1inch exchange is one of the best DEX aggregators in the market.

The protocol is available on Ethereum, BSC, Polygon and various other chains, and also has liquidity pools and allows users to stake its native token, 1INCH.

After the 1INCH token launch, 1inch’s AMM exchange, Mooniswap, has been deprecated and rebranded to 1inch Liquidity Protocol.

Now 1inch functions more like Uniswap and SushiSwap with its exchange and liquidity pools. But the platform may offer better rates as it also pulls liquidity from various other decentralized exchanges.

In this review & tutorial, I’ll show you how to use 1inch exchange and add liquidity to 1inch liquidity pools. Also, I’ll give you information about 1inch exchange fees, 1INCH token and 1inch limit order.

What is 1inch exchange?

1inch exchange is a DEX (decentralized exchange) aggregator. It splits orders among various decentralized exchanges to achieve the best rates possible.

1inch currently supports more than 90 liquidity protocols. Some of the major ones are Uniswap, Balancer, SushiSwap, Curve and Kyber.

The platform is also available on other chains such as BSC, Polygon, Avalanche, Arbitrum and Optimism in addition to Ethereum.

You can connect your web3 wallet such as MetaMask to 1inch exchange and swap ERC20 tokens and tokens of other chains at the best prices in the market.

1inch exchange also allows users to create limit orders for free and earn interest by lending cryptocurrencies and supplying liquidity to liquidity pools. (The lending feature is not available on 1inch v2.)

With the release of 1INCH token and the addition of liquidity pools to the platform, you can now add liquidity to 1inch liquidity pools and stake LP or 1INCH tokens to earn 1INCH token.

The platform has also a P2P feature which you can use to create orders that can be executed by an address specified by you.

1inch exchange fees

As a DEX aggregator, 1inch itself does not charge any extra fees for swapping tokens. The fee that will be paid for swaps rather depends on decentralized exchanges from which liquidity is sourced.

For example, Uniswap charges a trading fee of 0.01%, 0.05%, 0.30% or 1.00% depending on the pair and Balancer has variable fees depending on the pool.

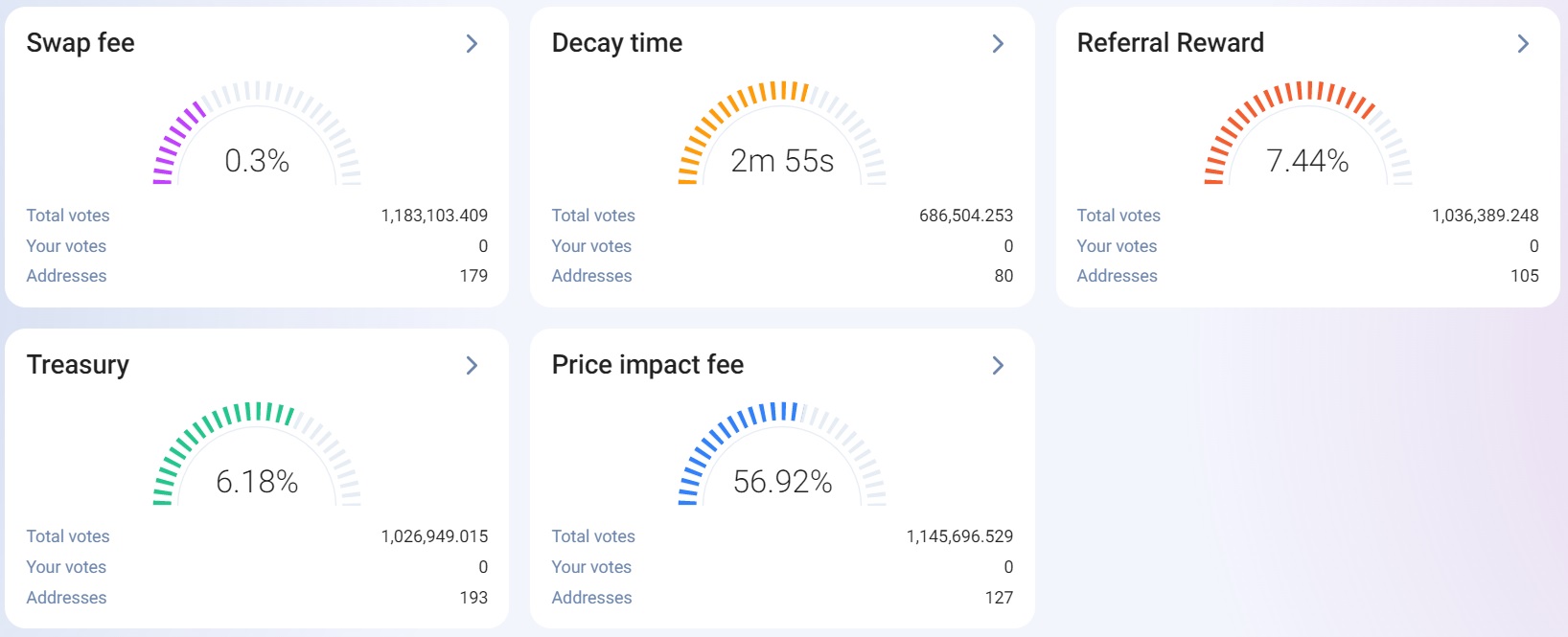

1inch’s own liquidity protocol currently has a swap fee of 0.30%, which is set by 1inch token holders an subject to change.

According to the article published by 1inch, trading fees which can vary depending on the decentralized exchanges used for the trade are already included in the swap rate.

For fees of other decentralized exchanges, you can check out this list of decentralized exchanges.

1inch Network’s native token, 1INCH, functions as a governance token and the platform is now heavily relied on its DAO with regard to fees and rewards.

You can check out the swap fee for the liquidity protocol, the governance reward and other parameters, and participate in governance under the ”DAO” tab on the platform.

If you stake your 1INCH tokens or provide liquidity to the protocol, you can have a say on major protocol parameters.

You might be wondering how 1inch exchange makes money if it does not itself charge any fees for swaps.

1inch receives a portion of fees that go to liquidity sources that it has partnered with. Also, it was making money from positive slippage.

Now a portion of these earnings that come from trades with positive slippage will be paid to referrers and the remainder will be included in the governance reward.

What is more important today for decentralized exchange users is rather gas fees. Due to the congestion in the Ethereum network, you may have to pay high transaction fees sometimes.

To minimize this burden, you can activate Chi Gastoken on the platform to reduce your transaction costs or trade when Ethereum gas price is low.

1inch token explained

1inch is an ERC20 token that is used to govern 1inch’s DEX aggregator and liquidity protocol.

The token is also available on other chains such as BSC and Solana.

1INCH token holders can decide on various parameters related to the protocol such as the price impact fee, the swap fee (for the liquidity protocol) and the governance reward.

You can find the current parameters and participate in governance under the DAO tab on the platform.

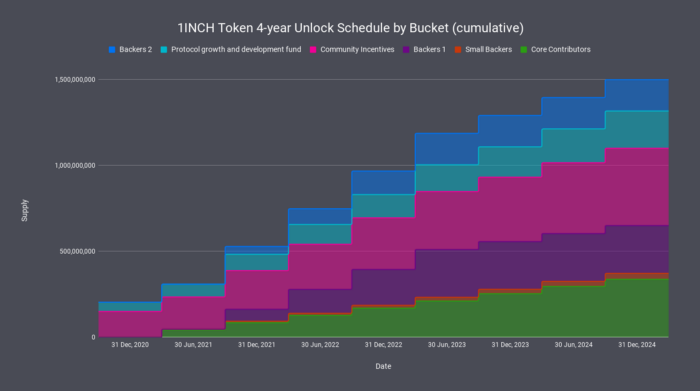

The total supply of 1INCH token is 1.5 billions. 30% of the total 1INCH token supply has been allocated to the community and will be used over a 4 year period.

The rest of the 1INCH token supply will be gradually distributed to the team, investors, etc. and 14.5% of the supply will be used for development.

How to buy 1inch token

1INCH token is currently traded on various centralized and decentralized exchanges such as Binance, FTX, KuCoin, Uniswap and 1inch.

In terms of liquidity and ease of use, the best exchange to buy and trade 1inch is Binance.

If you don’t have a Binance account yet, click this link or visit our guide to open your Binance account with a 20% fee discount.

If you already have a Binance account, you can use the code ”long90” when opening your Futures account on Binance and start trading on the platform.

How to stake 1inch token

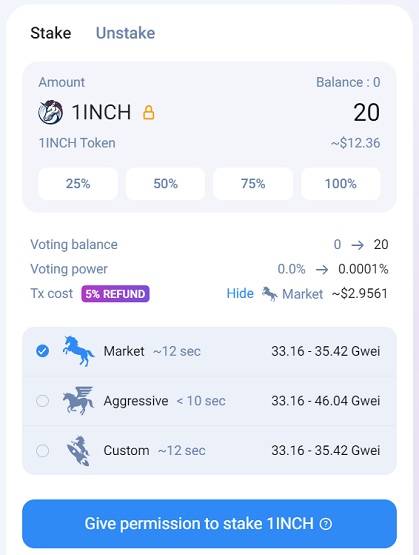

You can stake your 1inch tokens on the ”staking” page which can be found under the ”DAO” menu on the platform.

1inch token stakers can receive up to 95% of gas expenses refunded as 1INCH tokens and also participate in the governance of the protocol.

As a 1inch token staker, you can also vote on various parameters related to the liquidity and aggregation protocols such as the swap fee and governance reward (treasury).

To stake your 1inch tokens, first go to 1inch exchange and connect your wallet to the platform by clicking on the ”connect wallet” button.

After connecting your wallet to the exchange, click on the ”staking” page under the DAO menu.

Enter the amount of 1INCH that you want to stake and click the permission button to allow the smart contract to use your 1INCH token.

After approving the permission transaction on your wallet, you can stake your 1INCH tokens.

You can also set a custom gas fee or change it to ”aggressive” depending on how much transaction fees you are willing to pay and how fast you want your transaction to be completed.

1inch exchange supported wallets

1inch is a decentralized, Ethereum-based DEX aggregator and liquidity protocol. Users access to services provided by 1inch exchange without involvement of 1inch or third parties.

The protocol is also available on various other chains such as BSC and Polygon.

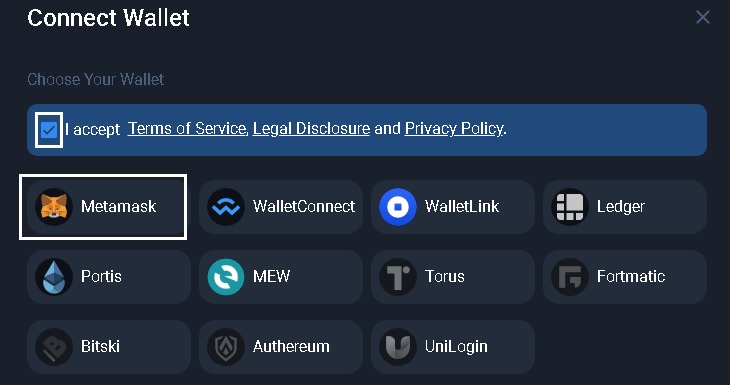

You can connect your crypto wallet to 1inch exchange and start swapping tokens on your own. 1inch supports various cryptocurrency wallets.

1inch exchange supported wallets: MetaMask, Trust Wallet, Torus, FortMatic, WalletLink, Portis, Authereum, UniLogin, WalletConnect, Bitski, MEW and Ledger.

You can use 1inch exchange with MetaMask, mobile wallets or Ledger. I’ll show you how to use 1inch exchange with MetaMask below.

To use 1inch on BNB Smart Chain (BSC), you can refer to our guide to learn how to add BSC to MetaMask.

How to use 1inch exchange

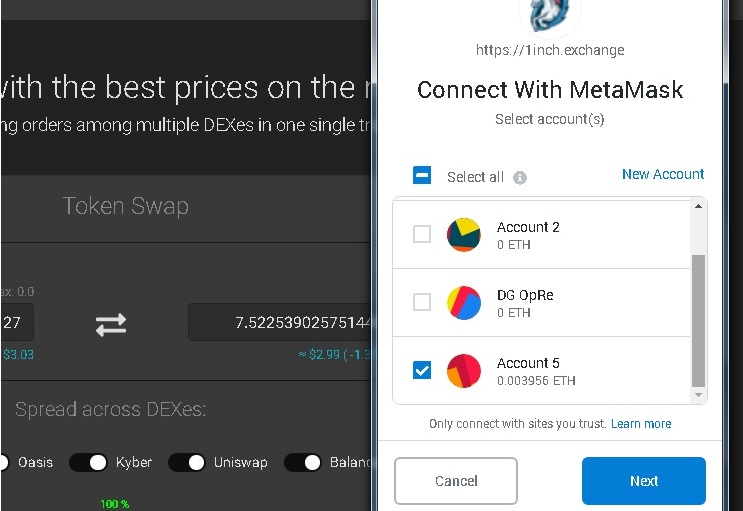

Step 1: Open your wallet and connect it to 1inch exchange

First log in to your MetaMask wallet on your browser or open another wallet supported by 1inch that you want to connect to 1inch.

Go to 1inch exchange and click on the ”connect wallet” button located at the top right corner of the page. Accept the terms and click MetaMask.

It might also be seen as Web3 wallet if 1inch has not detected MetaMask yet. In that case, you can refresh the page.

Step 2: Confirm the connection on MetaMask

When you click ”MetaMask” on 1inch exchange, a notification will pop up on your MetaMask wallet for the confirmation.

You can simply choose the address you want to use and connect your wallet to 1inch exchange through the MetaMask notification.

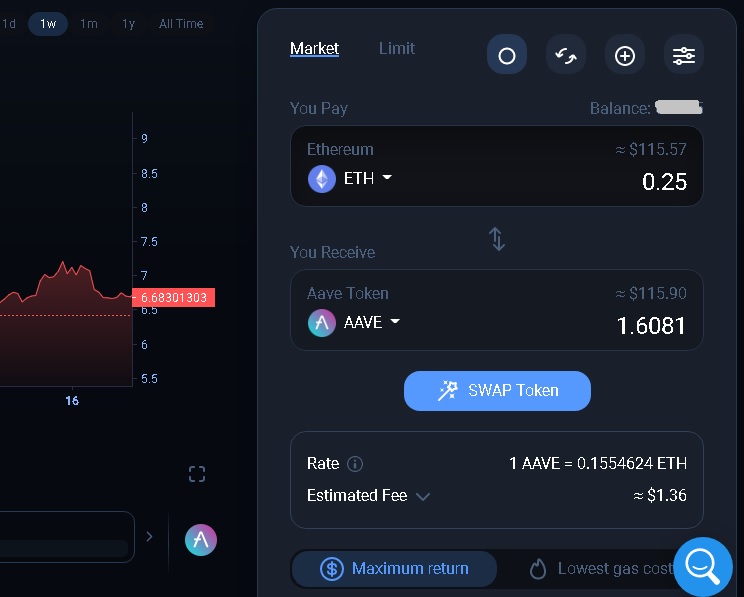

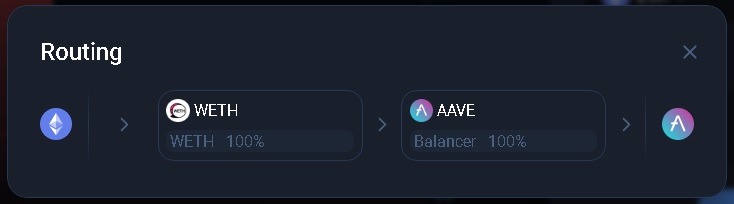

Step 3: Swapping tokens on 1inch exchange

First choose the coin you want to swap and enter the amount of coin. Then choose the coin you want to swap to. In the example below, I am swapping Ethereum to AAVE.

You first need to unlock the token you want to swap to be able to make a swap if you have not done it before. In the example below, as I’ve unlocked Ethereum before, there is no lock sign before ETH.

Only Balancer is used for this order which gives the best rate at the moment. Sometimes the order may be split among a few decentralized exchanges to achieve the best rate.

You can set a custom GAS fee by clicking on the settings icon and also use Chi Gastoken to pay lower gas fees. To learn how to use Chi Gastoken, you can refer to this article.

If you don’t want your transaction to fail due to price movements, you can increase the rate of price slippage. To execute the swap, click on the ”swap token” button and confirm the transaction on MetaMask.

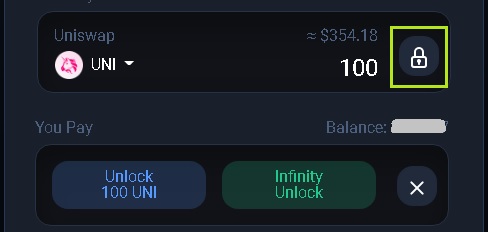

1inch exchange infinity unlock

You need to give the platform the permission to spend the token you want to swap by clicking ”unlock” or ”infinity unlock”.

”Infinity unlock” will save you gas costs as you will not need to unlock it again for future transactions.

On the other side, allowing the platform to spend only a certain amount with the option ”unlock” is safer but more costly in the long run if you will make more swaps.

You should especially unlock just for certain amounts on new / untrustworthy dapps.

1inch liquidity pools

1inch’s liquidity protocol, Mooniswap, which introduced virtual balances to bring more profit to liquidity providers, has been deprecated and rebranded to 1inch Liquidity Protocol.

1inch liquidity pools can be found on the ”pools” page under the earn menu on 1inch exchange.

If you have liquidity on Mooniswap, you can migrate to 1inch liquidity protocol on 1inch or just remove your liquidity from Mooniswap.

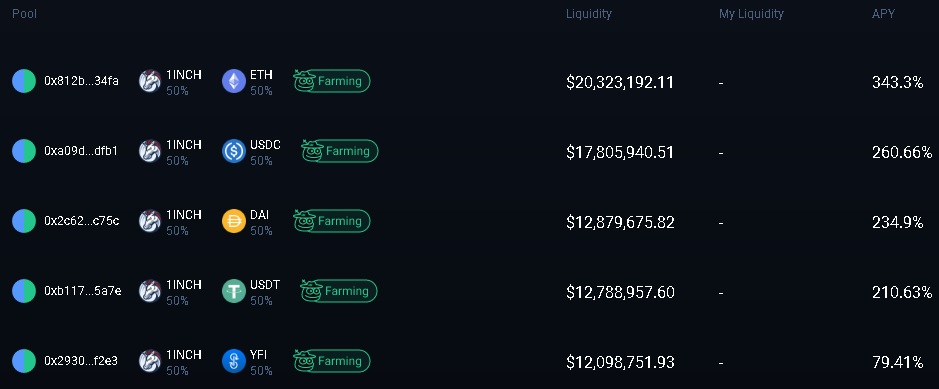

1inch liquidity protocol has currently various pools that you can add liquidity to and earn fees. Not all pools are included in the farming of 1INCH token.

So, if you want to earn 1INCH token by staking your LP tokens, add liquidity to 1INCH farming pools such as 1INCH-ETH, 1INCH-USDC and 1INCH-DAI.

How to add liquidity to 1inch liquidity pools

To add liquidity to 1inch liquidity pools, first connect your wallet to the platform and click on the ”pools” page under the DAO menu.

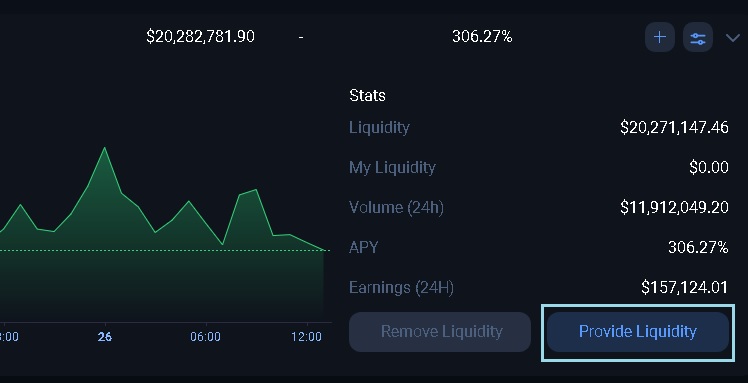

You can see various liquidity pools with APY rates and other information on the ”pools” section. Click on the pool you want to add liquidity to and then click on the ”provide liquidity” button.

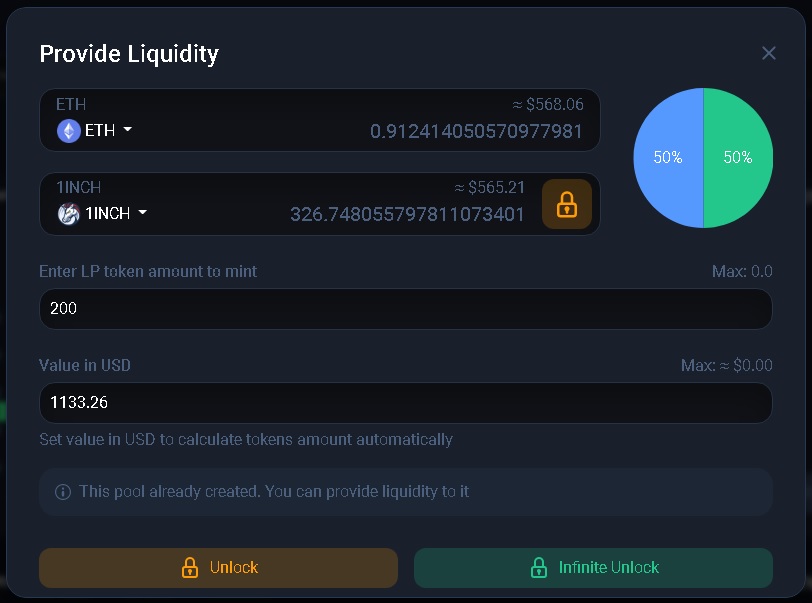

You need to deposit an equal value of each token into 1inch liquidity pools. Just enter an amount for LP token to be mint and adjust it according to the amount you want to add to the pool.

Use the ”unlock” or ”infinite unlock” button to allow the smart contract to spend your tokens. If you don’t know which one to use, read here.

After unlocking pair tokens, you can simply add liquidity to the pool by making a final transaction.

How to stake 1inch LP tokens to earn 1INCH

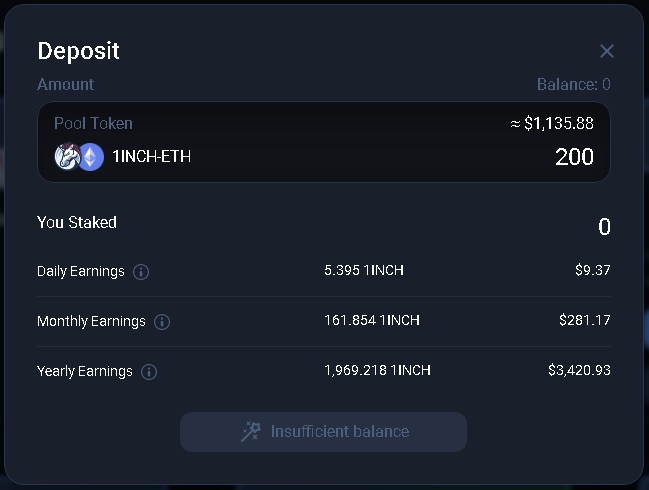

After providing liquidity to a pair that is included in the liquidity farming program, you can stake your LP tokens to earn 1INCH token.

Click on the ”farming” page under the DAO menu on the platform. You can see 1INCH farming pools and use the ”deposit” buttons to stake your LP tokens.

After clicking on the ”deposit” button of your pool, enter the amount you want to stake and make the transaction. You can see your estimated daily, monthly and yearly 1INCH earnings.

1inch limit order

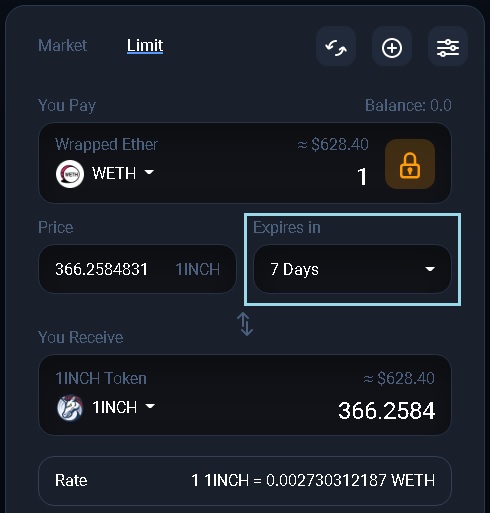

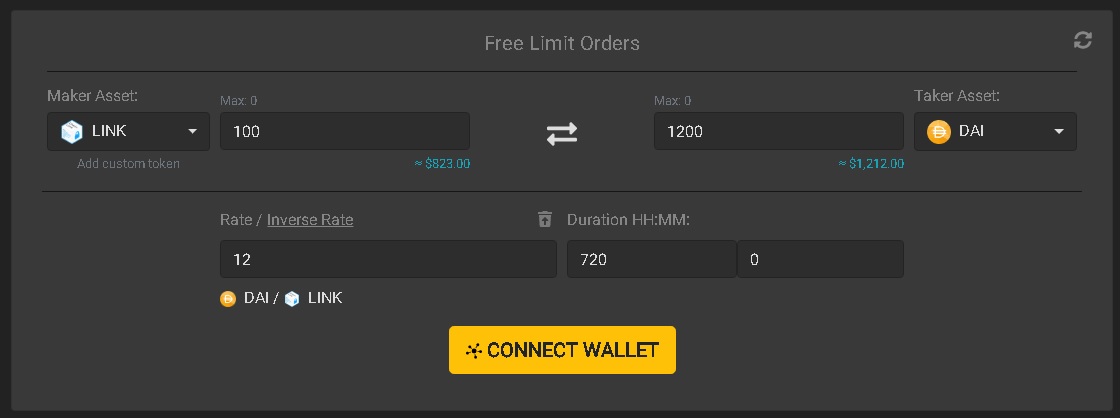

If you don’t want to execute a token swap at the market rates, you can place a limit order using limit order feature of 1inch. (Limit order is not available as of now, but will be available on 1inch v2 soon.)

Update: You can now place limit orders on 1inch v2.

To place a limit order, choose the pair and enter the amount of coins. You also need to enter the duration of your order within which it will be active and can be executed by takers.

1inch exchange lending

You can not only swap tokens at the best rates on 1inch, but also lend your cryptocurrencies or supply liquidity to liquidity pools to earn interest.

Click the ”earn” page on 1inch exchange to view liquidity and lending pools and filter them by token and platform.

You can view daily, weekly and monthly return rates, and provide liquidity to lending and liquidity pools of various dapps such as Aave, Compound and Uniswap.

(Update: Lending is not available on 1inch v2.)

Update 2: 1inch now also functions as a liquidity protocol and has its own liquidity pools. You can add liquidity to 1inch pools under the DAO tab and stake LP tokens to earn 1INCH token.

Check out other decentralized exchange reviews: