Binance Futures is Binance‘s derivatives trading platform where you can trade Bitcoin and other cryptocurrencies with leverage.

Binance Futures consists of USDⓈ-margined and COIN-margined Futures and has many altcoin pairs in addition to Bitcoin.

In this tutorial, you can find everything you need to know to start trading on Binance Futures. I will show you how to open long and short positions on Binance and how to use stop loss.

Also, I will give you detailed information about Binance Futures fees, fee calculation, funding rate and Binance Futures calculator.

You can open your Futures account with a 10%+10% fee discount and start trading on Binance Futures by following the steps below.

If you don’t have a Binance account yet, click this link or the button below to open your Binance account with a 20% fee discount:

You can also enter the code ”WRYOO8BZ” in the referral ID field when opening your Binance account and receive fee rebates while trading.

What is Binance Futures? Binance USDⓈ-M Futures

Binance allows users to trade Bitcoin with up to 125x leverage on Binance Futures.

Update: The maximum leverage on Binance was updated to 20x for new users which gradually increases after 60 days from account opening.

You can trade USDT-margined, BUSD-margined and coin-margined contracts on Binance to make a profit or hedge against losses.

USDS-M Futures includes Bitcoin and many other cryptocurrencies such as ETH, XRP, LINK and EOS which are traded against USDT and BUSD.

The maximum leverage you can use for the BTC/USDT pair is 125x and for the ETH/USDT pair, it is 100x.

It means that with a small amount of cryptocurrency, you can open very large positions which would otherwise be impossible.

Binance Futures might seem complicated at first glance. But trading on Binance Futures is actually very simple once you know the terms related to futures trading and get familiar with the trading interface.

With this step-by-step guide to Binance Futures, you can learn how to open long and short leveraged positions and start trading on Binance Futures.

How to use Binance Futures? Binance Futures trading guide

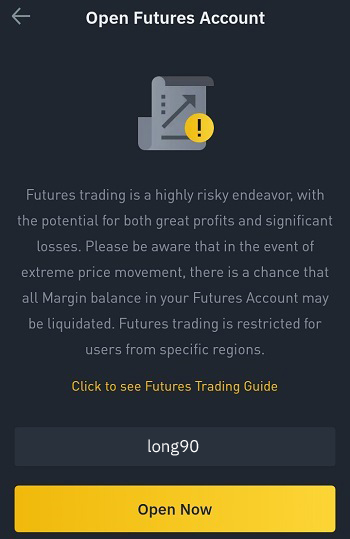

Step 1: Open your Futures account

First log in to your Binance account on the website or the mobile app and click Derivatives > USDⓈ-M Futures or the Futures tab on mobile.

Enter the code ”long90” when opening your Futures account and click the open now button.

You can also transfer some BNB to your USDⓈ-M Futures wallet to pay fees in BNB. By doing this, you’ll get a 10% fee discount.

If you don’t have a Binance account yet, you can first go to the tutorials below to open a Binance account with a 20%+25% fee discount:

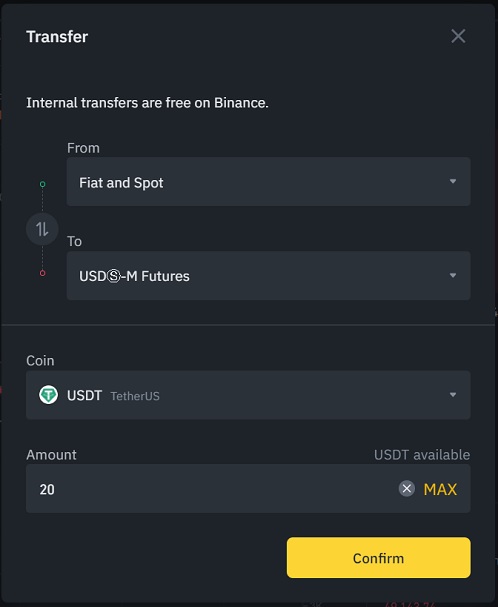

Step 2: Transfer USDT from your spot wallet to USDⓈ-M Futures wallet

Click on the ”transfer” icon or the ”transfer” button on Binance Futures and enter the amount of USDT you want to transfer to your USDⓈ-M Futures wallet and confirm the transfer.

You can also transfer cryptocurrencies between your wallets by clicking the ”transfer” button on the wallet page.

I’ve transferred 20 USDT to my wallet to simply show you how to open long and short positions on Bitcoin with up to 125x leverage.

You can also transfer some BNB to your USDⓈ-M Futures wallet to pay fees in BNB.

In this way, you can get a 10% fee discount while trading USDs-margined futures markets.

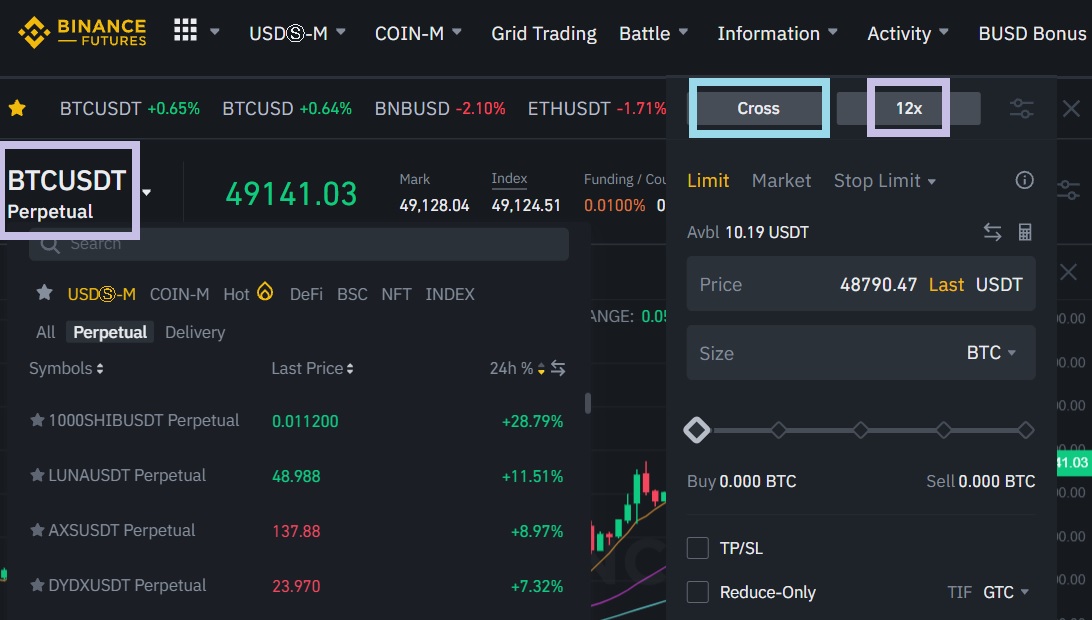

Step 3: How to open long and short leveraged positions on Binance

First you need to choose the pair you want to go long or short on and adjust your leverage. The highest leverage possible for the BTC/USDT pair is 125x.

Of course you should never use that high leverage. If you are a beginner, using no higher than 5x leverage might be a good idea.

There are many pairs you can trade on the USDⓈ-M Futures section. Binance has listed a lot of altcoins on Binance Futures, so there are many trading opportunities.

You should not use too high leverage like 100x or 125x because your position can get liquidated in no time without a stop loss order in place.

For example, with 100x leverage, only a 1% change in the price of the coin you trade is enough to get your position liquidated.

The logic behind this is simple. Let’s say you have 1 BTC and have opened a 100 BTC long position using 100x leverage.

If Bitcoin price falls by 1%, you’ll lose 1 BTC and your position size will be 99 BTC, but as your margin was just 1 BTC, your position will have been liquidated.

Binance Futures isolated vs cross – Binance Futures margin mode

You can switch between cross and isolated margin modes by clicking ”cross” on the trading page.

In cross margin mode, when your position is at the risk of liquidation, your other open positions and margin balance can be used to avoid the liquidation of that position.

With cross margin mode, you risk losing all your margin balance. You can get started with isolated margin mode which will be less risky.

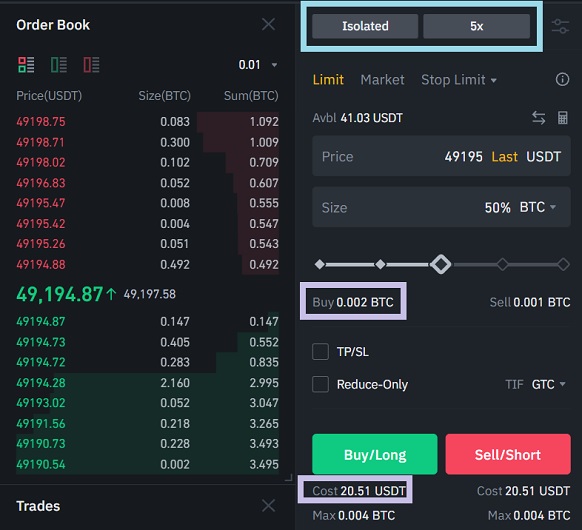

If you think BTC will go up, you need to open a buy/long position. If you are rather bearish and think BTC will go down, then you can make a profit by opening a short/sell position. As BTC price goes down, your profit will increase.

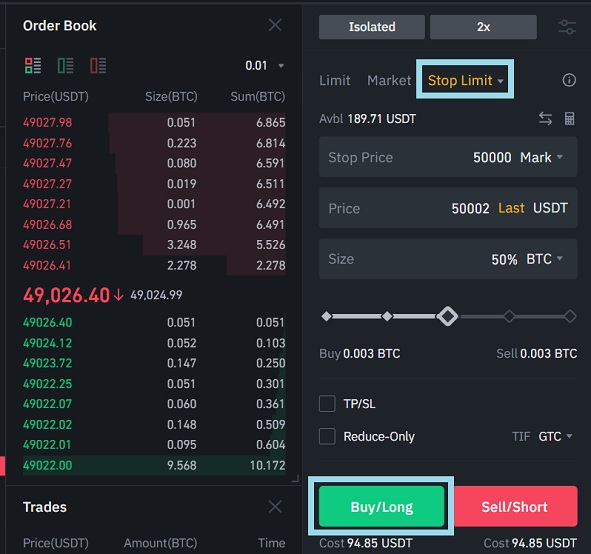

I will open a long position using 5x leverage in the isolated mode as you can see in the image below. I expect the price to rise above 49195 USDT.

My margin (cost) is 20.51 USDT and total order size is 0.002 BTC (98.39 USDT). After I click on the buy/long button, my order will be placed on the order book.

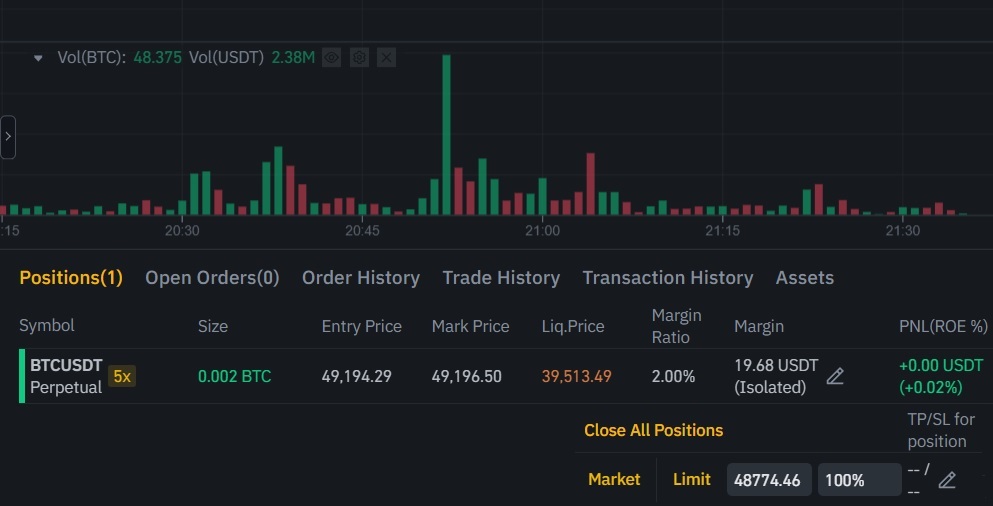

When the order is filled, you can see it under ”positions”, otherwise it will be under ”open orders” till execution.

The margin ratio indicates the risk of liquidation of your position. When it reaches 100%, your position gets liquidated.

PNL shows your profit based on the mark price. You can close your position by entering a price and clicking on ”limit” or immediately with a market order.

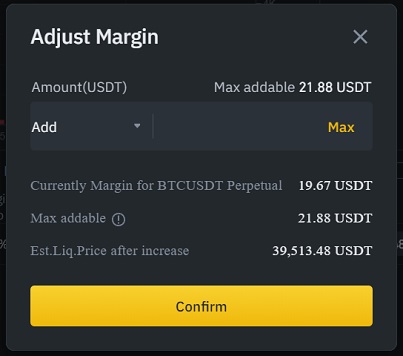

You can also add margin to and remove margin from your position by clicking on the plus/pencil icon located beside your margin, which will change your liquidation price:

Binance Futures TP/SL explained – Take profit and stop loss orders

With the new feature added to the platform, you can now set a take profit price and a stop loss price when placing a limit or market order.

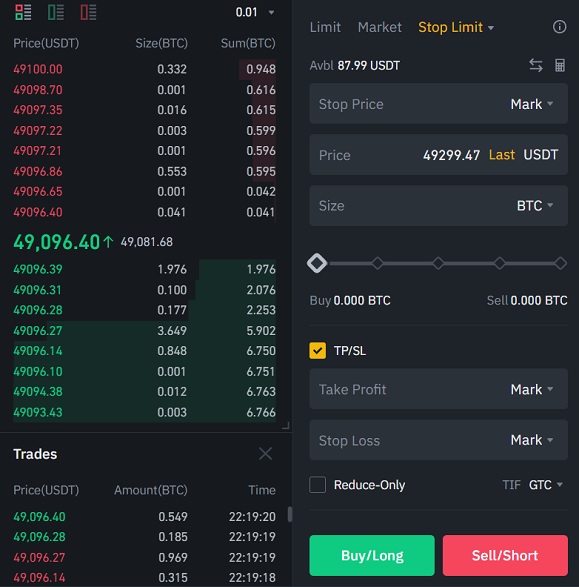

But, if you want to set a trigger price and also enter a certain amount, you should place ”stop limit” orders instead of using TP/SL.

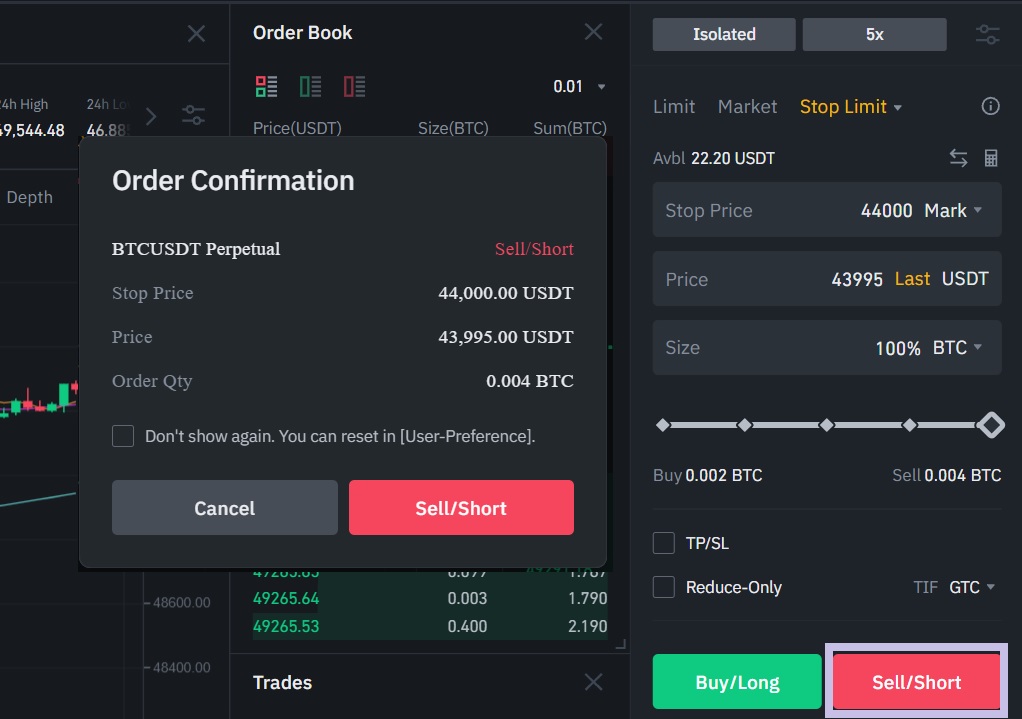

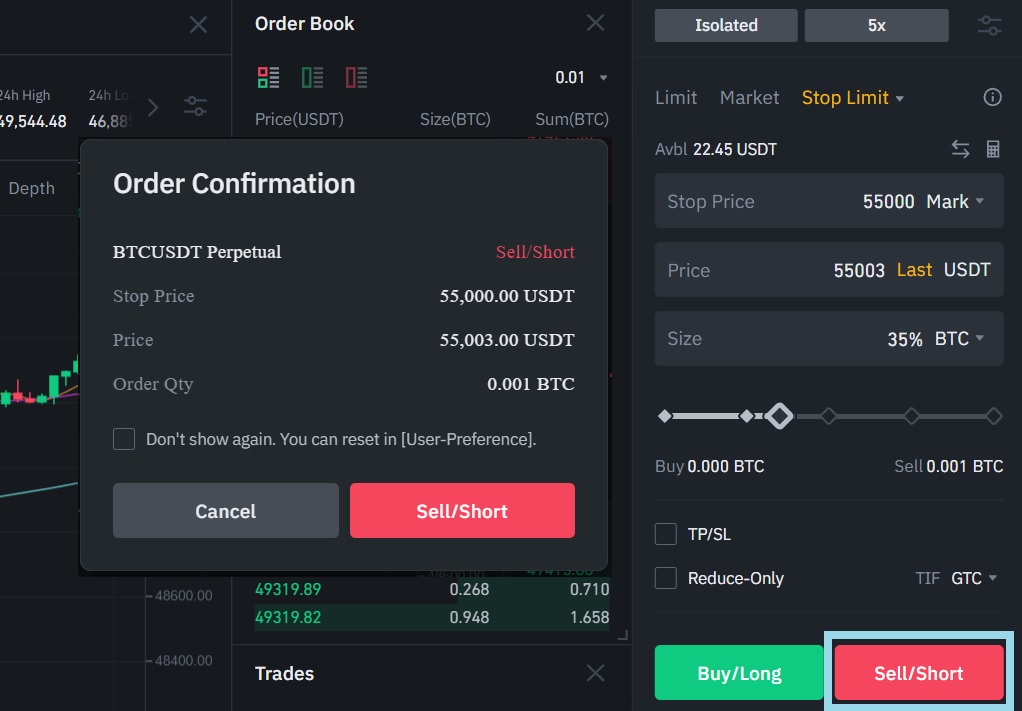

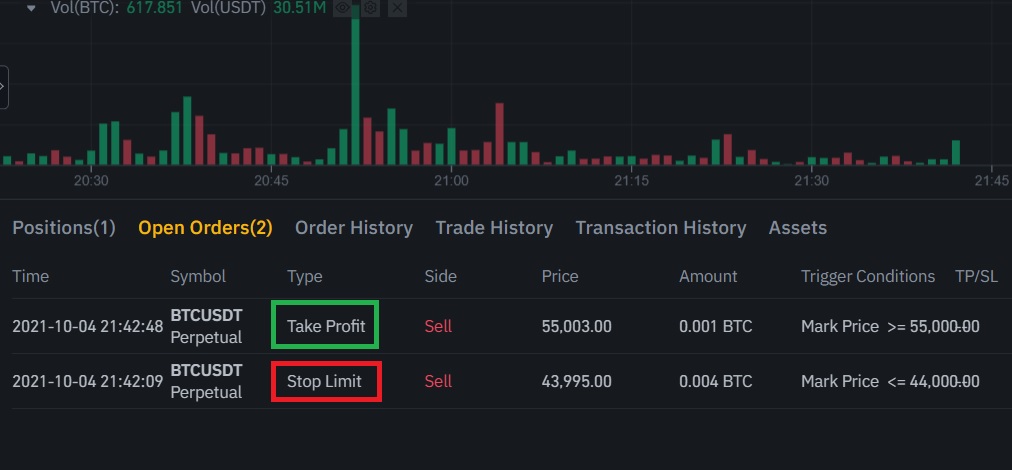

For a long position with an entry price of 49194 USDT and a liquidation price of 39513 USDT, you can place stop loss and take profit orders like the ones below using the stop limit order.

If you enter a stop price (44000) below the entry price (49194) and a limit price (price) (43995) below or equal to the stop price, it will be a stop loss order.

As it is a long position, you need to click the sell/short button when placing your stop loss and take profit orders.

The stop loss order will be placed on the order book once the price hits 44000, the stop price, and executed at the limit price, 43995.

We can also place take profit orders for our long position whose entry price is 49194.

To place a take profit order for a long position, first select ”stop limit” and enter a stop price above the entry price and a price above or equal to the stop price.

If you want to take a profit by closing only part of your position, you can enter a size other than 100%.

After placing your stop loss and take profit orders, you can see them under the ”open orders” tab.

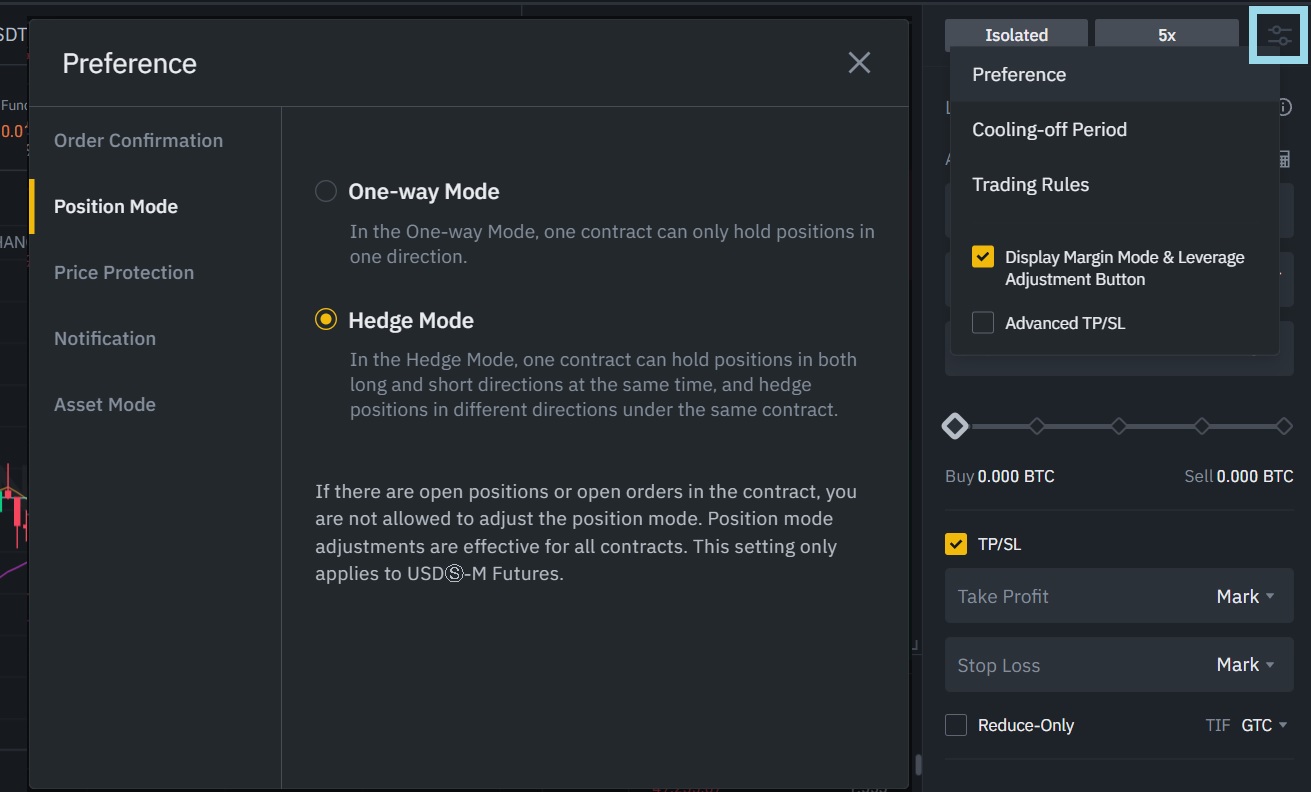

Binance Futures hedge mode

Another new feature you can take advantage of on Binance Futures is the hedge mode.

You can click on the preferences icon beside your leverage and then change your position mode from one-way mode to hedge mode.

In the hedge mode, you can open long and short positions at the same time. To change your position mode, you first need to close your positions or cancel your open orders.

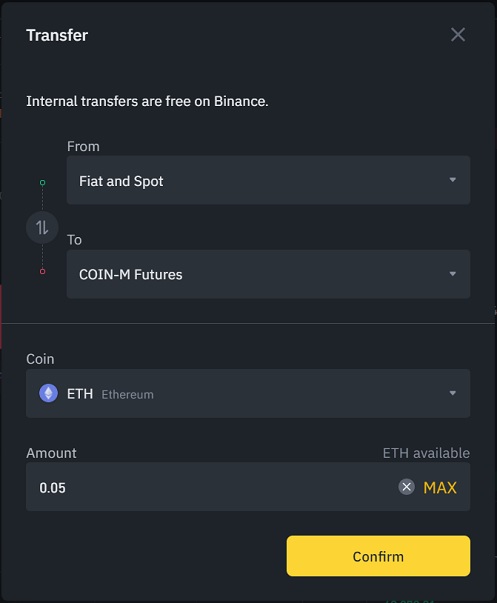

Binance COIN-M Futures explained

Besides USDT-margined and BUSD-margined perpetual and delivery contracts, you can also trade coin-margined perpetual and delivery contracts on Binance Futures.

The difference between them is that you don’t need USDT or BUSD to trade COIN-M Futures pairs. You can just transfer your coin, BTC, ETH, etc., to your COIN-M Futures wallet and open positions.

When you open a position with BTC, ETH or any other coin, you will earn or lose that specific coin as the price fluctuates.

Also, Binance’s COIN-margined Futures has lower trading fees for maker orders than the USDT & BUSD-margined Futures.

For example, if you want to trade the ETH/USD pair, you first need to transfer ETH from your spot wallet to COIN-M Futures wallet. After that, you can simply open long or short positions on the ETH/USD pair.

In a bull market, it might be a better idea to trade coin margined pairs as you can open positions without needing to sell your cryptocurrency for USDT or BUSD.

But, in a bear market, you can rather short USDT / BUSD margined pairs as you would not want to deal with cryptocurrencies that decrease in value.

Binance Futures stop loss explained

For example, if you only want to go long on Bitcoin when it breaks a certain price, let’s say $50,000, then you can place a stop limit order instead of a regular limit order.

In that case, you need to set the stop price at $50,000 and the price you want to buy Bitcoin at an amount equal to or above $50,000.

If you have a long position, you can place a stop loss order to minimize your loss in the event of a price fall.

For this, you need to enter a stop price below your entry price at which the order will be placed on the order book and a price equal to or below the stop price at which the order will be executed.

You can also use the stop limit order to place a take profit order. For example, if you have a short position with an entry price of 8,000 USDT.

A buy stop limit order with a stop price below the entry price and a price below or equal to the stop price would be considered as a take profit order.

Binance Futures fees explained

Binance USDⓈ-M Futures trading fees

| 30d Trade Volume (USD) or/& BNB Balance | Maker | Taker |

| < 15,000,000 USD or ≥ 0 BNB | 0.0200% | 0.0500% |

| ≥ 15,000,000 USD and ≥ 25 BNB | 0.0160% | 0.0400% |

| ≥ 50,000,000 USD and ≥ 100 BNB | 0.0140% | 0.0350% |

| ≥ 100,000,000 USD and ≥ 250 BNB | 0.0120% | 0.0320% |

If your trading volume on the futures exchange over the last 30 days is below 15M USD, you will pay 0.02% and 0.05% trading fees for your maker and taker orders respectively.

When your trading volume over the past 30 days reaches 15M USD and beyond and your BNB balance is equal to or above 25 BNB, your Binance Futures fee rates will be updated and you will trade futures with lower fee rates.

Also, if you hold Binance Coin (BNB) in your USDⓈ-M Futures wallet to pay fees in BNB, the trading fee rate will drop by 10%.

To upgrade your VIP level to VIP 1 and pay even lower futures & spot trading fees, you can also trade 1M BUSD or more on the spot exchange.

Binance COIN-M Futures trading fees

As you can see in the table below, the COIN-margined Futures has a different fee structure and lower fees than the USDⓈ-M Futures.

BNB fee discount does not apply to the coin-margined Futures. Trading fees are paid in the coin you trade.

| 30d Trade Volume (BUSD) or/& BNB Balance | Maker | Taker |

| < 15,000,000 USD or ≥ 0 BNB | 0.0200% | 0.0500% |

| ≥ 15,000,000 USD and ≥ 25 BNB | 0.0160% | 0.0400% |

| ≥ 50,000,000 USD and ≥ 100 BNB | 0.0140% | 0.0350% |

| ≥ 100,000,000 USD and ≥ 250 BNB | 0.0120% | 0.0320% |

Binance Futures funding calculation

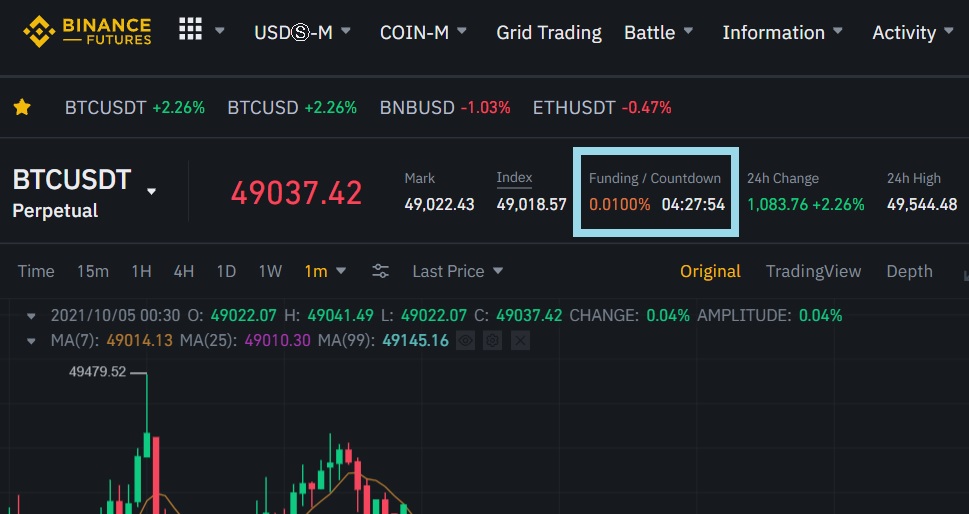

In addition to trading fees, users who have long or short positions also pay or receive funding payments every 8 hours.

Funding is directly exchanged between users, so it does not involve any fees paid to Binance. Funding rates are calculated every 8 hours and can be positive or negative depending on the market.

If the funding rate is positive, users who have long positions pay funding and those who have short positions receive funding.

And if the funding rate is negative, shorts pay longs. You can see your funding transactions under the ”transaction history” tab.

In the example above, if you have a 1000 USDT worth of long position, you’ll pay 0.1 USDT funding (1000/100×0.01), if your same sized position is short, you’ll receive 0.1 USDT funding.

To calculate funding, you should first calculate your position size in USDT. If your position size is 0.5 BTC, multiply it by the market price like 0.5×30,000 (if BTC is traded at 30,000 USDT).

After that, divide your position size (30,000 USDT) by 100 and then multiply it by the funding rate such as 0.01.

To calculate your futures fees and funding, you can also use our Binance fee calculator.

If you trade coin-margined pairs like BTC/USD, to calculate funding, you should first multiply the quantity of the contract you hold by the contract value.

If you have 50 BTC/USD contract, you need to multiply 50 by 100 as the each BTC/USD contract represents $100.

After that, divide $5,000 by the market price like 5,000/30,000 = 0.1666 BTC (if BTC is traded at 30,000 USDT).

Now you can divide 0.1666 by 100 and then multiply it by the funding rate to calculate the funding you’ll pay or receive.

You should especially take Binance funding rates into consideration if you will open a large position and the market is steady.

Binance Futures fee calculation

Let’s say you want to open a long position with 50x leverage and your margin is 1,000 USDT. In this trade, your position size will be around 50,000 USDT.

When you place your buy/long order in the market, you can calculate the trading fee you will pay when the order is executed by dividing 50,000 by 100 and then multiplying it by 0.02 or 0.05.

If it is a maker order rather than a taker order, you’ll be charged a trading fee of 10 USDT when the order is executed (50,000/100×0.02 = 10 USDT).

In this calculation, we assume that your monthly trading volume is below 15M USD (VIP 0) and you don’t have a fee discount.

If you rather trade coin-margined futures, to calculate the trading fee you’ll pay when opening or closing a position, you should first multiply the quantity of the contract you hold by the contract value.

If you hold 300 ETH/USD contract, you need to multiply 300 by 10 as the each ETH/USD contract represents $10.

After that, divide $3,000 by the Ethereum price like 3,000/1,200 = 2.5 ETH (assuming Ethereum is traded at 1,200 USD).

Now you can divide 2.5 by 100 and then multiply it by the COIN-margined Futures fee rate (0.02% / 0.05%) to calculate the trading fee you’ll pay.

You can also use our Binance fee calculator to calculate the trading fees you’ll pay in USDT and coin margined markets as well as funding.

Binance Futures calculator

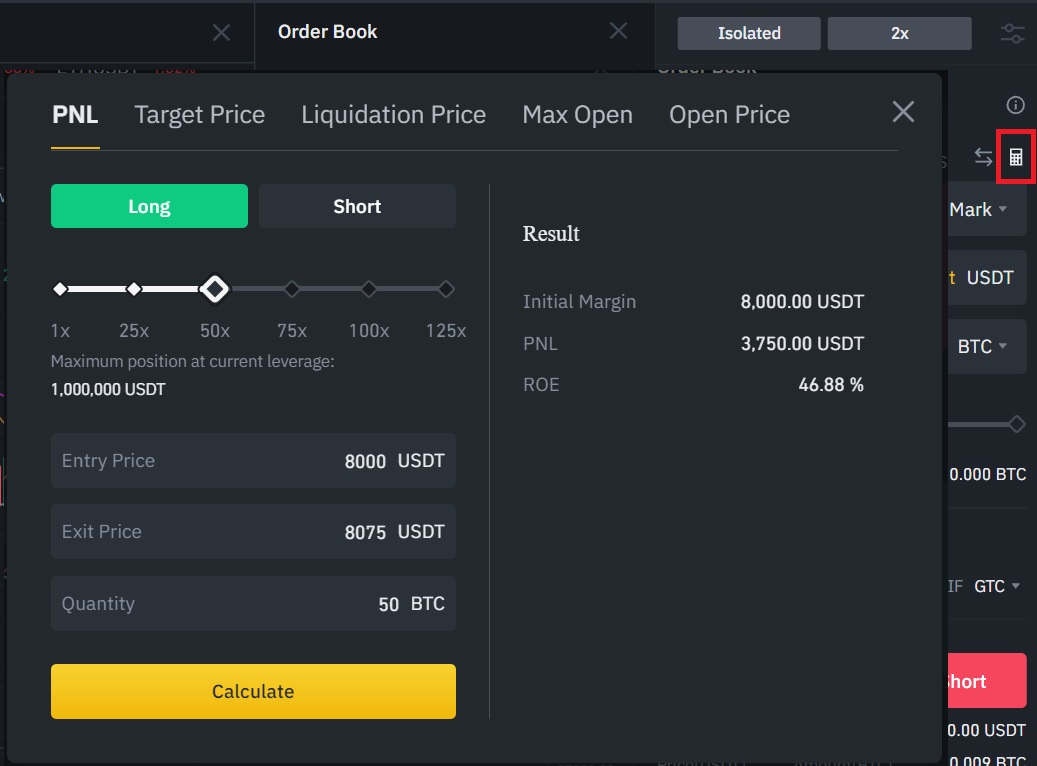

Before opening long or short positions on Binance Futures, you can calculate the profit you will make when you close your position at a certain price using the calculator, which you can find in the right upper part of the trading page.

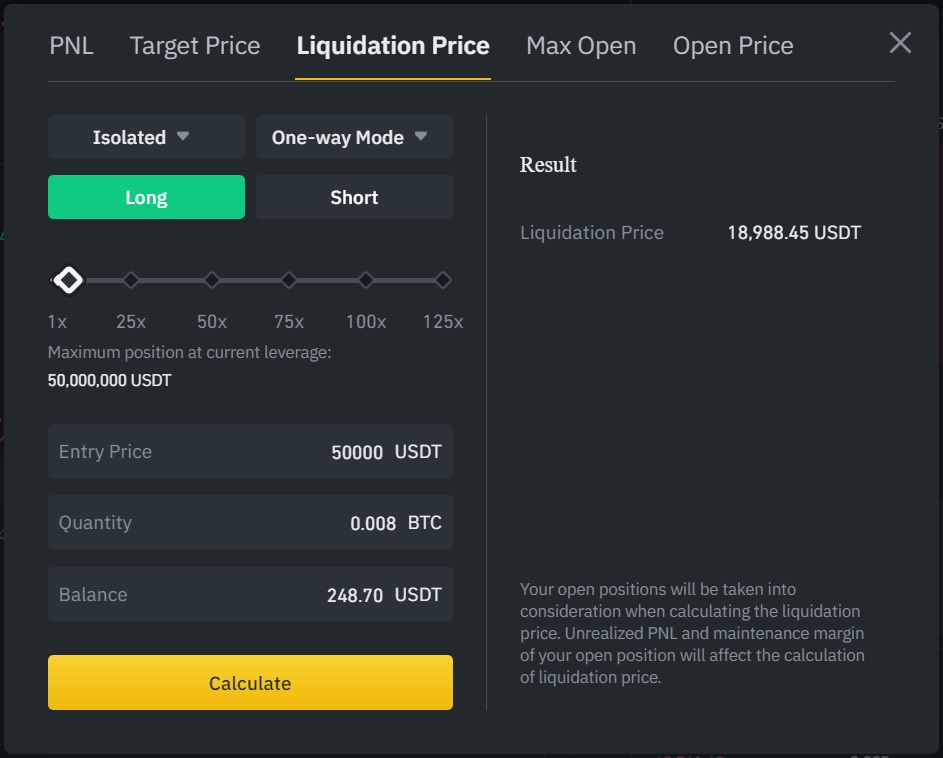

You can also calculate the liquidation price using the Binance Futures calculator.

Binance Futures profit calculator

In the example below, our initial margin and entry price is 8000 USDT and leverage is 50x, so order size (quantity) is 50 BTC.

As the position is long, we will make a profit when the BTC price goes up. If we close the position at 8,750 USDT, our profit (PNL) will be 3,750 USDT.

Binance Futures liquidation calculator

You can also calculate the liquidation price using the calculator on Binance Futures. You need to enter your entry price and quantity, and set leverage and other variables.

As stated by Binance, your open positions will also be considered when calculating the liquidation price.

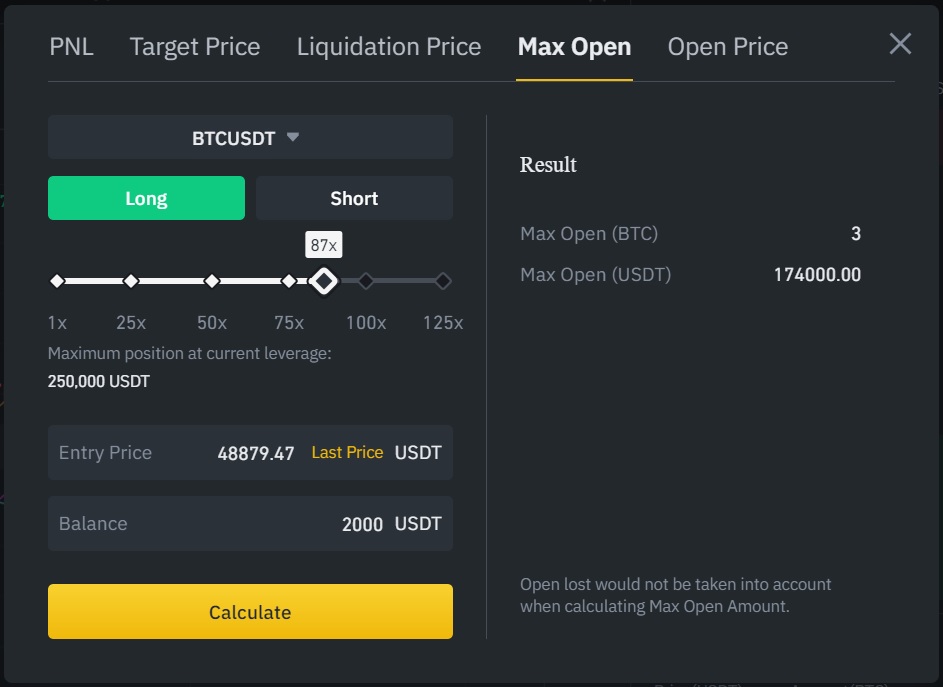

Binance Futures max open

Depending on the leverage used, there is a maximum position one can open on Binance Futures. For example, if you will use 5x leverage, you can open a 50,000,000 USDT position at max.

As the leverage rises, the maximum position size possible decreases. For example, the maximum position one can open at 75x leverage is 250,000 USDT, and at 125x leverage, it is 50,000 USDT.

You can share your thoughts and questions about Binance Futures by leaving a comment below. To learn how to use Binance and deposit fiat currencies, check out our Binance tutorial:

You can also check out our step-by-step tutorials below to learn how to open long and short positions on Binance: