Mooniswap is one of the most popular Ethereum-based AMM protocols. It was created by the 1inch team and has its own native token called 1INCH.

In this review and tutorial, I will show you how to use Mooniswap and add liquidity to Mooniswap liquidity pools. I will also give you information about Mooniswap fees and explain how 1INCH token works.

What is Mooniswap?

Mooniswap is an AMM (automated market maker) exchange launched by 1inch, one of the best DEX aggregators in the decentralized exchange ecosystem.

Mooniswap, a Uniswap competitor, aims to bring more value to liquidity providers with its different approach to exchange rates which minimizes impermanent loss.

It introduces virtual balances which decreases the profit of arbitrageurs due to temporarily mispriced pools, leaving more profit for liquidity providers.

The protocol has also its own token called 1INCH which will be released soon and an active liquidity mining program.

Update: With the release of 1INCH token, Mooniswap has been rebranded to 1inch Liquidity Protocol. For more information, check out our 1inch exchange review.

Mooniswap fees

Mooniswap charges a trading fee of 0.30% for swaps just like Uniswap. When you swap tokens on Mooniswap, you will pay a 0.30% fee which will be distributed to liquidity providers on Mooniswap proportional to their share of the pool.

When liquidity providers remove their liquidity from Mooniswap liquidity pools, they receive transaction fees along with their contribution to the pool, and the LP token they received after adding liquidity to the pool is burned.

The fee rate on Mooniswap is more flexible compared to Uniswap. 5% of the fee may go to external actors such as wallets and dapps that integrate with the protocol.

Also, it is mentioned in the whitepaper that the fee rate can be lowered all the way down to 0% in the future to provide users with more competitive prices.

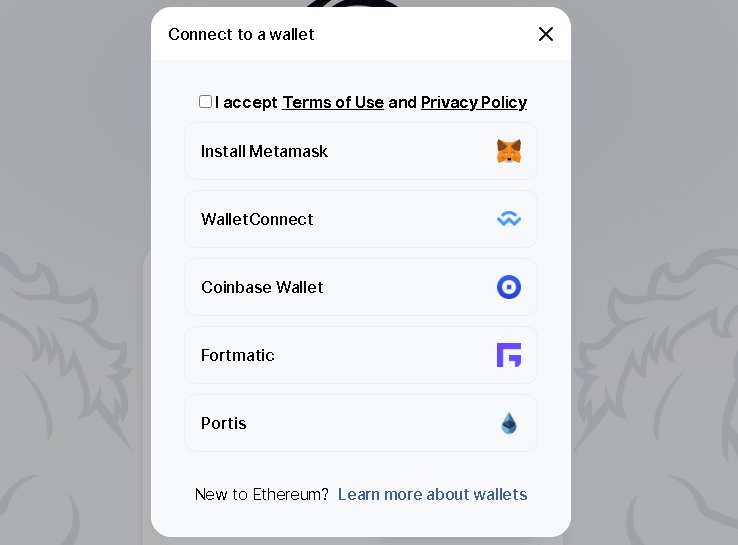

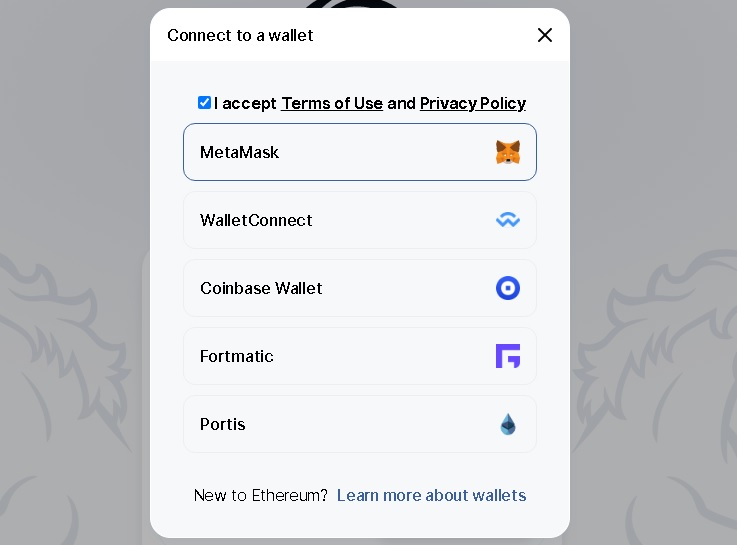

Mooniswap supported wallets

As Mooniswap is a decentralized exchange, you need a cryptocurrency wallet that allows you to interact with dapps to use Mooniswap. There are a number of wallets you can use to trade on Mooniswap.

Mooniswap supports MetaMask, WalletConnect, Coinbase Wallet, Fortmatic and Portis. You can also use Mooniswap with mobile wallets such as Trust Wallet and Coinomi via WalletConnect.

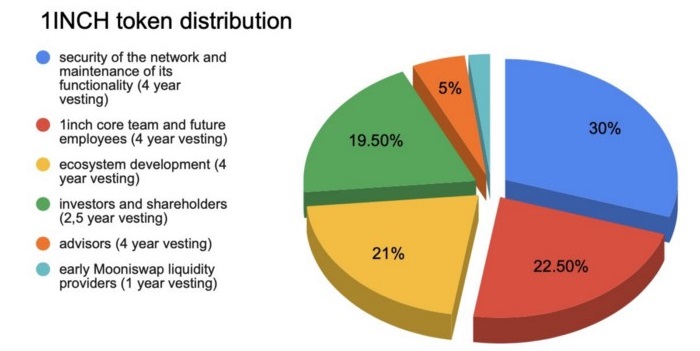

1INCH token explained

1INCH is a protocol token, similar to Uniswap’s UNI token. It will be used for governance, liquidity mining and various other purposes to secure the protocol and incentivize users.

1INCH token distribution

The distribution mechanism for 1INCH token can be seen in the chart below. Early liquidity providers will get 2% of the total supply of tokens with 1 year vesting.

How to trade on Mooniswap?

If you’ve used Uniswap before, then you’ll have no difficulty using Mooniswap because it is totally same. Also, it is much easier to use AMM exchanges like Mooniswap and Uniswap than most other decentralized exchanges. You can trade tokens on Mooniswap by following the steps below.

Step 1: Connect your wallet to Mooniswap

To start trading on Mooniswap, you first need to log in to your MetaMask (assuming you use MetaMask) and visit Mooniswap and click on the ”connect to a wallet” button.

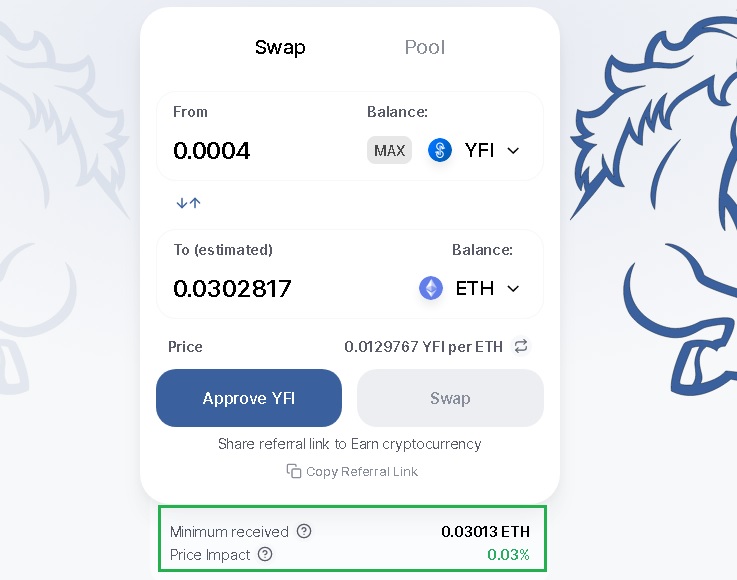

Step 2: How to swap tokens on Mooniswap

To swap tokens on Mooniswap, first choose the pair and then enter the amount of token you want to swap. Then you will see the estimated and minimum amount of token you’ll receive on the swap page.

You first need to allow Mooniswap to spend your token by clicking ”approve X token” and then confirming this on MetaMask. After that, you can swap tokens. You only need to approve a token once.

How to add liquidity to Mooniswap liquidity pools?

Adding liquidity to Mooniswap liquidity pools is quite easy. Before providing liquidity to a pair on Mooniswap, you can first check out Pools.fyi to find the most profitable pools on Mooniswap and refer to this article to see which pools are incentivized.

If you have no idea about impermanent loss, you should also read our guide to impermanent loss to learn how you can mitigate it as a liquidity provider before providing liquidity to Mooniswap.

After you are all set, you can add liquidity to Mooniswap pools by following the steps below.

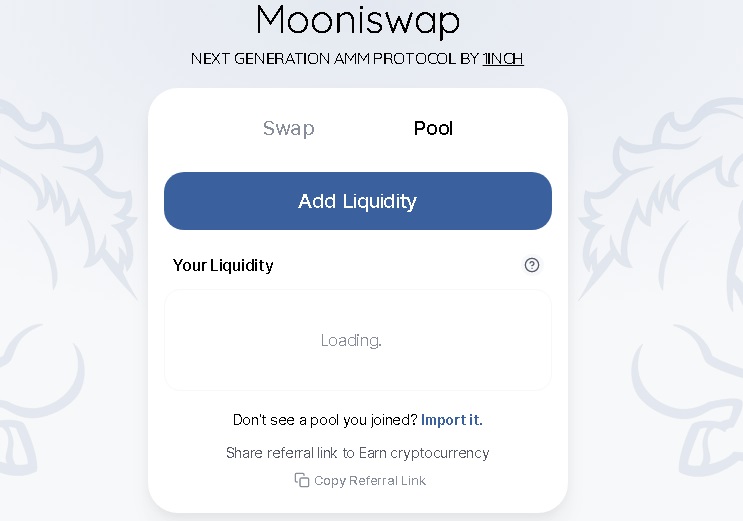

Step 1: Connect your wallet to Mooniswap and click on pool

First connect your wallet to Mooniswap, and click on ”pool” and then ”add liquidity” to add liquidity to a pair.

Step 2: How to add liquidity to a pair on Mooniswap

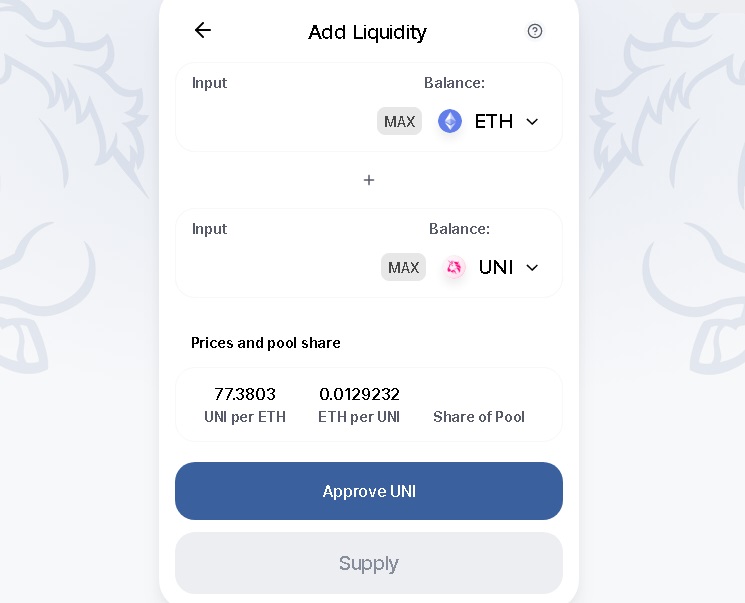

To add liquidity to a certain pair on Mooniswap, you need to deposit an equal value of each token. You can choose ETH, DAI, USDC, USDT or CHI as a base token.

When you enter the amount for your base token or the other, the amount of other token will be autofilled by Mooniswap. You need an equal value of each token in your wallet to be able to add liquidity to a certain pair.

When you add liquidity to a pair on Mooniswap, you need to approve the token by clicking on the ”approve X token” button and confirming the transaction on MetaMask. You’ll only pay gas for the approval of a token.

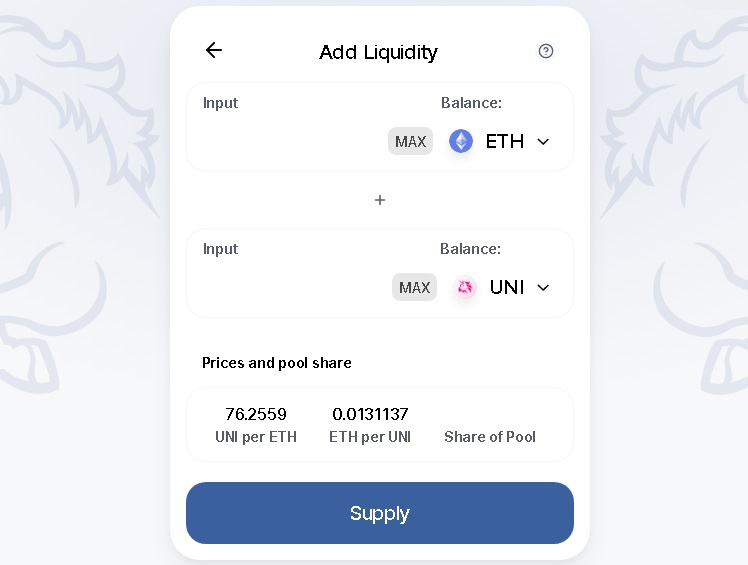

After approving the token, click on the ”supply” button to add liquidity to the pair.

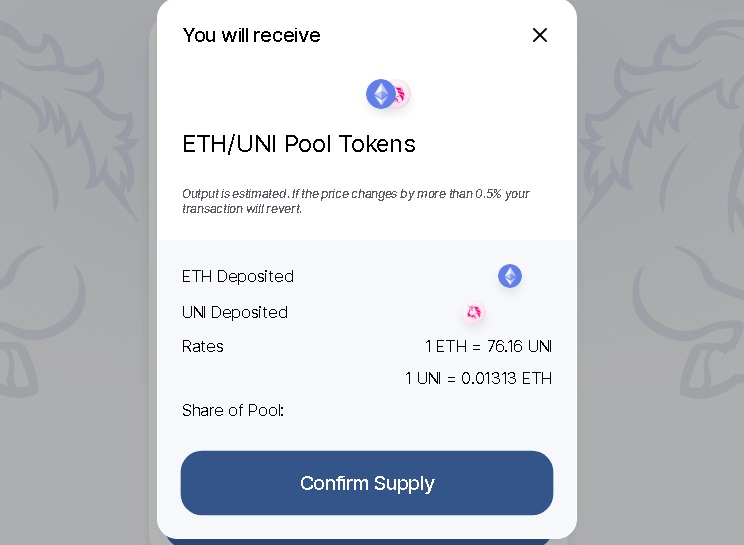

After clicking on the ”supply” button, check out the rates, your share of pool and the number of pool tokens you’ll receive, and click on ”confirm supply” to finalize the transaction. You again need to confirm the transaction on your wallet.

The pool tokens you will receive after adding liquidity to a Mooniswap pool will accrue trading fees. You can remove your liquidity from the pool to receive trading fees along with your contribution to the pool. The LP tokens you received after adding liquidity to the pool will be burned during this transaction.

Mooniswap impermanent loss

Mooniswap introduces virtual balances which decreases the profit of arbitrageurs due to temporarily mispriced pools, leaving more profit for liquidity providers.

According to the whitepaper, Mooniswap may generate from 50% to 200% more income for liquidity providers than Uniswap due to redirection of price slippage profits.

But, Mooniswap currently has much lower volume compared to Uniswap, so liquidity providers can’t earn as much as fee they can earn on Uniswap.

If you want to add liquidity to a pair on Mooniswap, you should consider the volume and liquidity of that specific pair on Uniswap as well as Uniswap and Mooniswap pool returns on Pools.fyi.

Check out other decentralized exchange reviews: