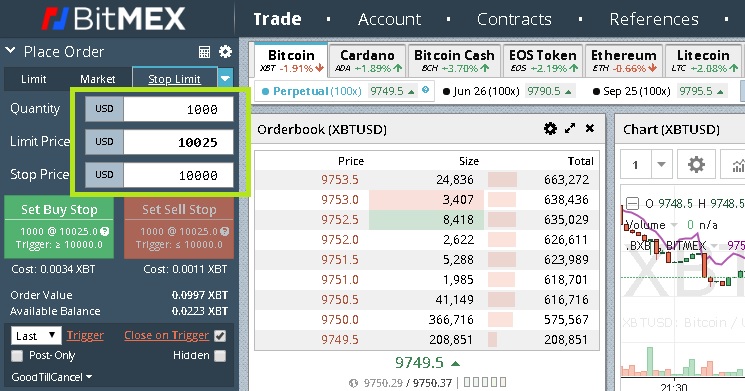

Let’s say you want to go long or short only when Bitcoin hits a certain price, then you can place a stop limit order instead of regular limit order.

In the example below, when Bitcoin hits 10,000 USD, the order will be activated and put on the market. And the order will be filled at 10,025 USD (limit price).

If you already have a long or short position, you can place a stop limit order to close your entire position or part of it to minimize losses.

You can find more information in the section ”BitMEX stop loss explained” above and learn how to place stop loss orders on BitMEX.

BitMEX take profit limit order explained

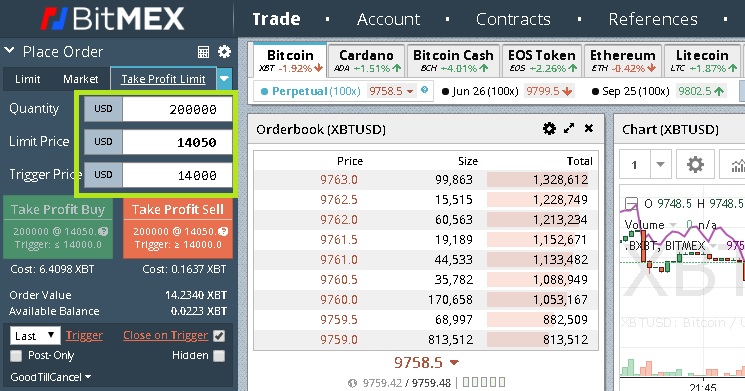

You can place take profit limit orders to take profit from your positions when a certain price is reached.

You need to set a trigger price at which the take profit order will be activated and a limit price at which you want the order to be executed.

My take profit limit order will be activated at 14000 USD in the example below:

To learn how to place a take profit limit order for an open long position, check the section ”BitMEX stop loss explained” above.

BitMEX trading fees

The trading fees for all pairs on BitMEX‘s derivatives exchange are 0.02%, and 0.075% for makers and takers respectively.

On the spot exchange, BitMEX’s trading fee is currently 0% for maker and taker orders.

Depending on your 30-day average daily volume (ADV) and staked BMEX amount, you can receive fee discounts and pay lower fees on the platform.

For further information about BitMEX fees, you can refer to this page.

To calculate trading fees and rebates for your positions, you can use our BitMEX fee calculator.

BitMEX funding rate

Funding is a payment that is exchanged between users who have open long or short positions and it takes place every 8 hours.

Just like Binance Futures, BitMEX does not get any fees from this payment which should not be confused with trading fees.

If the funding rate is positive, traders who have long positions pay those who have short positions.

If the funding rate is negative, the opposite happens and shorts pay longs. You can see funding transactions in your trade history.

BitMEX deposit & withdrawal fees

BitMEX does not charge any fees on Bitcoin deposits and deposits of other supported cryptocurrencies.

But, when withdrawing Bitcoin and other cryptocurrencies from your BitMEX account, you need to be charged a transaction fee, which is paid to miners.

You can currently withdraw Bitcoin from BitMEX with a network fee of 0.0002 BTC. If you want to make it faster, you can increase the fee.

For USDT withdrawals, the network fee is 25 USDT for the Ethereum network and 1 USDT for the Solana and Tron networks.

Bitcoin withdrawals are processed manually by BitMEX once a day for security purposes.

You can also trade Bitcoin and many other cryptocurrencies with leverage on Binance with up to 125x leverage.

If you’ve not opened your Futures account on Binance yet, you can use the code ”long90” when opening your Futures account and start trading on the platform.

If you don’t have a Binance account, you can click the button below or use the referral ID ”WRYOO8BZ” to open your Binance account with a 20% fee discount:

To learn how to open long and short positions on Binance, check out our Binance Futures tutorial: