Binance’s fee structure might look a bit complex to beginners at first.

But it is actually very easy to understand how Binance fees work and learn how to calculate Binance fees.

Binance has a simple trading fee structure with fees starting from 0.10% for spot markets.

There are also various other markets, products and types of trading activities you can engage in on Binance such as futures markets, leveraged tokens and margin trading.

Each comes with a different fee structure. So, if you do more than just trade spot markets on Binance, you should know about these fees too.

In this guide, I will give you an overview of Binance fees and show you how to calculate and reduce Binance fees.

Binance spot fees

The table below shows the trading fee that you will be charged when you make a spot trade on Binance depending on your trading volume in the last 30 days:

| 30d Volume &/or BNB Balance | Maker | Taker |

| < 1,000,000 USD or ≥ 0 BNB | 0.10% | 0.10% |

| ≥ 1,000,000 USD & ≥ 25 BNB | 0.09% | 0.10% |

| ≥ 5,000,000 USD & ≥ 100 BNB | 0.08% | 0.10% |

| ≥ 20,000,000 USD & ≥ 250 BNB | 0.042% | 0.06% |

Well, what do these rates exactly mean? How can you calculate the fee you will pay when you make a trade on Binance?

Even though understanding and calculating Binance fees are not a big deal for most traders, it might be still a bit confusing especially for beginners.

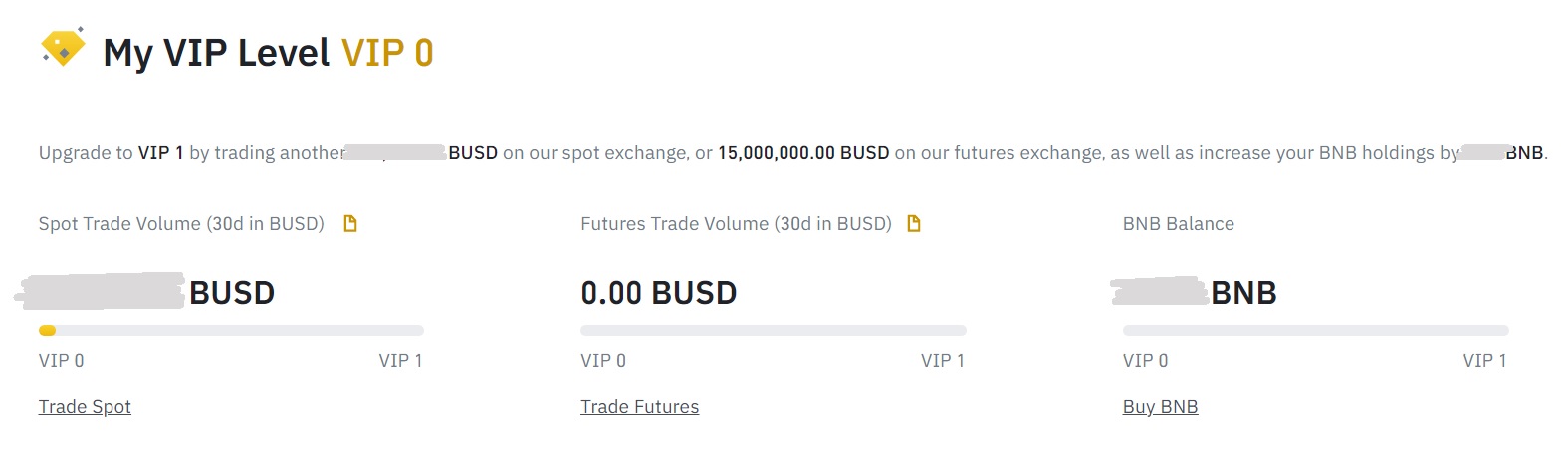

To calculate the fee you will pay, you should first know your trading volume in the last 30 days, which you can check out on this page if you have a Binance account.

If you don’t have a Binance account, you can click this link or use the referral ID ”WRYOO8BZ” to open your Binance account with a 20% fee discount.

In addition to a 20% fee discount on spot fees, you will also get a 10% fee discount on futures fees.

For example, my trading volume on the spot exchange in the last 30 days is below 1M USD as you can see in the image below, so I will be charged a 0.10% trading fee for both maker and taker orders as a VIP 0 / regular user.

To upgrade to VIP 1 level, you need to trade 1M USD worth of crypto on the spot exchange or 15M USD on the futures exchange.

To upgrade to VIP 1 level, you need to trade 1M USD worth of crypto on the spot exchange or 15M USD on the futures exchange.

Notice that you also need BNB (at least 25 BNB) in your wallet besides adequate trading volume to level up and enjoy lower trading fees.

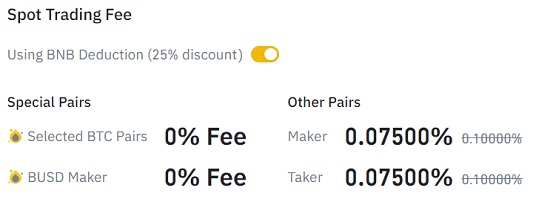

If you’ve enabled the option to use BNB to pay for fees in your Binance account, you can receive a 25% fee discount.

This way you will be charged a 0.075% fee in BNB instead of 0.10% when you make a spot trade on Binance.

You should always have an enough amount of BNB in your spot wallet to cover your trading fees so that you can continue paying fees with BNB.

If you’ve opened your Binance account with a 20% fee discount, you will also receive a 20% fee kickback every time you make a spot trade on Binance.

Besides, you could be also charged a zero fee when you trade certain pairs and/or place orders that can be considered as maker orders on Binance.

To learn about such zero-fee activities and campaigns offered by Binance, you can check out the announcement page on Binance and follow the exchange on social media.

How to calculate Binance spot fees

Now let’s move on to Binance fee calculation. It’s quite simple.

Let’s say you have 200 USDT in your wallet and you will buy BTC, BNB or any other coin.

When you make a trade with 200 USDT, 0.2 USDT will be charged as a trading fee. The calculation is simple: 200/100×0.10.

You should first divide your order size (total) by 100 and then multiply it by your fee rate which is 0.10% for VIP 0 / regular users.

So, if you buy Bitcoin with 200 USDT, you will basically get $199.8 worth of Bitcoin. To calculate these fees, you can also use our Binance fee calculator:

Luckily, you can pay much lower fees than 0.10% and you don’t need a trading volume of more than 1M USD to do that.

You can reduce Binance fees from 0.10% to 0.06% by opening a Binance account with a 20% fee discount using the referral ID ”WRYOO8BZ” and paying fees with BNB.

How to reduce Binance spot fees

To reduce Binance spot fees, you can open a Binance account with a 20% fee discount by clicking this link or the button below.

You will pay a 0.08% trading fee instead of the standard 0.10%. To open your Binance account with a 20% fee discount, click the button below:

To get a 20% fee discount on Binance, you can also directly enter the code ”WRYOO8BZ” in the referral ID field when opening your Binance account.

If you already have a Binance account, you can hold BNB in your account to pay fees in BNB, which will give you a 25% fee discount.

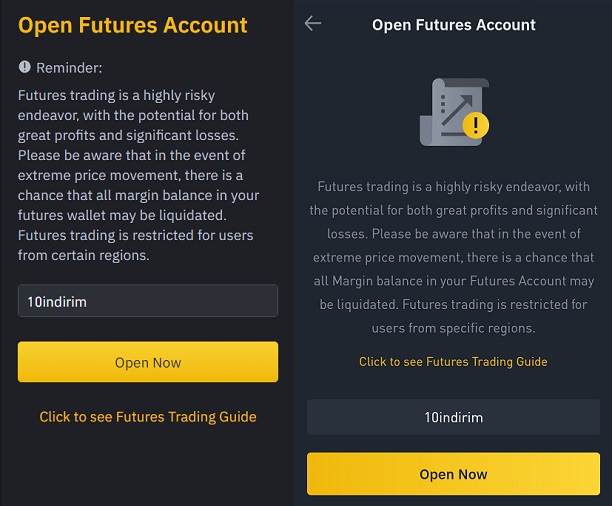

You can also enter the code ”10indirim” when opening your Futures account in your current Binance account.

This way you can get a 10% fee discount on futures trading fees.

After opening a Binance account with a 20% fee discount, to lower fees further, you should hold BNB in your spot wallet to pay fees in BNB and get a 25% fee discount.

When you hold BNB in your Binance account, Binance charges trading fees from your BNB balance when you make a trade and gives you a fee discount.

There is no minimum amount of BNB you should hold to receive a 25% fee discount. As long as there is enough BNB in your wallet to pay for fees, you will continue paying 25% lower fees.

By following these steps, you can reduce Binance fees by 40% (20%+25%), and your new fee structure will be:

| 30d Volume &/or BNB Balance | Maker | Taker |

| < 1,000,000 USD or ≥ 0 BNB | 0.06% | 0.06% |

| ≥ 1,000,000 USD & ≥ 25 BNB | 0.054% | 0.06% |

Note that you will be charged a 25% lower fee first (0.075% or lower depending on your volume) and then receive a 20% fee kickback.

So the fee table above also includes the fee kickback, but your trading history will only show the fee that is charged at 0.075% or lower depending on your VIP level / volume.

You can also see your fee kickbacks under the referral kickback section on Binance referral page.

Binance Futures fees

Binance Futures consists of USDS-margined and coin-margined futures, and each one has a different fee structure.

Let’s first look at the USDT-margined futures trading fees:

| 30d Volume &/or BNB Balance | Maker | Taker |

| < 15,000,000 USD or ≥ 0 BNB | 0.02% | 0.05% |

| ≥ 15,000,000 USD and ≥ 25 BNB | 0.016% | 0.04% |

| ≥ 50,000,000 USD and ≥ 100 BNB | 0.014% | 0.035% |

| ≥ 100,000,000 USD and ≥ 250 BNB | 0.012% | 0.032% |

As you can see in the table above, regular / VIP 0 users who trade USDT-margined contracts on Binance Futures pay 0.02% and 0.05% trading fees for their maker and taker orders respectively.

So, if your trading volume is below 15M USD, you will be charged a 0.02% or 0.05% trading fee when you open and close positions.

For BUSD-margined contracts, trading fees are lower and start at 0.012% and 0.03% for maker and taker orders respectively.

How to calculate Binance Futures fees

Let’s say you’ve transferred 1,000 USDT to your USDS-M futures wallet and will open a long or short position with 5x leverage.

As your position size will be around 5,000 USDT with 5x leverage, you can calculate the fee you will pay by dividing 5,000 by 100 and then multiplying it by 0.02 or 0.05 (5000/100×0.02).

If it is a maker order, you will pay a fee of 1 USDT when you open a 5,000 USDT position. If you want to pay lower, you need at least 15M USD trading volume on the futures exchange.

As your position size will be shown in BTC or any other coin you trade when opening/closing positions, you should first multiply your position size with your entry/close price.

After that, you can calculate the trading fee that will be paid in USDT or BUSD.

But again, you can reduce Binance Futures fees without having such a high trading volume on the futures exchange.

You can get a 10%+10% fee discount by opening your Futures account with the code ”10indirim” and transferring BNB to your USDS-M Futures wallet.

Now let’s look at Binance’s COIN-margined Futures trading fees:

| 30d Volume &/or BNB Balance | Maker | Taker |

| < 15,000,000 USD or ≥ 0 BNB | 0.02% | 0.05% |

| ≥ 15,000,000 USD and ≥ 25 BNB | 0.016% | 0.04% |

| ≥ 50,000,000 USD and ≥ 100 BNB | 0.014% | 0.035% |

| ≥ 100,000,000 USD and ≥ 250 BNB | 0.012% | 0.032% |

Let’s say you want to trade the BTC/USD pair and open a 5 BTC position, you can calculate the trading fee you will pay by dividing 5 by 100 and then multiplying it by 0.01 or 0.05.

If it is a maker order you will pay a trading fee of 0.0005 BTC (5/100×0.01).

But, when you trade coin-margined pairs on Binance, you buy/sell contracts and each contract represents different values like 100 USD depending on the pair.

So the calculation is a bit different than USDT and BUSD margined pairs.

For example, if you will trade the BTC/USD pair and buy 5 contracts, your position size will be 500 USD as each contract represents 100 USD.

To calculate the trading fee that will be charged when you open or close a position, first divide your position size (in USD) by the entry/close price.

And you will get your position size in the coin you trade. Divide it by 100 and then multiply it by the fee rate.

Calculating USDS-margined and coin-margined futures fees might be a bit confusing for beginners which is quite normal.

You can calculate futures fees as well as funding using our Binance Futures fee calculator and Binance funding fee calculator, and learn more about how to do it step by step.

For more detailed information about the fee calculation and funding, check out our Binance Futures tutorial.

How to reduce Binance Futures fees

When you open your Futures account on Binance, you can input the code ”10indirim” and receive a 10% fee discount.

If you’ve already opened your Binance Futures account, you can still get a 10% trading fee discount.

Just transfer some BNB to your USDS-M futures wallet to pay fees in BNB.

By paying fees in BNB, you can get a 10% fee discount on USDS-margined futures trading fees. If you trade coin-margined contracts, you can’t pay fees in BNB.

If you’ve opened your Futures account with the code ”10indirim” and transferred BNB to your USDS-M Futures wallet, you will pay ~20% lower trading fees.

To learn how to trade on Binance Futures and more about fees, you can refer to our tutorial below:

To long on Binance and short on Binance, check out our step-by-step tutorials below:

If you’ve opened your Binance account with a 20% fee discount by following the steps in this guide, you don’t need to enter an additional code for Binance Futures.

You will automatically get a 10% fee discount for futures markets in addition to the 20% fee discount for spot markets.

Binance margin trading fees

If you want to engage in margin trading on Binance, you can check out the daily interest rate for each coin on this page, which also reduces as your VIP level increases.

Interest is calculated on an hourly basis and you will pay interest even if you borrow coins for less than an hour.

You can calculate the interest you will pay by dividing the amount of borrowed coins by 100 and then multiplying it by the daily interest rate like A/100×0.05.

This will give you the interest that needs to be paid for coins borrowed for 24 hours.

Margin trading are also subject to spot trading fees.

You will pay a 0.10% trading fee for your margin trades. You can pay much lower trading fees if you’ve decreased the spot fees following the steps we mentioned above.

Binance leveraged tokens fees

Leveraged tokens maintain a leverage between 1.25x and 4x, and give traders an opportunity to make more money during price fluctuations without taking the risk of liquidation.

When you trade leveraged tokens on Binance, you will pay spot trading fees which you can check out above.

But there is more to it. You will also be charged a daily management fee and funding.

The management fee is 0.01% and is charged daily.

The funding is directly exchanged between traders. When the funding rate is positive, longs pay shorts and when the rate is negative, the opposite happens.

Binance P2P fees

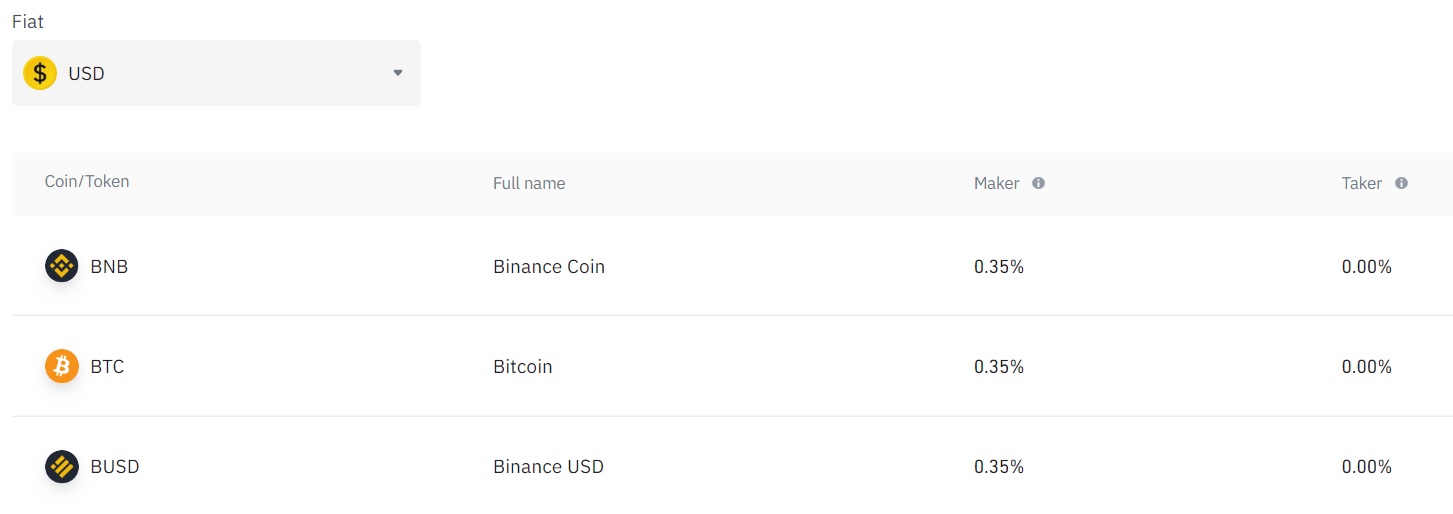

Binance P2P fees vary depending on the fiat currency and usually are 0%, 0.10% or 0.35%.

The good thing about Binance P2P fees is that if you just want to buy or sell crypto using Binance P2P, you will not be charged any transaction fees.

Binance P2P fees only apply to advertisers (makers) who post buy/sell advertisements on Binance P2P.

You can check out Binance P2P fees on this page.

To learn how to trade on Binance and deposit & withdraw fiat currencies, check out our Binance tutorial below: