OCO (one cancels the other) is a very useful order type on Binance which allows users to place a stop limit order and a limit order at the same time.

But why would you need to place a stop limit order and a limit order at the same time?

OCO buy order explained

Let’s say Bitcoin is currently traded at around $39,000, and you want to buy Bitcoin at $34,000.

But Bitcoin may also go up and breaks a certain resistance level, let’s say $45,000.

And in that case, you may want to buy Bitcoin before it even goes higher.

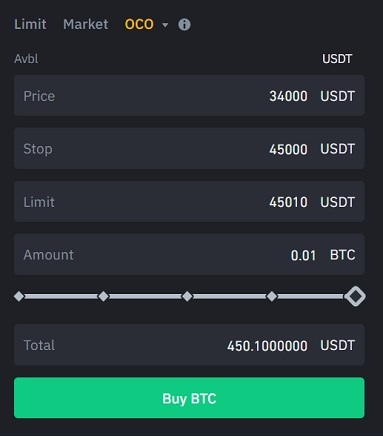

So you can place an OCO order like the one below:

When the stop limit order is triggered or the limit order ($34,000) is executed, the other order will be cancelled.

If Bitcoin price goes down and hits $34,000, your buy limit order will be executed and you will have bought BTC at $34,000.

If Bitcoin price goes up instead and hits $45,000 (the stop price), your buy stop limit order will be activated and executed at the limit price ($45,010).

So you will have bought BTC at $45,010 after the buy stop limit order is activated at $45,000 before the price goes even higher.

When placing an OCO buy order, your limit price (45010) must be higher than or equal to the stop price (45000) for the stop limit order.

When Bitcoin price goes up, the stop limit order will be first activated at the stop price.

So the limit price (for the stop limit order) at which the stop limit order will be executed must be equal or higher than the stop price.

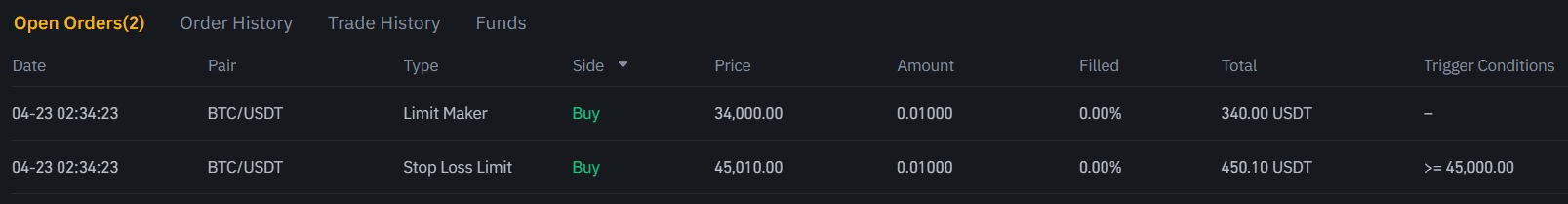

When you click the buy button and place your OCO order on Binance, it will look like this:

OCO sell order explained

Let’s say Ethereum is currently traded at around $2,900 and you have some ETH that you want to sell.

You want to sell your ETH at $3,200. For which, you simply need to place a sell limit order.

But Ethereum price may go down and break below a certain support level at which you may want to do something.

If the support level is at $2,500. You may want to buy ETH if the price hits and breaks below $2,500 before the price goes even lower.

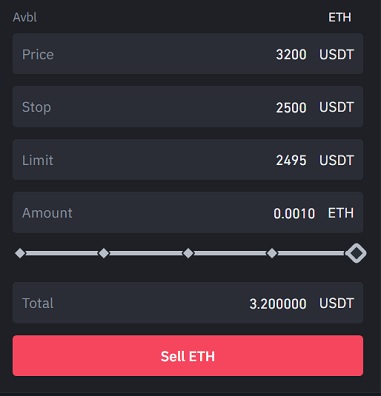

In that case, you can take advantage of the OCO order type and place a sell limit order and a sell stop limit order at the same time:

As your stop limit order will be activated when Ethereum price goes down and hits $2,500 (the stop price), the limit price ($2,495) must be lower than or equal to the stop price.

If you don’t have a Binance Futures account yet, you can use the code ”long90” when opening your Futures account on Binance and start trading on the platform.

To learn how to trade on Binance and open long and short positions, check out our tutorials below: