Balancer is one of the most popular decentralized exchanges based on the Ethereum blockchain. Balancer is an automated market maker (AMM) that allows users to swap tokens instantly and earn fees by providing liquidity to various pools.

Balancer is a much more flexible AMM compared to other protocols like Uniswap. It allows liquidity providers to create pools with more than two tokens, set different weights for each token and charge a trading fee between 0.0001% and 10%.

Balancer vs Uniswap

In Uniswap, liquidity pools consists of two tokens with equal weights. But, in Balancer, a liquidity provider can set up a pool that contains up to 8 tokens and each with different weights. Some of the Balancer and Uniswap pools are as follows:

Uniswap pools:

- 50% WETH 50% USDC

- 50% WETH 50% WBTC

Balancer pools:

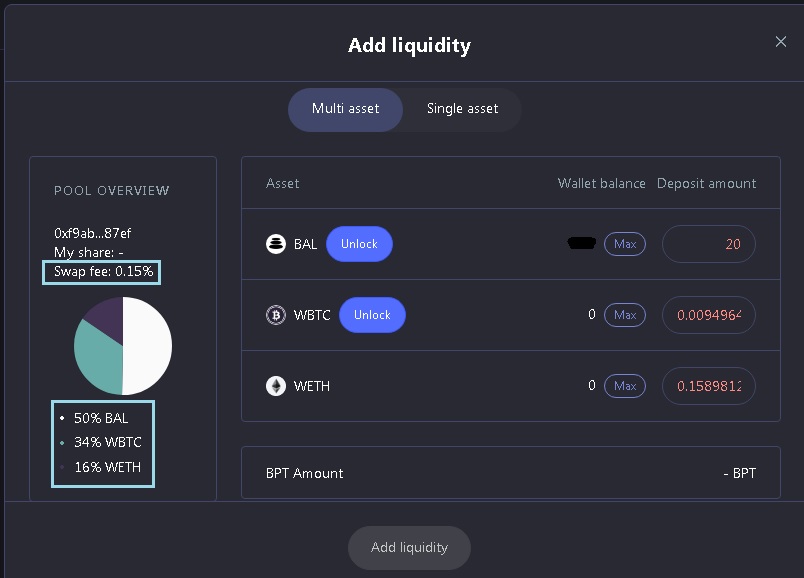

- 50% BAL 34% WBTC 16% WETH

- 60% MKR 40% WETH

- 50% WBTC 50% WETH

When you provide liquidity to a pool on Uniswap, you need to provide equal value of each token as the two token are equally weighted. So, if you have $100 ETH, you need $100 USDC to participate in the WETH / USDC pool.

But, let’s say, you want to provide liquidity to the 50% BAL 34% WBTC 16% WETH pool on Balancer, then you need $50 BAL, $34 WBTC and $16 ETH, or something proportional to this in your wallet.

You can also use the option of single-asset deposit while adding liquidity to Balancer pools. In this way, you deposit only one token into the pool, and the token is swapped for other tokens that you don’t have in the right proportion or at all under the hood, but you’ll get a lower amount of BPT tokens.

As for trading fees, when you trade on Uniswap, regardless of the pair you’re trading, you’ll pay a 0.30% fee. It’s is currently fixed and does not vary. But, when you trade on Balancer, the fee you’ll be paying all depends on the pool. It could be as low as 0.0001% and as high as 10%.

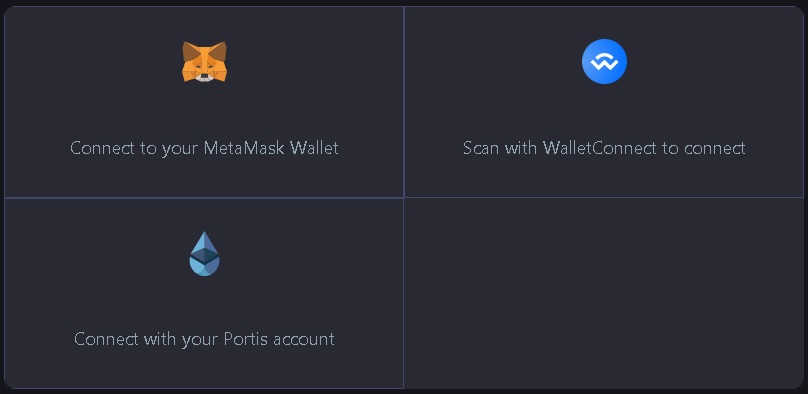

Balancer supported wallets

Balancer currently supports MetaMask, WalletConnect and Portis. WalletConnect support means that you can also use Balancer with mobile wallets such as Trust Wallet and Coinomi.

To use Balancer with the supported mobile wallets by WalletConnect, you just need to click on ”scan with WalletConnect to connect” and scan the QR code with your mobile wallet.

Balancer fees

The trading fee rate on Balancer is set by pool owners and varies according to the pool. The fee you will pay when you make a swap on Balancer is going to be between 0.0001% and 10%.

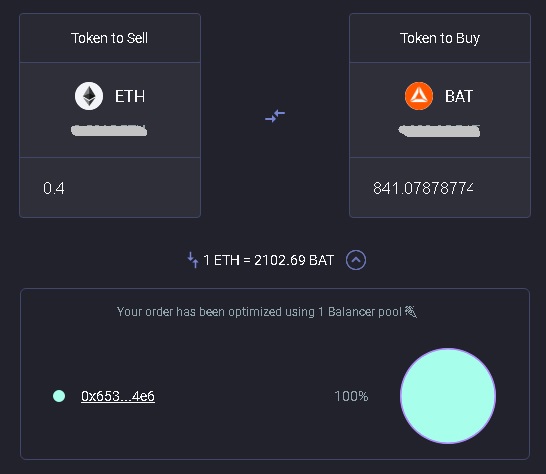

When you want to swap one token for another one, your order is automatically optimized by Balancer using existing pools, you can click on the address of the pool and check out its fee rate.

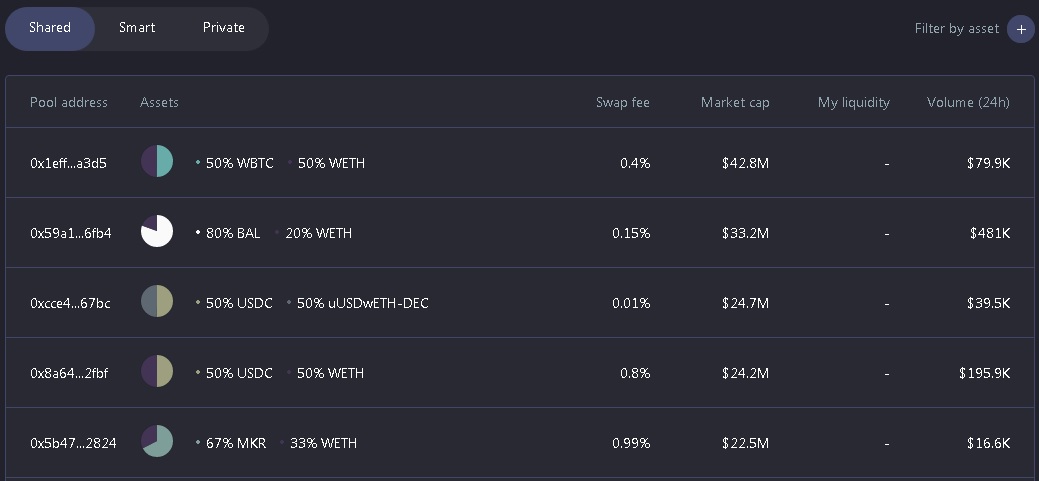

To get a better idea of Balancer fees, you can visit this page to see shared, smart and private pools and their fee rates. You can filter Balancer pools by token by clicking on the ”filter by asset” button.

Balancer (BAL) token distribution & rewards

According to the information provided by the Balancer team, the maximum and total amount of BAL tokens that will ever exist is 100 millions. But this cap might be changed in the future by BAL token holders through governance.

The Balancer token distribution is as follows:

- 25M BAL tokens – Founders, stock options, advisors and investors, all subject to vesting periods

- 5M BAL tokens – The Balancer Ecosystem Fund

- 5M BAL tokens – The Fundraising Fund

- 65M BAL tokens – Liquidity providers

Those who provide liquidity to Balancer pools that contain two or more whitelisted tokens can receive weekly BAL token rewards. A total of 145,000 BAL tokens are currently distributed to liquidity providers weekly.

How to use Balancer?

You can use Balancer to trade tokens and provide liquidity to pools to earn trading fees. Liquidity providers also earn BAL tokens weekly.

How to trade on Balancer?

To make a trade on Balancer, first visit Balancer and click on the ”connect wallet” button to connect your MetaMask wallet, mobile wallet or Portis account to the exchange.

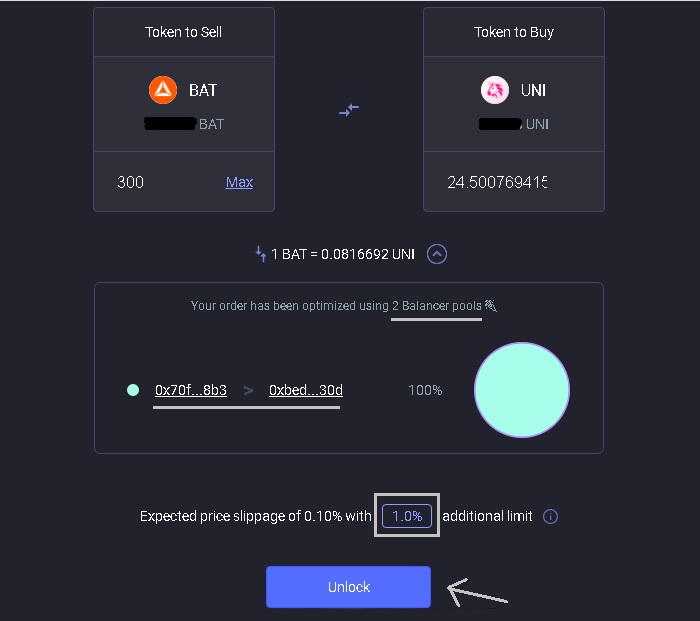

Pick the token you want to sell and enter the amount, and pick the token you want to receive. After that, you need to allow Balancer to spend your BAT by clicking on the ”unlock” button and then approving the transaction on your wallet.

Before that, you can check the exchange rate, set a slippage limit, and also check out the pools by clicking on the addresses given below the exchange rate.

After unlocking the token, you can simply make the swap. Before making an important trade, make sure to check out other AMMs such as Uniswap and Mooniswap, and DEX aggregators like Matcha and 1inch to see if there is a better rate.

How to add liquidity to Balancer?

To add liquidity to Balancer pools, click on ”add liquidity” on the exchange page, or simply visit this page. After connecting your wallet to Balancer, you can check out the pools, filter them by token and add liquidity to shared pools.

After choosing a pool, click on the ”add liquidity” button. After that, you need to unlock each pool token and deposit each token proportional to their weights on the pool.

After providing liquidity to a Balancer pool, you will receive BPT tokens that will accrue trading fees. Also, as a liquidity provider, you’ll receive weekly BAL token rewards.

According to Balancer, only pools that contain two or more whitelisted tokens is eligible for BAL liquidity mining. You can see the whitelisted tokens under ”homestead” on this page.

You can also deposit only one token into the pool using ”single asset” option. Your token will basically be swapped for other tokens in the pool under the hood, but you’ll receive a lower amount of BPT.

Balancer impermanent loss

Balancer may offer some advantages to those who provide liquidity to decentralized exchanges and want to minimize their impermanent loss.

Impermanent loss arises when the exchange rate deviates from the initial rate at which you provided liquidity to a pair. To minimize impermanent loss, you can provide liquidity to the pools with a token that has a higher weight and you are bullish on.

For example, if you are bullish on Ethereum, instead of providing liquidity to the 50% WBTC 50% ETH pair on Uniswap, you can provide liquidity to a Balancer pool like 70% ETH 30% WBTC.

In this way, if Ethereum outperforms Bitcoin as you predict, you’ll suffer less from impermanent loss compared to providing liquidity to a 50%-50% pool.

But, if things don’t go as you expected and Bitcoin outperforms Ethereum, you’ll lose more by participating in a 70% ETH 30% WBTC pool instead of a pool with equally weighted ETH and BTC.

You can check out the ROI of Balancer pools which also includes impermanent loss on Pools.fyi. Some of the liquidity pools on Balancer are further incentivized by project developers. You can also find such incentivized pools on Pools.fyi.

Check out other decentralized exchange reviews: