Centralized cryptocurrency exchanges vs decentralized exchanges

Today, centralized cryptocurrency exchanges account for almost all of the trading volume. If you compare centralized exchanges with decentralized ones, instead of comparing decentralized exchanges to one another, decentralized exchanges are nothing but a drop in the ocean.

This, on the one side, shows that decentralized exchanges are not ready for mainstream yet, and on the other side there is a great opportunity for those which will be able to deliver the best experience to traders.

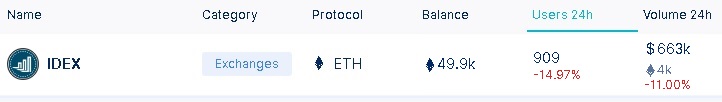

Looking at the decentralized exchange stats on DappRadar, IDEX, with $663k daily volume is the top Ethereum decentralized exchange by volume. Even including other Ethereum DEXs, the daily trading volume on DEXs is less than $2M.

According to CoinMarketCap, total daily volume of cryptocurrencies in the last 24 hours is $59.2B and $16.4B comes from BTC trading pairs. The BTC/ETH trading pairs in OKEx and Binance currently have ≈ $110m volume in total.

This $16.4B trading volume and the only two BTC/ETH pairs making more than $110m volume have some implications for decentralized exchanges. There is a huge trading volume in the market that can be captured by a promising decentralized Bitcoin exchange like Bisq and Ethereum-based decentralized exchanges with WBTC token pairs.

Decentralized Bitcoin exchanges

What is Bisq

Bisq, simply put, is an open source, peer-to-peer, decentralized Bitcoin exchange. It is a desktop application running on Windows, Mac, Debian/Ubuntu, Arch Linux and Red Hat/Fedora, so users need to download the application to use it.

Using a peer-to-peer network over Tor, Bisq has no servers to be hacked or DDoS’d. In this sense, Bisq is very much different than current decentralized exchanges and can be seen as a truly decentralized platform which is difficult to be censored and hacked.

Just as any other decentralized exchange, Bisq does not hold the funds of users. All bitcoins are held in multi-signature Bitcoin wallets rather than a wallet controlled by Bisq. As a decentralized bitcoin-to-fiat exchange, Bisq also does not hold any fiat currency or intervene in any transactions between traders. Any dispute between traders is solved with an specially designed arbitration mechanism.

Bisq requires no identity verification whatsoever, and all the data is encrypted and stored locally. In a nutshell, Bisq is just a code that anyone can run on a computer to exchange bitcoin for fiat currencies and other cryptocurrencies over the internet.

With the Bisq DAO (decentralized autonomous organization) going live on Bitcoin mainnet on April 15, Bisq will be an entirely decentralized platform which is a self-sustaining and censorship-resistant by decentralizing its decision-making and revenue distribution processes.

You can download and run the software on your computer to use the decentralized Bitcoin exchange Bisq.

What is Wrapped Bitcoin (WBTC), Why is WBTC important

Wrapped Bitcoin (WBTC) is an ERC-20 stablecoin backed by Bitcoin. Each WBTC token is backed by one Bitcoin, so the price of one WBTC token always fluctuates according to Bitcoin price.

The reason why WBTC is an important stablecoin for decentralized exchanges is that it makes Bitcoin compatible with the Ethereum blockchain, so WBTC can bring liquidity to the Ethereum-based decentralized exchanges which suffer from low trading volumes. Similarly, many other cryptocurrencies or different assets can be integrated into the Ethereum blockchain.

WBTC is jointly initiated by Kyber, Ren, and BitGo. It works with three different parties: WBTC DAO, merchants and custodians. Despite the transparency and standardized mechanism through smart contracts, it is essentially a centralized stablecoin.

But, considering the significance of BTC trading pairs in the markets, Bitcoin-backed stablecoin WBTC can diffuse the current Bitcoin volume. As a fact, just look at the volume of cryptocurrencies below. Tether, as a USD-pegged stablecoin, most of the time has even higher volume than Bitcoin.