1inch is a DEX aggregator and also a liquidity protocol (AMM). With the launch of 1INCH token, Mooniswap has been rebranded as 1inch Liquidity Protocol.

Now the platform functions both as a DEX aggregator and an exchange which uses a different AMM model that puts emphasis on the profit of LPs.

Uniswap, on the other hand, is an easy-to-use and most people’s classic, favorite decentralized exchange. By TVL and volume, it is the best decentralized exchange in the market.

You can use both Uniswap and 1inch to trade ERC20 tokens and tokens of other chains, and make money by providing liquidity to pools as they are both AMM protocols.

But which one should you use? Uniswap or 1inch? In this guide, you can learn which exchange is more suitable for you as a trader or liquidity provider.

Should you trade on 1inch or Uniswap?

If you’re going to make a quick, small trade in which only one liquidity source is used, don’t use 1inch. In that case, you can save on transaction fees by using Uniswap.

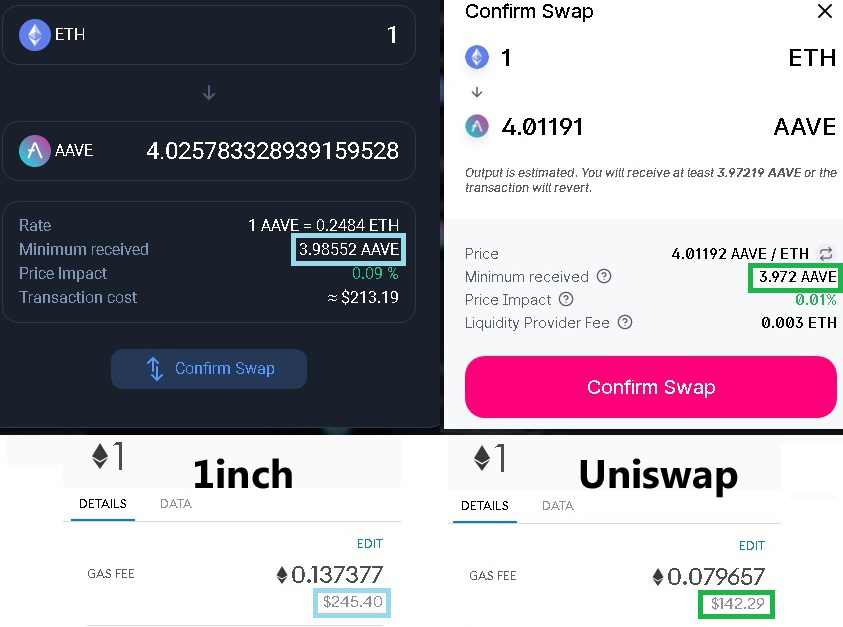

For example, when we want to swap 1 ETH to AAVE and set a custom gas value at 226 on both 1inch and Uniswap, the transaction cost is like this:

Don’t mind the gas fees, you should not even trade on decentralized exchanges when the gas fee is this high. You can use centralized exchanges such as Binance which has the lowest fee rate (0.06%).

So, when you trade on 1inch instead of Uniswap, it is more likely that you will pay higher transaction fees.

But with the launch of the 1inch Router v5, today 1inch is much more gas optimized, and in addition to that, Ethereum gas fees are usually pretty low.

So you may rather check prices than gas fees when deciding whether to use 1inch or Uniswap.

As you may have noticed in the image above, the minimum amount of AAVE I’ll receive for this trade is higher on 1inch.

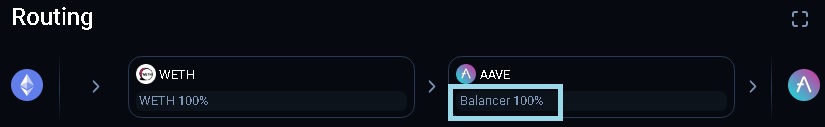

Because 1inch checks more than 40 liquidity sources to find the best price. And, for this order, it uses Balancer instead of Uniswap or any other liquidity source.

But it does not split the order among multiple liquidity sources as that is not needed for this trade. So why use 1inch?

Just check 1inch to find the decentralized exchange that has the best price and go trade there. This way you can save on transaction costs.

Even though exchanges like Balancer may have better prices than Uniswap sometimes, you should also compare gas fees.

If there is not a big price difference between Uniswap and other decentralized exchanges, you can instead trade on Uniswap as it is likely to offer lower transaction fees.

But, if there is more than one liquidity source used and there is a noticeable price difference between 1inch and other exchanges like Uniswap, it means that 1inch does its job.

In that case, you can make the swap on 1inch instead of using Uniswap or any other decentralized exchange.

Also, you should not trust what you see on the screen, sometimes you may actually lose and 1inch may make money off your trade through positive slippage.

The rates on 1inch might be a bit overestimated sometimes. For most traders, it might be better idea to stick to Uniswap especially if they don’t know what they’re doing.

Note that with the launch of the 1inch Router v5, Ethereum gas fees should not be a problem now when you trade on 1inch instead of Uniswap.

Key takeaways

- For small trades, use Uniswap instead of DEX aggregators like 1inch.

- Use 1inch to find the decentralized exchange that offers the best price for your order.

- Trade on 1inch when there is more than one liquidity source is used and there is a noticeable price difference between 1inch and Uniswap.

Should you add liquidity to 1inch or Uniswap?

You can provide liquidity to both 1inch and Uniswap and earn fees. But there are various things you should consider when deciding which exchange to add liquidity to.

First you should check the liquidity and the volume of the pool that you want to add liquidity to on both Uniswap and 1inch.

If the volume/liquidity ratio is comparably higher on one pool, you can earn more fees for your liquidity by adding liquidity to that pool.

Uniswap charges a 0.3%, 0.05% or 1% trading fee for trades and distributes all of it to liquidity providers. On 1inch, it is much more complex.

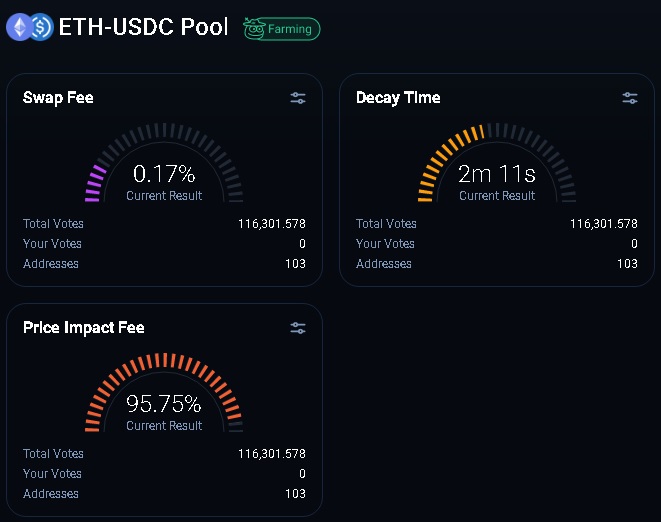

Each liquidity pool is separately governed and has different fees on 1inch exchange, as can be seen in the example below.

1inch also has a price impact fee and utilizes a feature called decay period which positively impacts liquidity providers’ profits.

Thanks to the price impact fee and the decay period, you may make more money on 1inch than Uniswap as a liquidity provider, but it also depends on the pool.

But it is not that easy to compare different pools and decide whether Uniswap or 1inch is better for liquidity providers.

There are many factors involved in it such as trading volume, fee rate, impermanent loss and so on, most of which are variable.

Another important thing, maybe the most important one, is liquidity mining programs. Both Uniswap and 1inch allow users to earn protocol tokens, UNI and 1INCH, by staking their LP tokens in certain periods.

If there is an ongoing liquidity mining program on 1inch or Uniswap, you should consider participating in it as you can earn protocol tokens in addition to trading fees.

Key takeaways

- Check the volume/liquidity ratio of the pool that you want to add liquidity to on both Uniswap and 1inch.

- Check if there is an active liquidity mining program that allows users to earn 1INCH or UNI.

- Consider other factors like swap fee, impermanent loss, etc.

UNI vs 1INCH: Which one and where to buy?

Uniswap is currently the leading decentralized exchange by TVL and volume. 1inch exchange also used to have very high, over a billion, total liquidity.

But now 1inch Liquidity Protocol has much lower total liquidity, around $5-50M.

Uniswap’s token, UNI, is currently in the top 20 and traded on many major exchanges such as Binance and Kraken.

1INCH is only traded on exchanges like Binance and KuCoin, and currently has much lower market cap than UNI token.

As decentralized exchanges and overall DeFi space are on the rise, both 1INCH and UNI could be very good choices.

To trade UNI and 1INCH, you can use Binance which has the lowest fee rate (0.06%) in the market with a 20%+25% fee discount.

If you don’t have a Binance account yet, click this link or visit our guide to open your Binance account with a 20% fee discount.

To learn how to use Uniswap and 1inch, you can refer to the reviews / tutorials below:

For other decentralized exchanges, check out the reviews below: